Mechanics Behind AI Investment Bots: How They Really Work

📊 Closing Bell Overview: Top 7 Assets & Alpha Hedge AI Algo Portfolio Review

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

Mechanics Behind AI Investment Bots: How They Really Work

AI investment bots operate through a combination of advanced algorithms and machine learning techniques to analyze market data, make predictions, and execute trades automatically. Here’s a detailed overview of their mechanics:

Core Components of AI Investment Bots

Algorithms and Machine Learning:

AI trading bots are powered by algorithms that dictate their behavior under specific conditions. These algorithms utilize machine learning to analyze vast amounts of data in real-time, including historical price movements, current market trends, and alternative data sources like news and social media.Signal Generation:

The first step in the bot's operation is signal generation. This involves identifying specific price and trend signals that meet predefined criteria. When a signal is detected, the bot can either alert the user or automatically execute a trade, depending on its configuration.Risk Management:

AI bots assess the risk associated with potential trades by analyzing the user's risk tolerance. This allows the bot to recommend position sizes and manage exposure effectively, ensuring that trades align with the user's investment strategy.Trade Execution:

Once a trading signal is generated and risk is assessed, the bot executes the trade. This process is automated and can occur much faster than human traders, allowing bots to capitalize on fleeting market opportunities.

Types of AI Trading Bots

Crypto Bots: Focus on cryptocurrency markets, analyzing trends specific to digital assets.

Forex Bots: Operate in the foreign exchange market, executing trades based on currency pair movements.

Arbitrage Bots: Take advantage of price discrepancies across different markets.

Market-Maker Bots: Place buy and sell orders to profit from the spread between them.

Robo-Advisors: Provide investment advice based on user profiles and preferences, often automating asset allocation.

Advantages of AI Trading Bots

Speed and Efficiency: Bots can analyze data and execute trades much faster than humans, which is crucial in volatile markets.

Emotionless Trading: Unlike human traders, bots do not let emotions like fear or greed influence their decisions, leading to more disciplined trading.

24/7 Operation: AI bots can monitor the markets continuously, ensuring that no trading opportunities are missed, even outside regular trading hours.

Challenges and Considerations

Despite their advantages, AI trading bots come with challenges:

Technical Complexity: Developing and effectively using these bots requires a solid understanding of machine learning and data analysis.

Market Volatility: Bots may struggle in highly volatile markets where conditions change rapidly.

Dependence on Historical Data: Bots rely on historical data for predictions, which may not always accurately reflect future market conditions.

Conclusion

AI investment bots represent a significant advancement in trading technology, offering speed, efficiency, and the ability to analyze vast datasets. While they can provide a competitive edge, their effectiveness often depends on the quality of the underlying algorithms and the market conditions in which they operate.

CLOSING BELL OVERVIEW

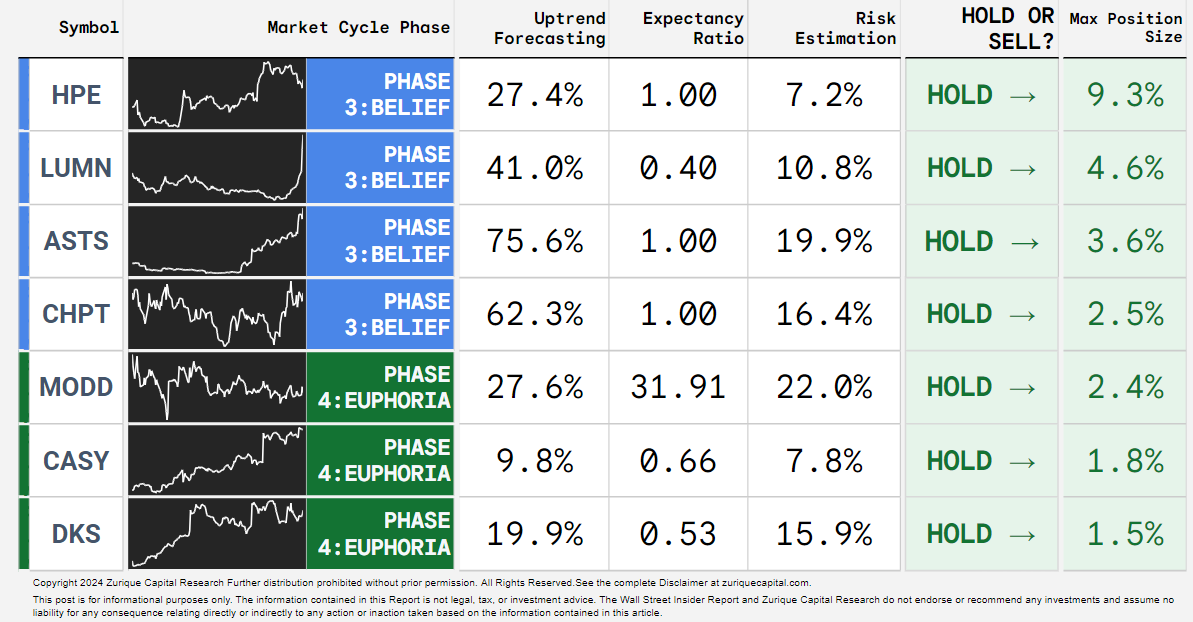

TOP 7 ASSETS OF THE DAY: 09/05/2024

The Alpha Hedge Algorithm decodes market movements to identify assets with high long-term growth potential. Today, it identified 47 assets; here are the Top 7:

HPE 0.00%↑ LUMN 0.00%↑ ASTS 0.00%↑ CHPT 0.00%↑ MODD 0.00%↑ CASY 0.00%↑ DKS 0.00%↑

Follow our notes and access all the analyzed assets of the day:

https://substack.com/@wallstreetinsider

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

▶️Read what the Wall Street Insiders wrote about us↓

Subscribe today to the Wall Street Insider Report Premium and join 1.9K+ Global Investors across 60 countries who are building legacy wealth. Gain access now to:

Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

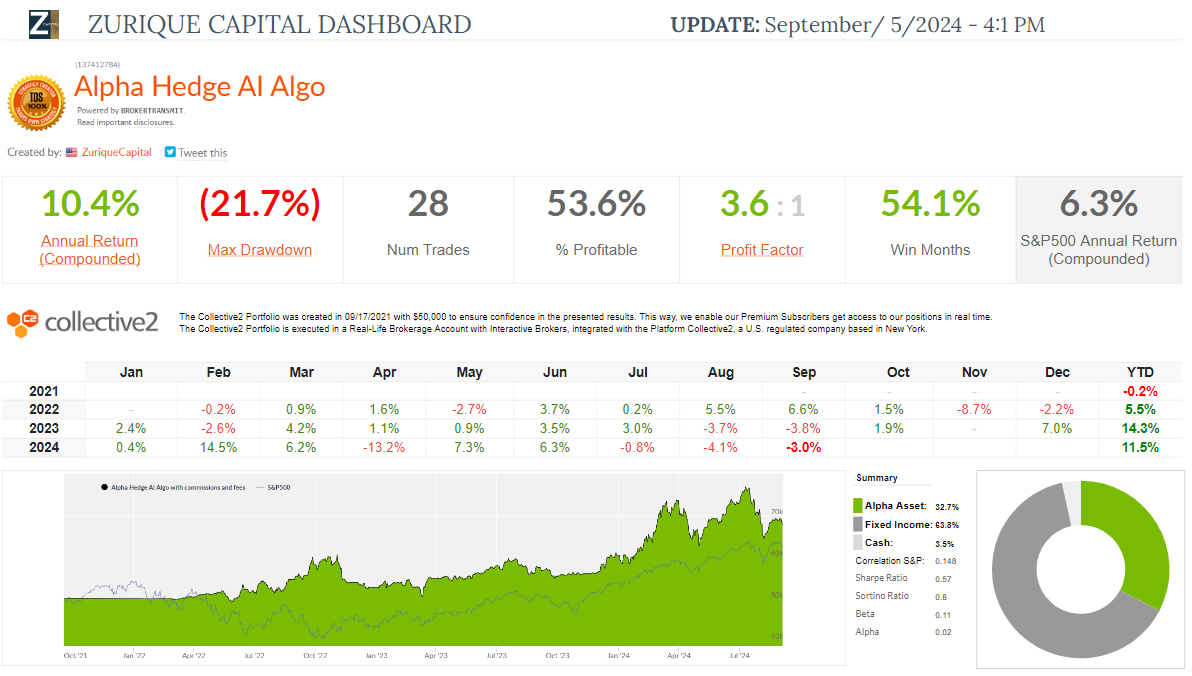

ALPHA HEDGE PORTFOLIO REVIEW: 09/05/2024

The Alpha Hedge Portfolio is down 3% this month, with a year-to-date gain of 11.5%.

Over 36 months, it has returned 34.2% (CAGR 10.4%), compared to the S&P 500's 19.5% (CAGR 6.1%).

The portfolio doubles capital in 7 years, while the S&P 500 takes 11.8 years.