Insider Secrets: How Investors Predict Stock Surges

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 11/04/24

Insider Secrets: How Investors Predict Stock Surges

The art of spotting market trends before they unfold isn't about predicting the future—it's about recognizing the present signals. Learn how Zurique leverages early price indicators to stay ahead of the curve and make strategic investment moves. Stay informed, stay ahead.

Picture this: while others wait for news headlines to break, some investors are already positioned advantageously, having interpreted subtle signals in the market. How do they do this? By understanding that price movement itself serves as a leading indicator—a signal that something significant is about to unfold.

By the time news makes its way to the public, these insightful investors have already acted on early price signals. They aren't scrambling to react; instead, they are strategically positioned, having anticipated the move.

Reading Market Signals

Zurique Capital exemplifies this proactive approach. The key isn't about possessing insider information or having a crystal ball to predict the future. It's about recognizing and interpreting the signals the market provides. The language of the market is rich with subtle cues, often unnoticed by the untrained eye.

By consistently monitoring price trends, Zurique identifies those nuanced shifts that could foreshadow significant market changes. This strategic vigilance allows them to capitalize on opportunities before they become apparent to the broader market.

Mastering Market Language

The ability to read the market's language is a powerful skill. It involves gaining an understanding of the signals and cues that are typically overlooked. Recognizing these indicators helps investors make well-informed decisions that keep them ahead of the game.

In conclusion, the art of spotting market moves before they happen hinges on the ability to recognize and interpret the signals already present. Investors like those at Zurique show that remaining vigilant and responsive to these signals can make all the difference in strategic market positioning.

So, take a page from their playbook: hone your ability to read the market's signals and ensure that you, too, are ahead of the curve.

AI Investment Bot: Today's Stock Market Trends

WYNN 0.00%↑ DJTWW 0.00%↑ DJT 0.00%↑ ET 0.00%↑ PLTR 0.00%↑ CMI 0.00%↑

Here’s How We Find These Market Opportunities:

Alpha Hedge AI Algo Portfolio Review

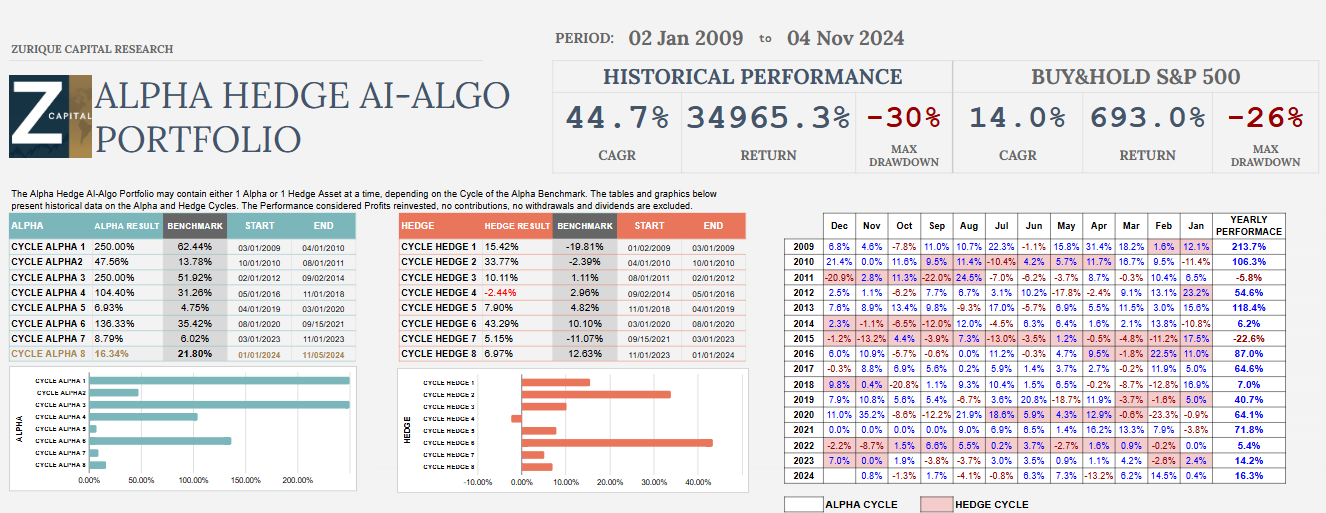

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 11/04/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 38 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 38.9% (CAGR 11.3%), compared to the S&P 500's total return of 25.3% (CAGR 7.8%).

The portfolio is currently up 0.8% this month and has gained 16.3% year-to-date. At a CAGR of 11.3%, the portfolio doubles capital in 6.4 years, whereas the S&P 500, with a 7.8% CAGR, takes 9.2 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 53.6% of its 28 trades, with a profit factor of 4.0.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓