June/24 Portfolio Alpha Hedge Rebalancing

Fundamental Principles Every Pro Investor Should Learn to Navigate the Market in June/24

We believe a significant advantage of a Portfolio managed with a Market Cycle approach with a Trend Following overlay (the Alpha Hedge Algorithm) is its ability to help manage investors’ emotions and behaviors by providing a clear, adaptable plan for any market scenario.

This systematic investing strategy aims not only to generate alpha through investment returns but also to maintain discipline and consistency in the face of market fluctuations.

In our view, the Alpha Hedge Algorithm excels at managing market outliers — those rare, unpredictable events that can significantly impact performance.

For instance, NVIDIA’s NVDA 0.00%↑ market cap has reached $2.6 trillion, surpassing the combined market cap of all companies in the S&P 500 Energy sector by $890 billion.

Such unprecedented events underscore the need for a robust plan to navigate these exceptional occurrences.

April’s U.S. equity market declines were erased in May, as the market bounced back and set new all-time highs.

This illustrates that Alpha Hedge Algorithm is less about predicting outcomes and more about maintaining a disciplined process, enabling decisive action without second-guessing.

May 2024 Recap

S&P 500

After breaking a run of 5 straight positive months by declining in April, the S&P 500 Index SPY 0.00%↑ resumed its ascent in May, reaching new all-time highs.

While all segments performed well, growth and tech remained the leaders IWM 0.00%↑ QQQ 0.00%↑ . For the second consecutive year, the benchmark index will approach its halfway point with a double-digit return, leading the Alpha Hedge Portfolio to remain overweight in RISK ON MODE.

Allocations to this asset will stay at MODERATE RISK ACCEPTANCE MODE (about 50% exposure) as we transition from May to June.

We are in a transitioning period of the Alpha Hedge Algorithm for a more concentrated Portfolio focusing in the S&P500 (Equity) Market.

Fixed Income

Allocations within the fixed income asset class remain overweight as we are in MODERATE RISK ACCEPTANCE MODE.

For the portfolio’s Fixed Income bucket, our approach is allocation in U.S. Treasury floating-rate securities (FRNs).

U.S. Treasury floating-rate securities (FRNs) are government-issued bonds with interest rates that adjust weekly based on the most recent 90-day Treasury bill auction. These securities offer investors a low-risk investment option with minimal interest-rate sensitivity, making them attractive for those seeking stability in rising rate environments. FRNs provides a secure place to park cash with regular income.

This illustrates the minimum asset portfolio approach to adapt to changing conditions.

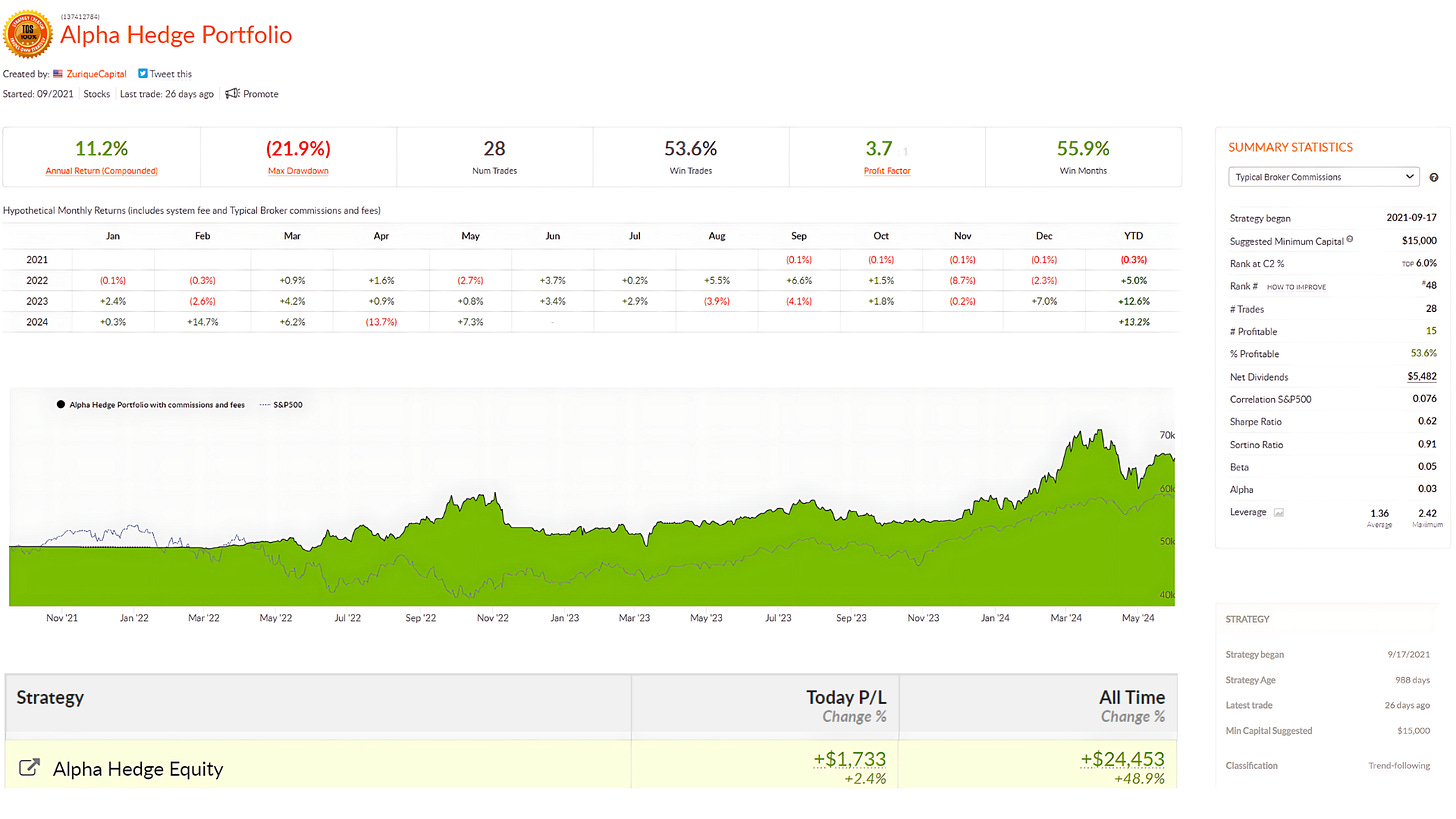

Alpha Hedge Portfolio Result May/2024

09/17/2021 to 05/31/2024

In our experience, applying a Market Cycle Analysis overlayed with Trend Following strategies, through the Alpha Hedge Algorithm, offers a simplified approach to portfolio management that is particularly beneficial for Pro Investors and Finance Professionals managing multiple clients and services.

It’s about committing to a disciplined process and acting on it, rather than constantly second-guessing decisions.

The key to successful investing is having a plan and sticking to it, regardless of market conditions.

After the decline in April, May closed up 7.3%, marking the second-best performance since September 17, 2021, when we publicly shared the evolution of our portfolio.

In 2024, the portfolio has increased by 13.2%.

As a result of these outcomes, the Annual Compounded Return has increased from 6.7% in April to 11.2% in May (since September 17, 2021).

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 09/17/2021

In 2021, the Alpha Hedge Portfolio increased 10x, yielding a 967% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

Unlock the Alpha Hedge Portfolio ↓