January/25 Alpha Hedge AI Algo Portfolio Rebalancing

Monthly Portfolio Allocation Overview and The Story of Resilience: Markets and the Economy in 2024

January/24 Alpha Hedge AI Algo Portfolio Rebalancing

The Story of Resilience: Markets and the Economy in 2024

Let me start with a question: What makes a year unforgettable? For investors, 2024 has been nothing short of remarkable. The Nasdaq surged over 31%, the S&P 500 climbed more than 25%, and the Dow Jones added 14%. These are just numbers, right? But beneath these figures lies a story of resilience, adaptation, and the interplay of human ambition and systemic forces.

I’m here to share a story that goes beyond the charts. It’s a story about our collective ability to navigate uncertainty and find opportunities in the face of change.

2024 was a testament to the resilience of markets and the economy. Despite political upheavals, inflationary pressures, and a cooling labor market, the world showed us that growth and stability are achievable, even amidst turbulence.

The Magnificent Seven and the Bull Market Surge

The bull market continued to roar, fueled by corporate earnings and the tech sector’s "Magnificent Seven": Nvidia NVDA 0.00%↑, Tesla TSLA 0.00%↑, Alphabet GOOG 0.00%↑, Amazon AMZN 0.00%↑, Apple AAPL 0.00%↑, Microsoft MSFT 0.00%↑ , and Meta META 0.00%↑.

Nvidia alone surged over 175%, showing the outsized role of innovation in shaping market dynamics. However, the concentration of wealth in a few stocks also raised important questions. The top 10 companies in the S&P 500 now account for nearly 40% of the index’s market cap — the highest in 30 years.

What does this mean for the broader market? Incredible momentum!

Navigating Complexity: The Economy’s Balancing Act

2024 brought a presidential election like no other.

Donald Trump’s victory after a tumultuous campaign sparked a wave of market reactions.

Bitcoin surged past $100,000, bolstered by pro-crypto politics. Yet, the election also reignited inflation fears. Proposed tariffs and tax cuts raised questions about the sustainability of growth. It’s a vivid reminder that politics and markets are intricately linked, often in unpredictable ways.

Navigating Complexity: The Economy’s Balancing Act

The U.S. economy demonstrated resilience with robust GDP growth, strong retail sales, and a steady unemployment rate of 4%.

But inflation remained a challenge. Even as it moderated, sticky core price increases and persistent wage pressures kept the Federal Reserve cautious.

The Fed’s easing cycle was slower than expected, signaling a more deliberate approach to balancing growth and inflation. This cautious optimism reflects the delicate dance between monetary policy and market expectations.

The Human Spirit Behind the Numbers

I’ve watched markets recover from crashes, ride waves of exuberance, and grapple with uncertainty.

Each time, I’m reminded of the human spirit — our ability to adapt, to innovate, and to persevere.

2024 wasn’t just about charts and indices; it was about people. Entrepreneurs driving growth, policymakers navigating crises, and investors like you and me seeking stability amidst chaos. It’s a story of hope, and it’s a story we’re all part of.

Shaping Tomorrow: Lessons from 2024

As we look to 2025, let’s remember the lessons of 2024. Markets thrive on resilience, but they also demand vigilance and adaptability. Whether you’re an investor, a policymaker, or someone trying to make sense of it all, take this message to heart: the future is unwritten, but it’s in our hands. Let’s write it with wisdom, courage, and a commitment to building a better world through the opportunities we seize today.

Alpha Hedge Portfolio Result December/2024

In this video, we dive into a detailed analysis of our assets and portfolio strategy surrounding the S&P 500 Index.

We discuss the concepts of alpha assets and hedge assets, highlighting allocation strategies during bull and bear market cycles.

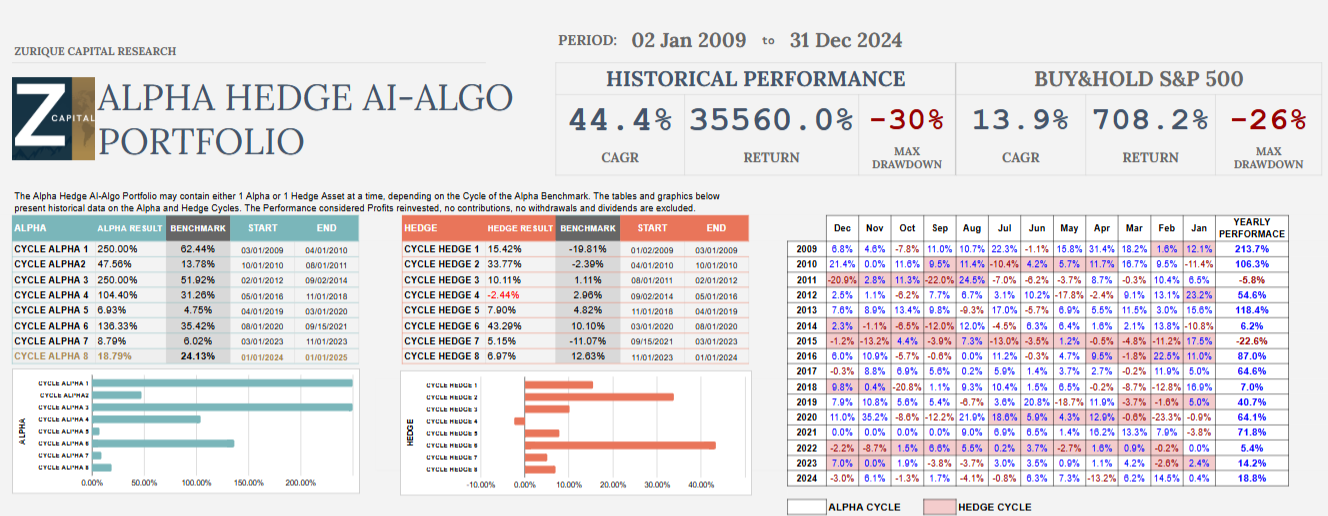

We analyze the past 16 years of performance, the current upward trend of the S&P 500, and the Phase 4 euphoria we are experiencing, with plans to maintain alpha positions through 2025.

Additionally, we address factors that may signal the end of the cycle, such as interest rate cuts, increased volatility, and the presidential cycle. The discussion delves into historical data and forecasts, providing a clear view of our conservative portfolio management strategy.

The Alpha Hedge Portfolio will remain in RISK-ON MODE. The allocation adjustments solely reflect the market movements observed in November.

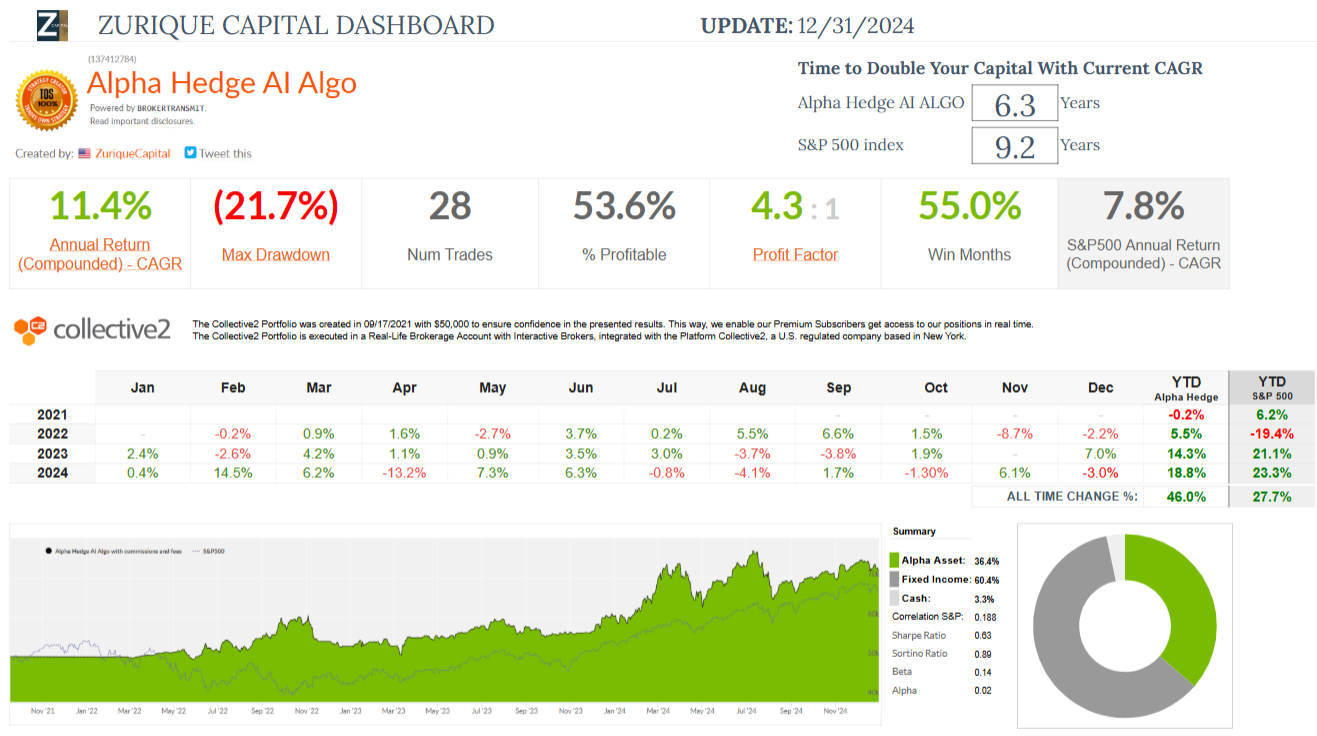

09/17/2021 to 12/31/2024

Alpha Hedge Portfolio Result December/2024: -3.0%

Alpha Hedge Portfolio Result 2024: +18.8%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has grown significantly, with its value reaching $71,568 from the original investment of $50,000, a 46.0% gain since September, 17, 2021 (date we public shared publicly the evolution of our portfolio and considering typical broker commission and platform subscription).

The S&P 500 had a gain of 27.7% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved 11.4% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 55% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 4.3:1, which means the gains are 4.3 times the losses.

Correlation with S&P 500: With a correlation of 0.188 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.63 and Sortino Ratio of 0.89 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.14 suggests low market sensitivity, while an alpha of 0.02 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 12/31/2024

Unlock the Alpha Hedge AI Algo Portfolio ↓