📊In What time of the Cycle are we now? 7 Markets Case Study

Dive into the Cycles of Bonds, Interest Rates, Currency, Commodities, Stocks, REITs and Crypto (Update September/23)

#keypoints

Maximizing Returns

One Investing Strategy for Different Market Phases

Market Cycle Phases

In What time of the Cycle are we now? 7 Markets Case Study

Cycles of Bonds, Interest Rates, Currency, Commodities, Stocks, REITs and Crypto

Maximizing Returns

One Investing Strategy for Different Market Phases

Before delving into specific investment strategies, let's first understand the concept of the market cycle.

The market cycle refers to the recurring patterns and phases that the all assets undergoes over time.

By understanding these market phases, investors can gain insights into potential investment opportunities and adjust their positions accordingly.

After more than 10 years in the market and validations through backtests spanning 30 years, I have developed the Alfa Hedge Strategy, based on the trading systems of Stan Weinstein, Nicholas Darvas, and Curtis Faith.

Let's detail all the 6 Price Cycle Phases.

All assets go through 6 Price Cycle Phases.

Market Price Phases

1. Institutional Phase

Transition from a downtrend to an uptrend as "smart money" accumulates positions.

Transition from selling to buying pressure.

Investors should:

Detect early price shifts.

Focus on fundamentally strong stocks.

Await confirmation of an uptrend.

2. Basis Phase (Accumulation Phase)

Prices stabilize after a decline.

Phase is marked by price consolidation.

Decline in selling pressure indicates a downtrend nearing its end.

3. Wall Street Insiders Phase

Best Reward / Risk Point. The market exhibits a consistent rise.

Strong and steady uptrend observed.

Market shows higher highs and higher lows.

Technical indicators confirm the trend.

Investors should:

Buy and hold to maximize returns.

Implement trailing stop losses to guard profits.

4. The Public Phase

Period of immense public participation and heightened enthusiasm.

Extensive media attention and hype.

Significant retail investor involvement, often driven by FOMO.

Predominance of speculative behavior.

Peak of optimism and euphoria in the market.

Rapid, possibly unsustainable, price appreciation.

Large institutions may start exiting, securing profits.

5. The Top Phase (Distribution Phase)

The uptrend begins to falter, hinting at a market peak.

Uptrend starts to weaken.

Price movements are consolidated within a narrower range.

Visible signs of distribution such as institutional selling.

6. The Decline Phase (Bear Market)

The market shows a drastic shift from the prior uptrend, entering a bearish phase.

Persistent decline in stock prices with lower highs and lows.

Escalating selling pressure dominates.

Technical signs like breakdowns below key support levels emerge.

Investors should:

Emphasize risk management.

Prioritize capital preservation and consider defensive strategies.

The Alfa Hedge Strategy

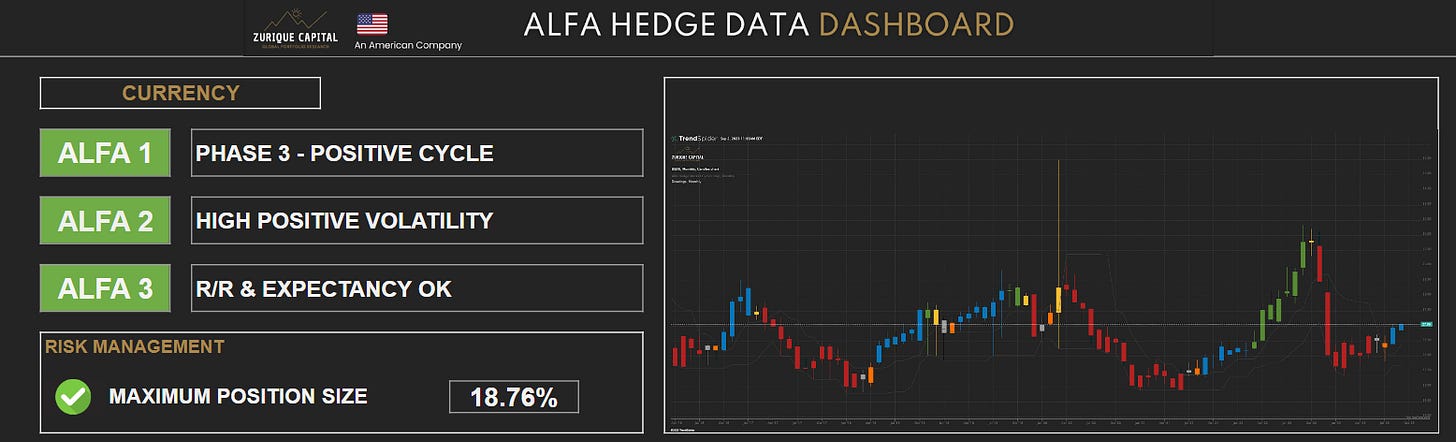

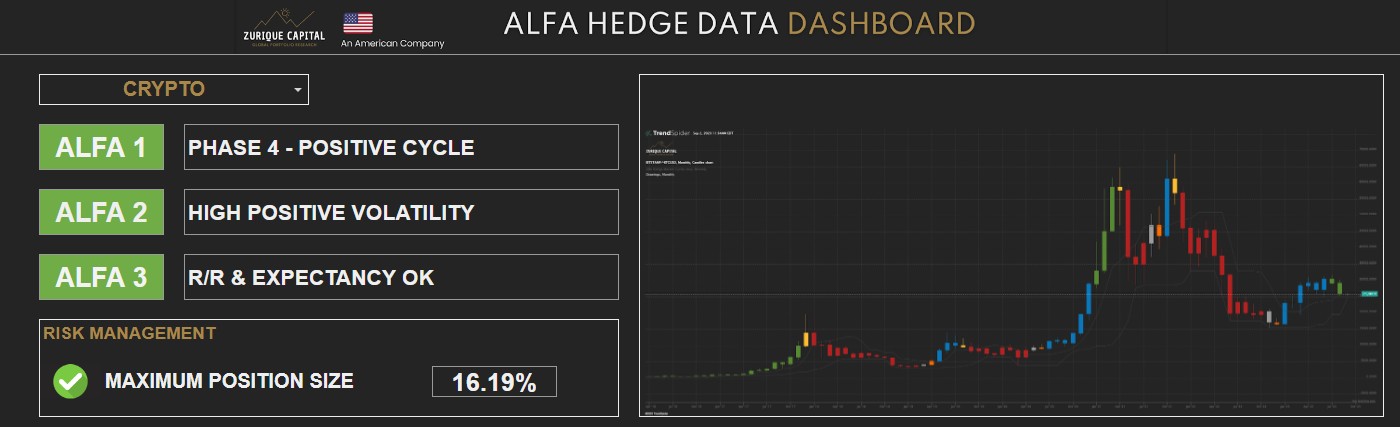

The Alfa Hedge Data Analysis was developed by Zurique Capital, and It has 3 key points:

ALFA 1: Market Cycle Phase, with this data we analyze the present situation of the asset.

ALFA 2: Historical Positive Volatility (highest probability of Long-Term uptrends), with this data we analyze the past.

ALFA 3: Expectancy Ratio, with this data we analyze what to expect in the future based on statistics.

MAX POSTION SIZE: The maximum position size in the portfolio is calculated using the statistical data of expected gain and risk-return ratio according to the Kelly criterion.

We invest our own money and share our Portfolio with Premium Subscribers.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

Know More About Premium Subscription

In What time of the Cycle are we now? 7 Markets Case Study

Our Market Cycle Algorithm (Alfa Hedge Data Analysis) monthly analyze Bonds, Interest Rates, Currency, Commodities, Stocks, REITs and Crypto and we assemble our positions accordingly.

Our Market Cycle Algorithm (Alfa Hedge Data Analysis) monthly analyze Bonds, Interest Rates, Currency, Commodities, Stocks, REITs and Crypto and we assemble our positions accordingly.

BONDS

Birthday to Bonds’ Negative Cycle. It’s making 3 years in September that Bonds entered in downtrend, and with no signal of Interest Rates reversion, It should stay in decline for another month.

Red light for Bonds. No positions in the Alfa Hedge Portfolio for Bonds because of the ALFA 1 analysis (momentum).

INTEREST RATES

Interest Rate kept the buying pressure in August and is in Positive Cycle.

We have position in the Alfa Hedge Portfolio, but accordingly with our algorithm, this position was reduced for September Rebalancing.*

*Premium Subscribers have access to our positions and can follow in real-time our real-life brokerage account portfolio.

CURRENCY

Currency Market entered the Phase 3, Positive Cycle in August.

A new Position in the Currency market will be added to our Portfolio in September. The last time we had a position in the currency market was from Oct/21 to Dec/22 Sep/2021 (+12.21%).

COMMODITIES

The Commodities market is loosing momentum, but the uptrend remain. Phase 4, Positive Cycle.

We will keep our position in September (this position was reduced in July/23) accordingly our algorithm.

STOCKS

The Stock Market after a short term volatility ended the month keeping the Phase 3 Uptrend.

We have 3 positions in our portfolio following the Stock Market, one of them was reduced accordingly our algorithm.

REITS

REIT Market still in downtrend with no signs of reversion for now.

No positions in the Alfa Hedge Portfolio in September.

CRYPTO

Crypto Market lost momentum in August, remained stagnant, but in the ring of the bell kept the ALFAs.

Position will be reduced or even closed in September.

Premium Subscribers click the Button bellow to access all the data of our Portfolio Rebalancing for September.

(All the details of what we will buy, sell, keep or close in September).

If the button doesn’t work, please click this link:

https://www.wallstreetinsiderreport.com/p/dailyupdate