Lesson 7: 6 steps. 1 Algorithm. Quantitative Precision.

Leia também em Português:

Clique aqui para ler em português.

Lesson 7: 6 steps. 1 Algorithm. Quantitative Precision

You’ve just decoded the system behind institutional wealth.

You’ve now seen what powers institutional returns:

AI, neural networks, expectancy math, and position sizing.

In this final core lesson, we’ll bring all the components together and show you how the Alpha Hedge AI Algo Portfolio is constructed, managed, and dynamically adapted based on market cycle intelligence.

This is your blueprint to build a living portfolio—one that grows, adapts, and protects based on quantifiable signals, not opinions.

Step-by-Step: How the Alpha Hedge Portfolio Is Built and Managed

Step 1: Determine the Current Market Cycle

Everything begins here.

Using AI-driven analysis of the S&P 500, we determine whether we are in a:

Positive Cycle → Time to allocate to Alpha assets

Negative Cycle → Time to shift into Hedge assets

The portfolio never allocates blindly. It follows quantified market rhythm, not speculation.

Step 2: Select the Right Asset Based on the Cycle

Each month, the algorithm assesses whether the S&P 500 is bullish or bearish.

If bullish, we allocate to a specific Alpha ETF based on three layers:

Alpha 1: Market cycle timing

Alpha 2: Performance vs. Buy-and-Hold

Alpha 3: Expectancy

If bearish, we rotate into a defensive Hedge ETF

The cycle review happens monthly—yet the average cycle duration is 14 months, making this a long-term tactical system.

Step 3: Construct the Portfolio

The Alpha Hedge Portfolio is binary and focused:

It holds only one asset at a time—either Alpha or Hedge—based on the prevailing market cycle.

Selection is driven by statistical advantage.

We don’t diversify—we optimize.

Step 4: Optimize the Position Size

(Summarized here, covered in-depth in Lesson 6)

Once the asset is selected, the Kelly Formula—adjusted with a K% Factor—is used to calculate the optimal position size, tailored to the investor’s risk tolerance*.

This step ensures capital is deployed strategically, not emotionally.

* The balance of capital not allocated to the Alpha or Hedge asset can be held in cash or allocated to a fixed income asset or ETF.

Step 5: Define Your Risk Tolerance

Before executing the trade, the investor must define their acceptable drawdown:

Conservative: ~8% drawdown

Moderate: ~15% drawdown

Aggressive: ~30% drawdown

The system automatically adjusts the position size to fit your profile.

This isn't just about preference—it’s about aligning allocation with psychological and strategic resilience.

Step 6: Rebalance Monthly with Discipline

Every first Monday of the month, the portfolio is reviewed and rebalanced (if necessary), based on updated Alpha Indicators.

For our premium clients, this is fully transparent:

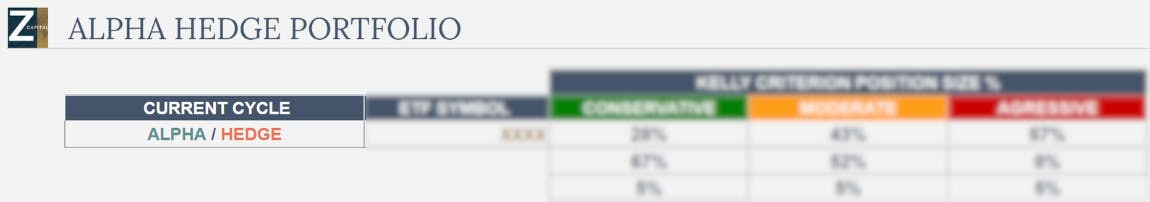

They receive a real-time spreadsheet containing:

1: Current market cycle (Alpha or Hedge);

2: ETF Symbol (Ticker of the ETF);

3: Closing price;

4: Protective sell order price (for abrupt market falls);

5: Size of the optimized position size depending on the risk tolerance of the investor.

This ensures clients always know what we’re holding, why we’re holding it, and where the risk boundary lies.

Final Thought: The Future of Wealth Management Is Now

The Alpha Hedge Portfolio is more than a strategy.

It’s a system that evolves, learns, and protects your capital through:

Market regime awareness

Intelligent allocation

AI-enhanced decision-making

Quantitative risk control

As AI and neural networks continue to advance, the gap between traditional investing and quantitative precision will only widen.

You’ve now seen how Wall Street’s top minds engineer portfolios behind the scenes.

And now—you’re inside the machine.

See the full Alpha Hedge AI Algo Portfolio — Subscribe to the Wall Street Insider Report.

Decode the Algorithms Behind Wall Street’s Moves from the Inside.

Turns AI investment management and quantitative investment strategies into results.

Discover AI investment opportunities, curated by our quant-driven AI Advisor Algorithm.

▶️ Read what the Wall Street Insiders wrote about us↓