Market Trends: From Interest Rate Cuts to Tech Giants

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 11/07/24

Decoding Market Trends: From Interest Rate Cuts to Tech Giants

Are we in a market euphoria phase, or is the tech surge just the beginning of something bigger? From the influential impact of policy changes post-election to AI-driven portfolio magic, there's a lot to consider in today's investing landscape.

Market Movements and the Federal Reserve's Influence

First things first, let's talk about the Federal Reserve's recent decision to cut interest rates by a quarter of a percent. The new benchmark range stands between 4.5% and 4.75%.

This move has driven the S&P 500 and the Nasdaq to record highs, with tech stocks leading the way. It’s a clear indicator that people are betting on the continued growth and strong returns from the tech sector. But is now the right time to jump in?

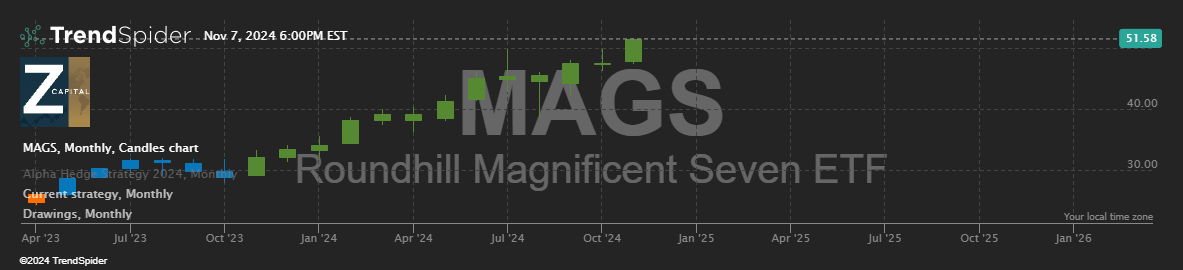

The Magnificent Seven: Leading the Charge

The "Magnificent Seven"—Apple, Alphabet (Google), Microsoft, Amazon, Tesla, NVIDIA, and Meta—are reaching new heights in the stock market. However, while they soar, other sectors aren't performing as well. Interestingly, the Dow is relatively flat. Could this signal a euphoria phase where excitement overshadows risk perception? Overconfidence in these companies could lead to a market correction.

The question is: should investors ride the wave of the Magnificent Seven, or is that tempting fate? It’s a classic risk-reward dilemma. While these companies are pioneers in AI, cloud computing, and e-commerce, diversification remains key. As enticing as their successes are, it's wise not to place all bets on them, no matter how shiny they seem.

The Influence of Election Outcomes

Lastly, let's touch on how election results can influence market dynamics.

The recent news indicates that anticipation of potential policy changes under Donald Trump may be boosting certain sectors like financials. Still, the long-term effects remain unpredictable amidst numerous economic variables.

Conclusion: The Ever-Changing Market Landscape

In conclusion, the financial market is an entity in perpetual flux, driven by the economy, investor sentiment, advancements in technology, and political shifts. Understanding what's behind these shifts is essential.

We've only scratched the surface here, but it's crucial to stay informed, inquisitive, and continuously delve into the layers of market movements. Looking ahead, the future possibilities with AI investment portfolios and the impact of major market players like the Magnificent Seven are worth pondering. Stay curious and keep exploring the depths of financial market trends.

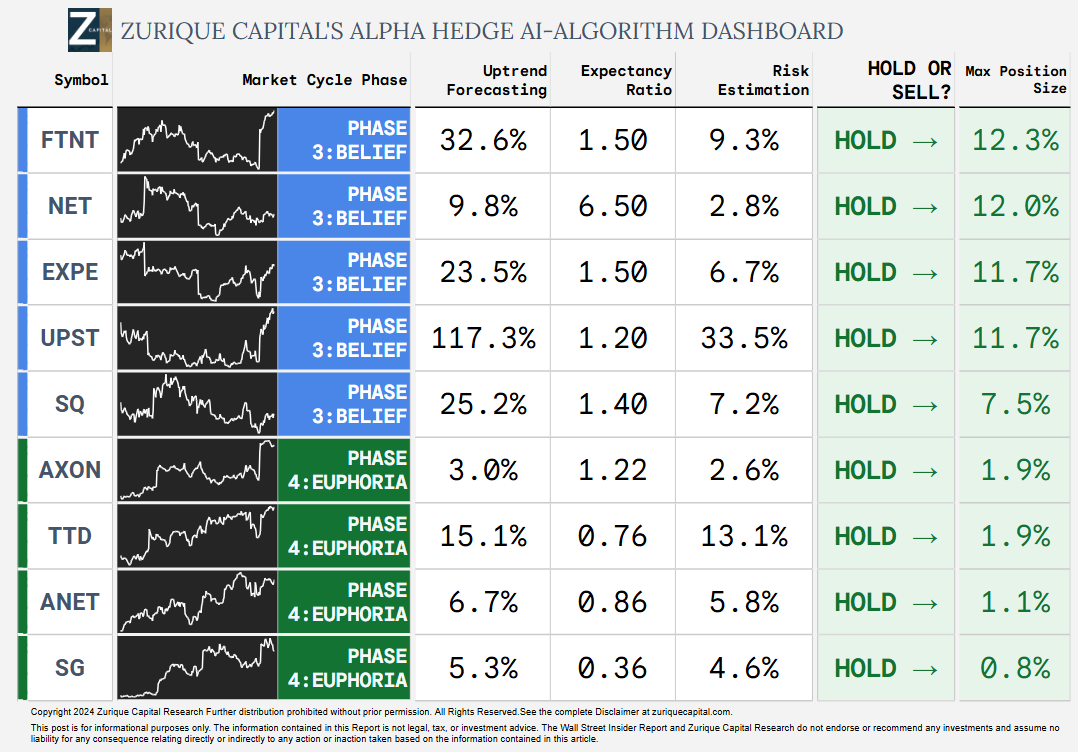

AI Investment Bot: Today's Stock Market Trends

FTNT 0.00%↑ NET 0.00%↑ EXPE 0.00%↑ UPST 0.00%↑ SQ 0.00%↑ AXON 0.00%↑ TTD 0.00%↑ ANET 0.00%↑ SG 0.00%↑

Here’s How We Find These Market Opportunities:

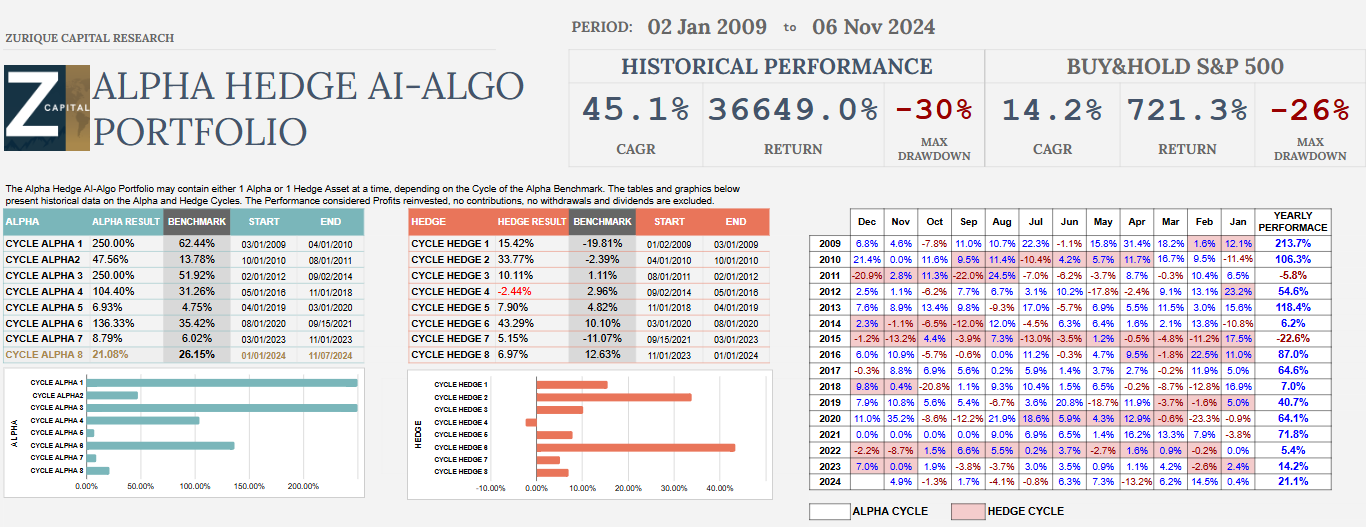

Alpha Hedge AI Algo Portfolio Review

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 11/07/24

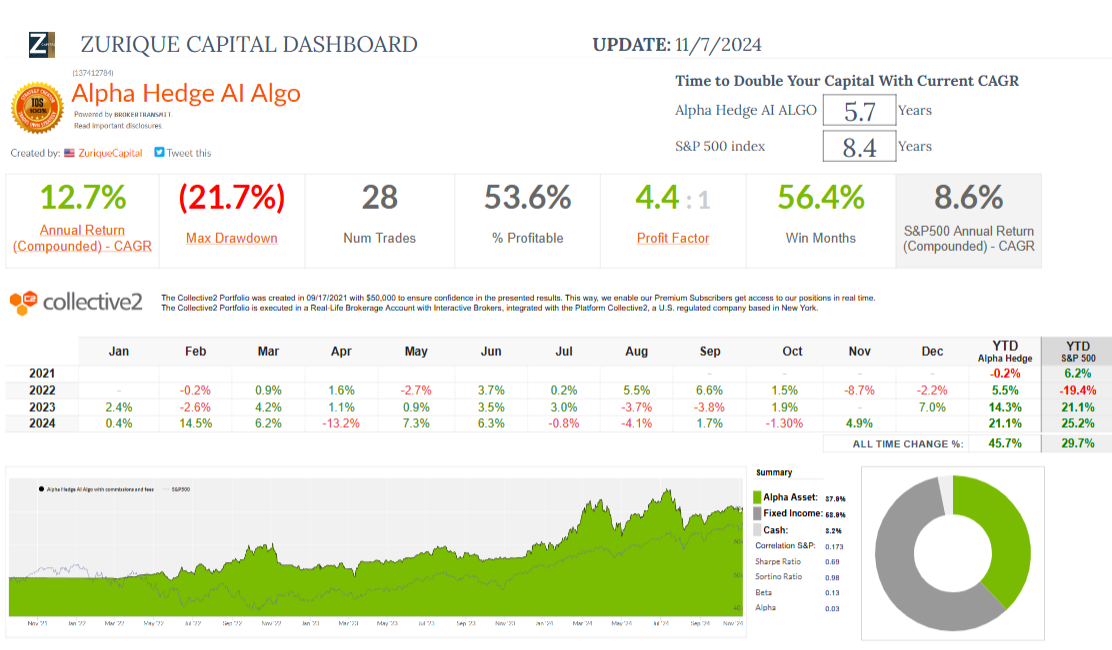

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Switching gears, let's explore AI-powered investing, specifically the Alpha Hedge AI Algo Portfolio. Over the past 38 months, it has boasted a 45.7% return, with an average annual return of 12.7%. In comparison, the S&P 500 has seen a 29.7% return and an 8.6% average annual return over the same period. Clearly, the AI portfolio is doubling capital much quicker than the S&P.

This success isn't driven by instinct alone. The AI is adept at crunching massive datasets and identifying patterns humans might overlook, thereby maximizing profit potential. For every dollar lost, the AI-generated portfolio recovers $4.40—a commendable profit factor. Could AI investings like this be the future? They’re certainly making impressive strides and provoking much thought.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓