📊In Which Phase of the Market Cycle Are We Now?

March/24 Update for Bonds, Currencies, Equities, Growth Stocks and Crypto

Wall Street Insider Report

Join +1,4k Wall Street Insiders across 25 US states and 45 countries who are scaling 10x their investments demystifying the Psychology of the Market Cycles.

Bond Market

When will the Fed cut interest rates in 2024?

Economists have revised their forecasts, with many of them now projecting the Fed's first cut will come later in 2024 than they had earlier forecast. In other words, don't hold your breath for a cut at either of its next two meetings, in March and May. (cbsnews)

The Alpha Hedge Bond Portfolio combines one Alpha Asset during an increasing 20-Year Rate or one Hedge Asset during a 20-Year Rate downtrend.

The Alpha Hedge Bond Portfolio currently represents 15% of the Alpha Hedge Portfolio.

Since the 20-year interest rate downtrend that began in November 2023 (Phase 6 - Denial) continued through February, our Hedge position will be maintained into March.

Currency Market

Dollar dips as U.S. inflation reading meets expectations

The dollar fell on Thursday after data showed that U.S. inflation was in line with economists’ expectations in January, easing concerns that price pressures could be seeing a renewed uptick. (cnbc)

The Alpha Hedge Currency Portfolio combines one Alpha Asset when the US Dollar Index is increasing or one Hedge Asset during a US Dollar Index downtrend.

The Alpha Hedge Currency Portfolio currently accounts for 11% of the overall Alpha Hedge Portfolio.

Since the Dollar Index entered Phase 6, the Denial Phase, in January, a Hedge position was established and will continue to be maintained through March.

Equity Market

Here's how global and domestic equity markets performed in February 2024

In the US, the Dow Jones index jumped 2.1%, while the tech-heavy Nasdaq index zoomed 5.2%

Global equity markets have ended the February month on a higher note. Major global equity benchmarks surged significantly and rose up to 8% this month. This outperformance was led by Asian stock markets such as China and Japan. On the other hand, UK and Singapore stock markets ended in the red. (BusinessToday)

The Alpha Hedge Equity Portfolio combines either 1 Alpha Asset during equities’ Bull Market or 1 Hedge Asset, usually Commodities, during equities’ Bear Markets.

The Alpha Hedge Equity Portfolio currently represents 26% of the Alpha Hedge Portfolio.

The Equity Market has been in Belief Phase 3 since January, at which time we initiated an Alpha position. Given that the Bull Market persists, we will maintain this position through March.

Growth Stocks Market

NVIDIA NVDA 0.00%↑ Q4 2024 earnings results beat revenue & EPS expectations

The NVIDIA company is arguably one of the most important and successful tech companies in the entire world right now, and it just reported its latest fiscal quarterly earnings results report. With hands in graphics technology, ray-tracing technology, and especially the currently booming artificial intelligence sector, NVIDIA was hugely successful in Q4 2024. It beat its revenue expectations by a mile, and it came out well ahead of earnings-per-share (EPS) expectations as well. (Schacknews).

The Alpha Hedge Growth Portfolio combines either 1 Alpha Asset during Growth Stocks Bull Market or 1 Hedge Asset, during Growth Stocks Bear Markets.

The Alpha Hedge Growth Portfolio currently represents 16% of the Alpha Hedge Portfolio.

The Growth Stocks Market has been in Euphoria Phase 4 since September 2023 and has been in a Positive Cycle since March 2023. We have an Alpha Position in our portfolio that will be maintained through March.

Crypto Market

Bitcoin near All-Time-Highs

In February 2024, the cryptocurrency landscape was dominated by Bitcoin’s impressive surge past the $60,000 mark, a feat not seen since November 2021. This milestone propelled Bitcoin’s market value to the brink of surpassing Meta, positioning it as a contender for the ninth most valuable asset in the world by market capitalization. The anticipation of Bitcoin’s fourth halving event, coupled with significant trading volumes and liquidation of short positions, underscores the growing investor confidence in digital assets. This bullish momentum suggests a new era of digital asset valuation. (blog.bitcoin.com).

The Alpha Hedge Crypto Portfolio combines either 1 Alpha Asset during Crypto’s Bull Market or 1 Hedge Asset during Crypto’s Bear Markets.

The Alpha Hedge Crypto Portfolio currently represents 21% of the Alpha Hedge Portfolio.

The Crypto Market is in Phase 4 (Euphoria Phase). Accordingly, an Alpha position was established in February 2023. This position will be maintained through March.

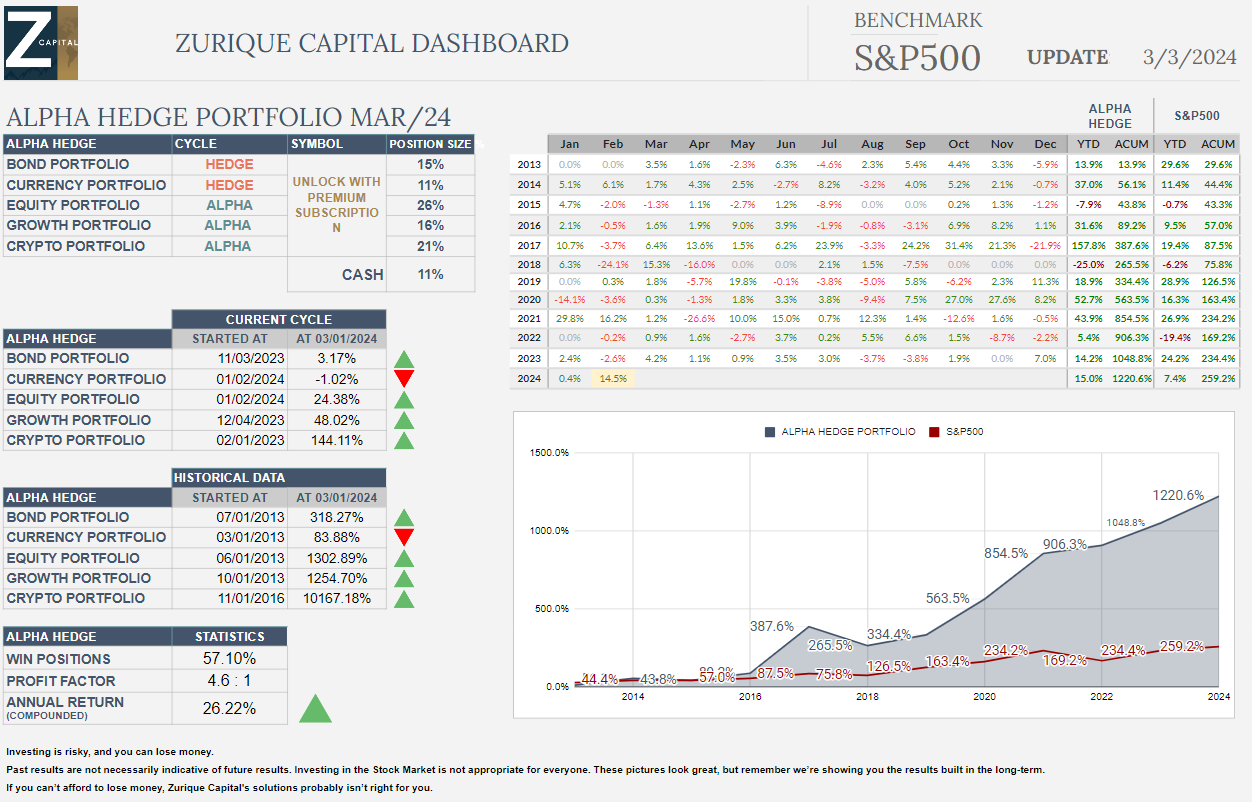

Alpha Hedge Portfolio Result Feb/2024*

2013 to 03/03/2024*

The Alpha Hedge Portfolio experienced a 14.5% increase in February, marking its best performance in 36 months.

The top-performing portfolios were Crypto, Growth, and Equity, in that order. The Bond portfolio demonstrated signs of recovery, while the Currency Portfolio was the only one to report a negative position.

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

In 2021, we restarted the 10x journey.↓

Alpha Hedge Collective2 Portfolio

09/17/2021 to 03/03/2024*

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.