June/25 Portfolio Rebalancing

The Market Speaks in Code. Most Miss The Message.

The Market Speaks in Code. Most Miss The Message

One of the most common mistakes I see among investors and advisors is expecting a system to solve every market condition.

That’s not strategy. That’s wishful thinking.

As Michael Porter said, “The essence of strategy is choosing what not to do.”

And in algorithmic portfolio design, this isn’t just philosophy, it’s architecture.

At Zurique Capital, we don’t build systems that try to capture every signal, every asset, every opportunity. We build for clarity and precision.

Our Alpha Hedge AI Algo Portfolio focuses on a single high-conviction asset or cash.

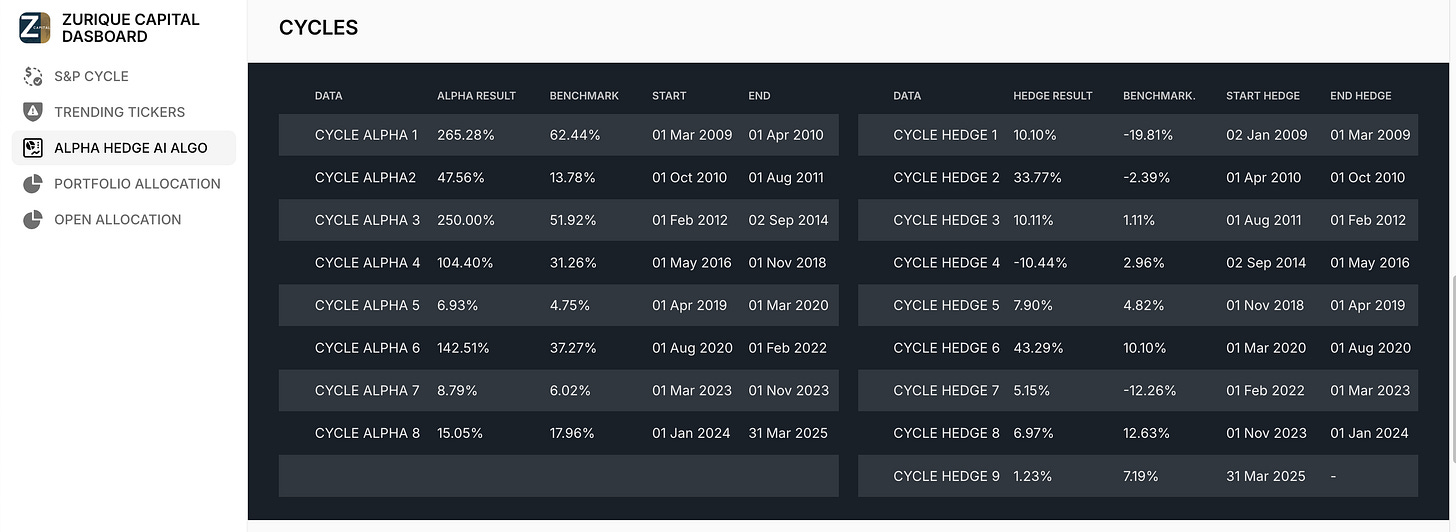

It’s not trying to do everything. It’s built to do the right thing, at the right time, based on cycle signals that have survived 17 market turns.

That focus means tradeoffs. Less diversification. More conviction. Lower noise. Higher signal. And full transparency on what we intentionally exclude.

Let’s start with a quick breakdown of how the markets moved in May.

What If That Bounce in Stocks Was Just Noise?

In May, our equity and fixed income signals diverged.

U.S. stocks rebounded sharply after April’s drawdown, but the trend has not yet confirmed bullish. That’s why we didn’t increase equity exposure.

Fixed income, meanwhile, showed weakness. The middle of the yield curve lost momentum, so we shifted toward a floating rate strategy.

We don’t predict reversals.

We act when the data confirms them.

The S&P 500 remains in Phase 6.

Protection cycle. No entries. No risk exposure.

But signs of change are starting to form.

Microsoft MSFT 0.00%↑ and NVIDIA NVDA 0.00%↑ ended the month in Phase 2, one step away from a confirmed uptrend.

Apple AAPL 0.00%↑ remains negative, closing the month down 4.07%.

Amazon AMZN 0.00%↑, Meta META 0.00%↑, Alphabet GOOG 0.00%↑ , and Tesla TSLA 0.00%↑ still show no trend reversal.

So why does it matter?

Because two of the three largest weights in the index are pointing to a shift.

When leadership changes cycle, it often precedes broader market movement.

But our strategy doesn’t jump early.

We wait for confirmation.

We listen to the cycle.

We let the math decide.

June/25 Portfolio Rebalancing

This Month, the Best Position Wasn’t Alpha. It was Patience.

Let me explain 100% of the portfolio moves into cash.

That’s exactly what we did this month.

Our Alpha Hedge AI Algo signaled no entry for either the Alpha or Hedge Asset in June.

So we allocated 95% to a Cash Equivalent ETF with strong yield, and kept 5% unallocated.

This isn’t passive. It’s protection, part of a 17-cycle-tested strategy that waits for signals, not stories.

A client asked:

“What if Alpha rallies next month?”

My answer: it might.

But we’ve seen that before, rebounds that turn into bull traps.

One quick example: Alpha surged 10%, then dropped 59% two months later.

That’s why we don’t front-run the signal.

If the conditions align, we re-enter at the July open.

Until then, we preserve capital, earn yield, and let the cycle confirm the move.

Since 2009, this AI-driven system has rotated through just 17 positions.

Yet it turned $50K into over $13.8M.

That’s a CAGR of 40.99%.

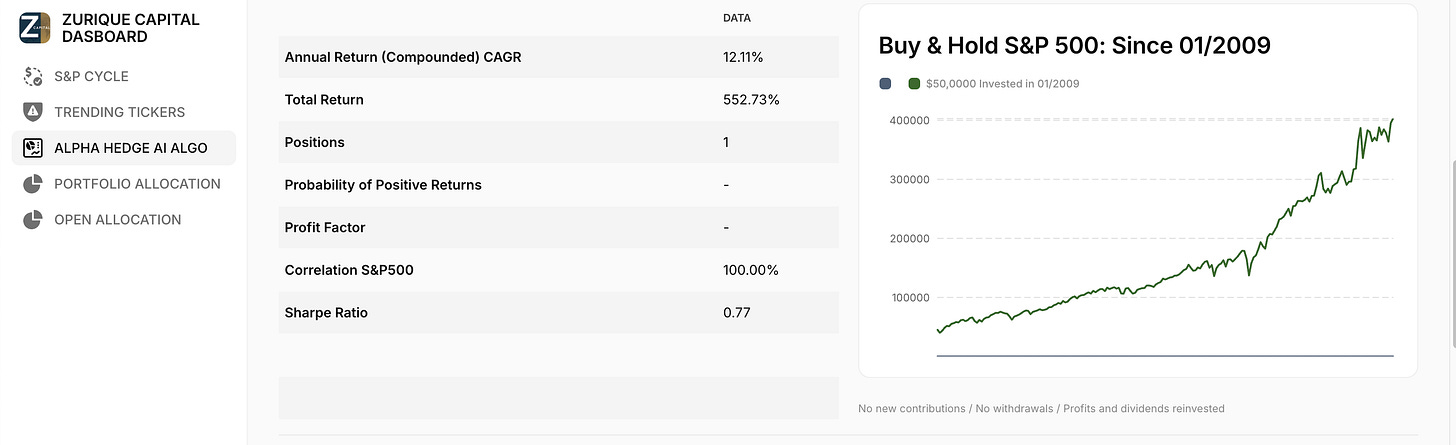

Meanwhile, Buy & Hold S&P 500 returned 552.73% in the same period.

Right now, we’re in Hedge Cycle 9.

That means: full cash allocation.

Capital protected. Yield earned.

While others stay exposed, we wait.

What Do We Expect Next?

The market doesn’t move without a catalyst. Are you watching the right ones?

We look at pressure.

Three overlooked catalysts are building momentum beneath the surface:

Student loan collections are back.

Delinquency rates jumped from 0.7% to 8% in one quarter.

That’s billions in lost consumer spending, enough to drag GDP by 0.1%, according to Morgan Stanley.Housing demand is deteriorating.

Pending home sales dropped 6.3% in April.

Inventory is up 21% from last year.

Rates at 6.86% are locking buyers out of the market.Tariff policy just snapped.

A federal court ruled Trump’s broad tariffs invalid.

It may be temporary, but it signals instability in trade—right when supply chains are already fragile.

None of these headlines alone would move the market.

But together, they build pressure.

And pressure is what triggers trend changes.

Unlock the Alpha Hedge AI Algo Portfolio ↓