Investment Cycle Analysis: Timing Short Positions

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 11/13/24

Investment Cycle Analysis: Timing Short Positions

Our latest report reveals potential selling opportunities as 29 market assets show diverse trends. Uncover which assets may soon transition into a downturn and what that means for strategic positioning.

New York Call

Every business day, we hold a live meeting with our Brazilian clients, called the New York Call, where we analyze the market, our portfolio, and assets on demand. This is an excerpt from the meeting in Portuguese and AI-Dubbed in English.

🔰 In Portuguese ↓

🤖AI-Dubbed in English (in test) ↓

(The AI-powered version is still a work in progress, but we’re actively working to enhance the experience. Thank you for your understanding.)

Comprehending Market Phases

The market transitions through six distinct phases. When investors aim for short positions, they traditionally target assets in the downward trending Phase 6 or those on the brink of such a decline. These phases aren't mere theoretical constructs—they are crucial guides for investment decisions. Our recent analysis identified 29 assets with significant market interest in establishing short positions. But which assets truly warrant this strategy?

Identifying Ideal Short Positions

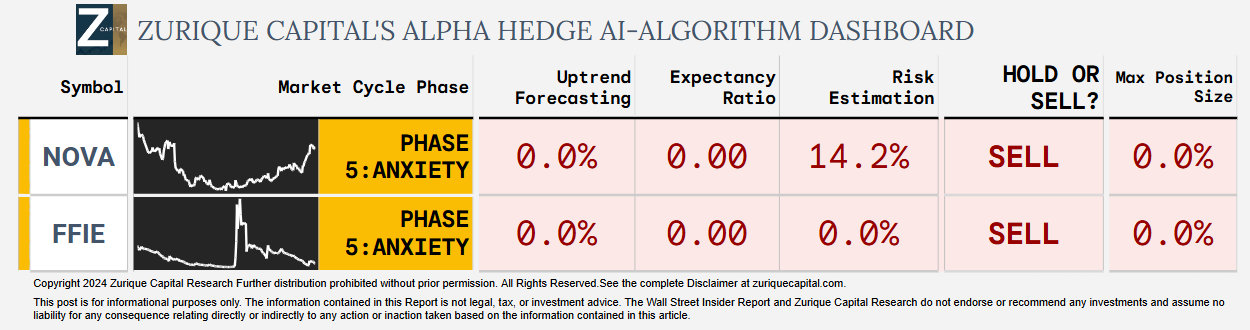

The optimal targets for short positions are assets in Phase 5. Why? Because they are on the cusp of moving into Phase 6, the penultimate point before a full-fledged downturn.

By timing sells at the end of a Phase 5 cycle, investors can maximize potential returns. In our evaluation, assets like Marathon MARA 0.00%↑ or Plug PLUG 0.00%↑, currently in Phase 2, are erroneously targeted for short positions. These assets are poised to rise, marking them unsuitable for selling.

Timing and Execution

MARA 0.00%↑ PLUG 0.00%↑ ALT 0.00%↑ SAVE 0.00%↑ EOSE 0.00%↑ ABR 0.00%↑ PCT 0.00%↑ LUNR 0.00%↑ MPW 0.00%↑ DRUG 0.00%↑ PHAT 0.00%↑ UPST 0.00%↑ AAOI 0.00%↑ LOVE 0.00%↑ SAVA 0.00%↑ TARS 0.00%↑ ENVX 0.00%↑ EVGO 0.00%↑ NOVA 0.00%↑ FFIE 0.00%↑ KSS 0.00%↑ WOLF 0.00%↑ SEDG 0.00%↑ CHPT 0.00%↑ BYND 0.00%↑ SPCE 0.00%↑ RILY 0.00%↑ VERB 0.00%↑ XPON 0.00%↑

While it's tempting to sell assets already in a downturn, evidenced by the 9 assets in a current downtrend, the timing isn't optimal. Instead, the focus should be on NOVA 0.00%↑ and Faraday Future FFIE 0.00%↑, both in Phase 5, perfect for short positioning if trends continue.

Alpha Hedge AI Algo Portfolio Review

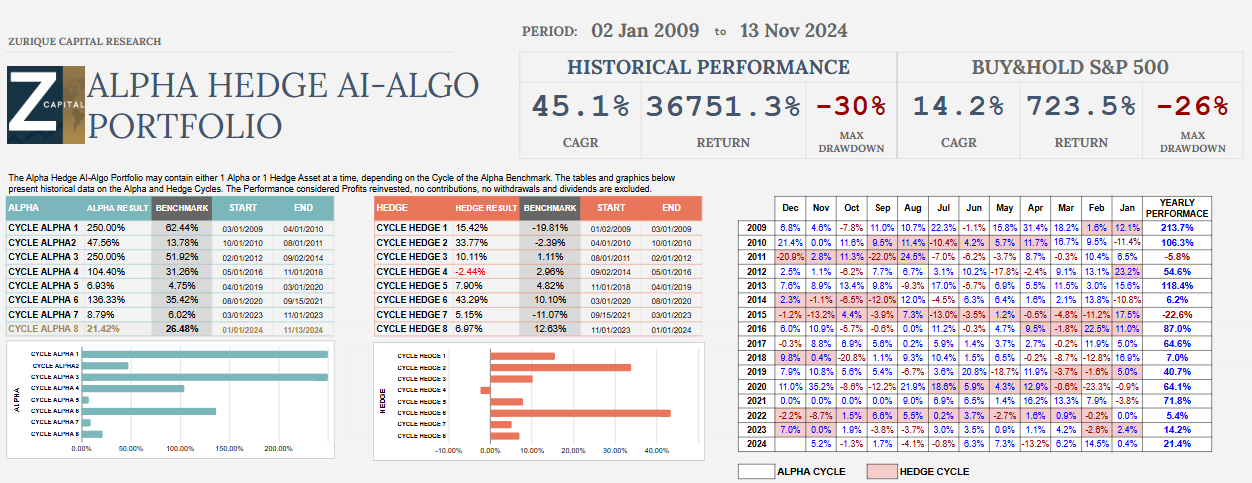

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 11/13/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓