📊Market Development: Week #19/2024

Inside Wall Street, Alpha Hedge Portfolio Evolution & Institutional Spotlight

Market Development: Week #19/2024

Inside Wall Street: Week #19/2024

Biotech Shines During Market's Gloomiest Months

The Biotech and Information Technology sectors have historically bucked the trend by posting notable gains.

Particularly, Biotech has seen an average increase of 6.78%, based on data spanning 29 years, although the consistency of these gains has hovered around 55.2%.

Meanwhile, Information Technology, with a sturdier data set of 34 years, offers a safer harbor with a success rate of 70.6%.

Risks and Opportunities Across Sectors

Let's face it, not all sectors are created equal, especially during the market's challenging phases.

While Consumer Staples often prove to be a safe bet, advancing 76.5% of the time, other sectors such as Materials might just set you up for disappointment.

Over the past 34 years, the Materials sector has consistently underperformed, losing an average of 1.53%.

Long-Term Market Patterns and Anomalies

While the broader market typically takes a dip during downturns there are always exceptions to the rule.

Notably, assets like Biotech, 30-year bonds, and gold have shown resilience by posting gains in both August and September, defying the usual downturn.

This anomaly in the pattern presents a unique opportunity for those who look beyond the surface and seek to capitalize on these less conventional gains.

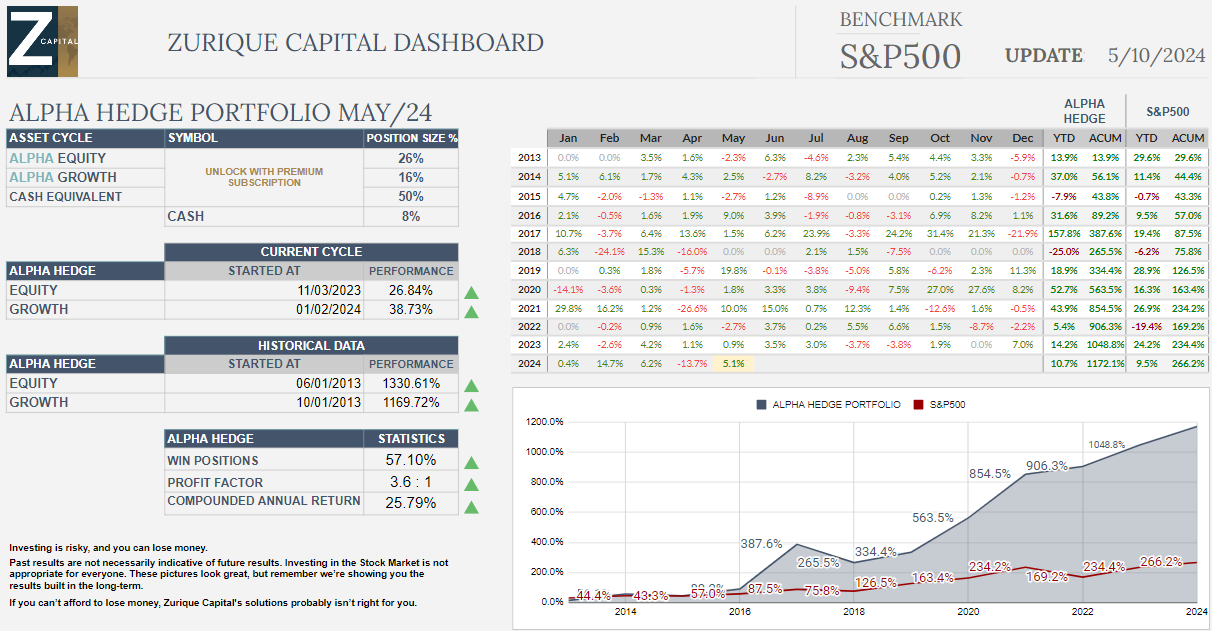

Alpha Hedge Portfolio Evolution

Alpha Hedge Portfolio Evolution: 2013 to 05/10/2024

The Alpha Hedge Portfolio is +5.1% in May. The portfolio increased by +4.19% last week.

The Alpha Hedge Portfolio has yielded +1,172.1% since March 2013 (S&P500 266.2%), and +38.2% since It became public in September 17, 2021(S&P500 16.8%).

Combining these outcomes, the Annual Compounded Return has increased to 25.79% since 2013, and the Profit Factor has increased to 3.6 to 1 in week 19 of 2024.

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

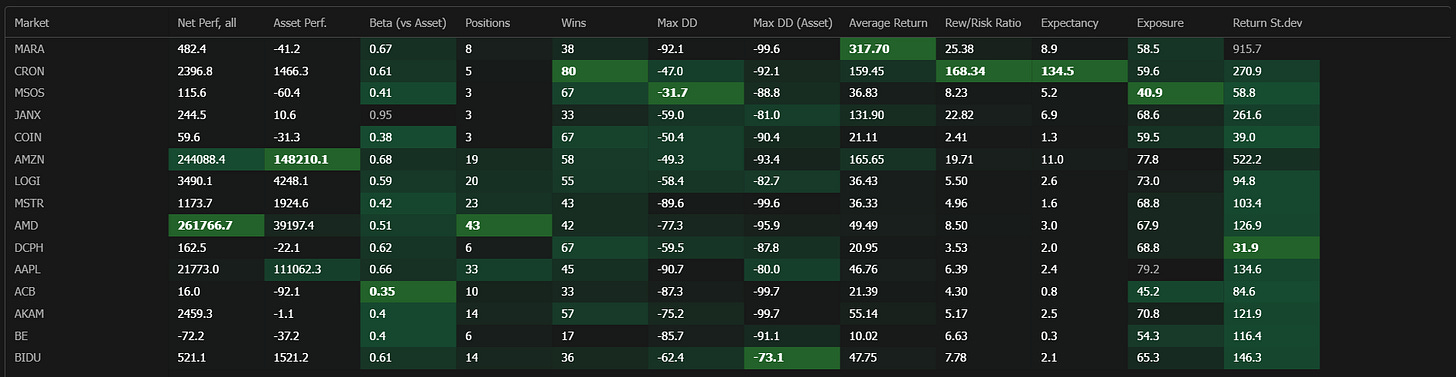

Institutional Spotlight: Week 19/2024

Every day, Institutional Clients (Hedge Funds, Family Offices, Advisors, Real Estate Agents and Private Offices) Premium Subscribers send assets to our Mathematical Market Cycle Analysis, through the Alpha Hedge Algorithm.

Institutional Watchlist

These are the assets we are working on this week in our Institutional Clients’ Watchlist.

MARA 0.00%↑ CRON 0.00%↑ MSOS 0.00%↑ JANX 0.00%↑ COIN 0.00%↑ AMZN 0.00%↑ LOGI 0.00%↑ MSTR 0.00%↑ AMD 0.00%↑ DCPH 0.00%↑ AAPL 0.00%↑ ACB 0.00%↑ AKAM 0.00%↑ BE 0.00%↑ BIDU 0.00%↑ BLNK 0.00%↑ CAUD 0.00%↑ CGC 0.00%↑ CHGG 0.00%↑ CLSK 0.00%↑ COUR 0.00%↑ DBX 0.00%↑ DJT 0.00%↑ DNA 0.00%↑

Top 10 Stocks/ETFs Week #19/2024

Mathematical Market Cycle Analysis

The assets undergo a statistical data analysis, and those in a negative cycle, exhibiting low positive volatility and a negative expectancy ratio, are excluded.

This are the Top 10 Findings of this week:

MARA 0.00%↑ CRON 0.00%↑ MSOS 0.00%↑ JANX 0.00%↑ COIN 0.00%↑ AMZN 0.00%↑ LOGI 0.00%↑ MSTR 0.00%↑ AMD 0.00%↑ DCPH 0.00%↑

Over the past decade, our subscribers have outperformed the American market Mastering the Mathematical Cycles of the Market.

You, too, can make investment decisions based on objective data. Discover how with the Wall Street Insider Report Premium and the Alpha Hedge Algorithm.

Subscribe to the Wall Street Insider Report Premium, unlock the Alpha Hedge Portfolio, and begin your journey to scale your investments today.↓