In 2022, Stocks Plunged 25%, Yet Smart Investors Celebrated

Weekly Market & Portfolio Results: NVIDIA Jumping 16.8% in May | Cash Isn’t Lazy. It’s Strategic: Updated May/2025 Positions

In 2022, Stocks Plunged 25%, Yet Smart Investors Celebrated

The stock market isn't swayed by emotional speeches or political drama.

The market is an impartial judge, responding strictly to policies that affect real-world financial metrics, the price.

When governments introduced aggressive tariffs, markets reacted negatively because tariffs slow growth, raise prices, and harm corporate earnings. According to JP Morgan’s David Kelly, tariffs "raise prices, slow economic growth, cut profits, increase unemployment, and diminish productivity." Markets priced in these realities immediately, punishing stock valuations.

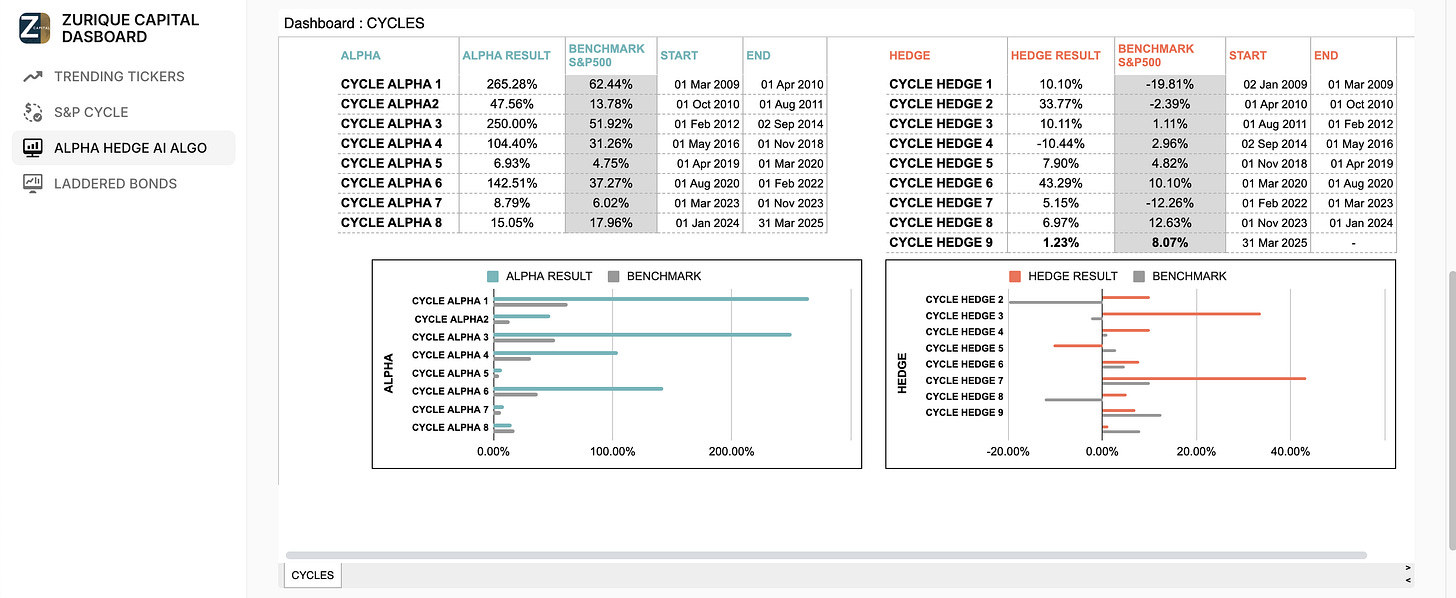

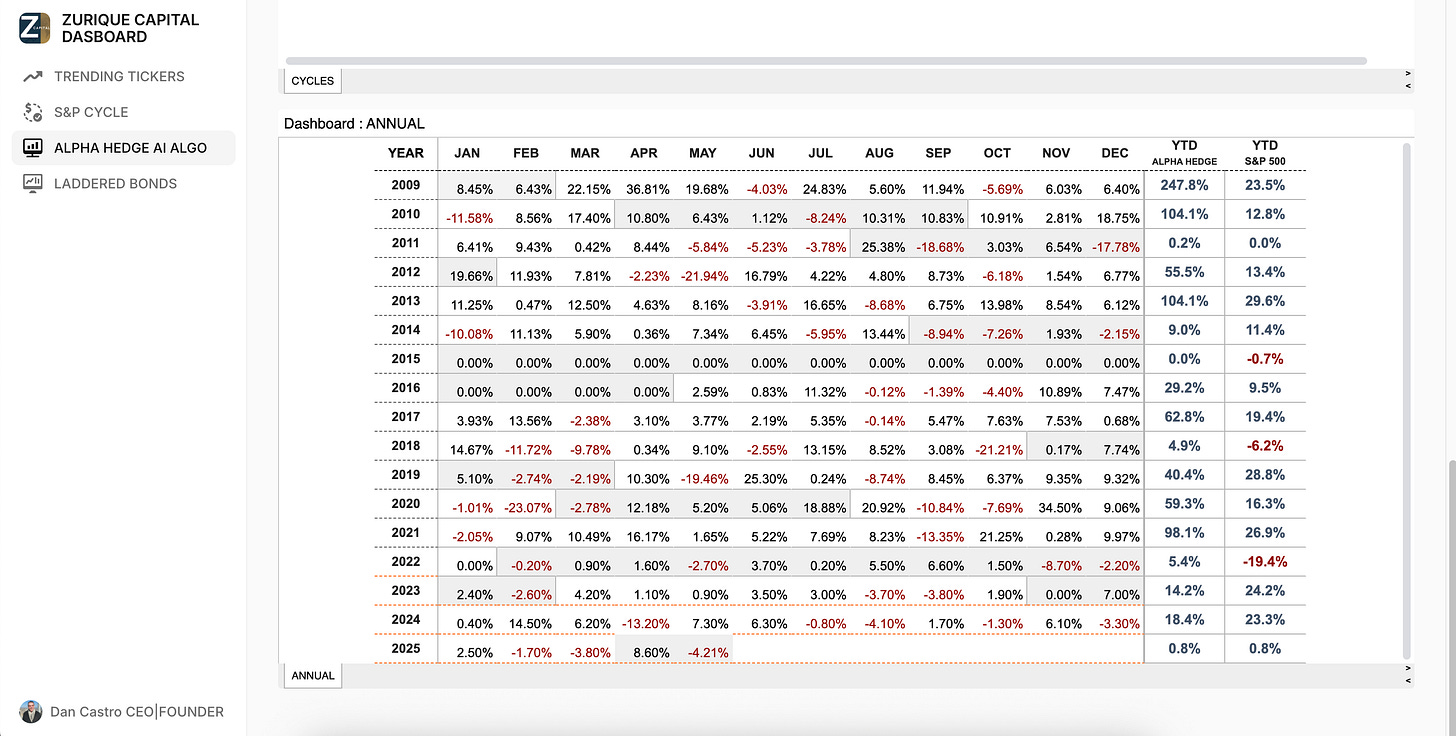

But there's an upside: historically, these market tantrums present strategic opportunities. During the inflation-driven market plunge of 2022, smart investors who understood market cycles hedged early, then turned aggressive precisely when the market signaled reversion, capturing exceptional returns in the years that followed.

The takeaway? Ignore political distractions—master the cycles, hedge wisely, and know exactly when to get aggressive.

Weekly Market Results

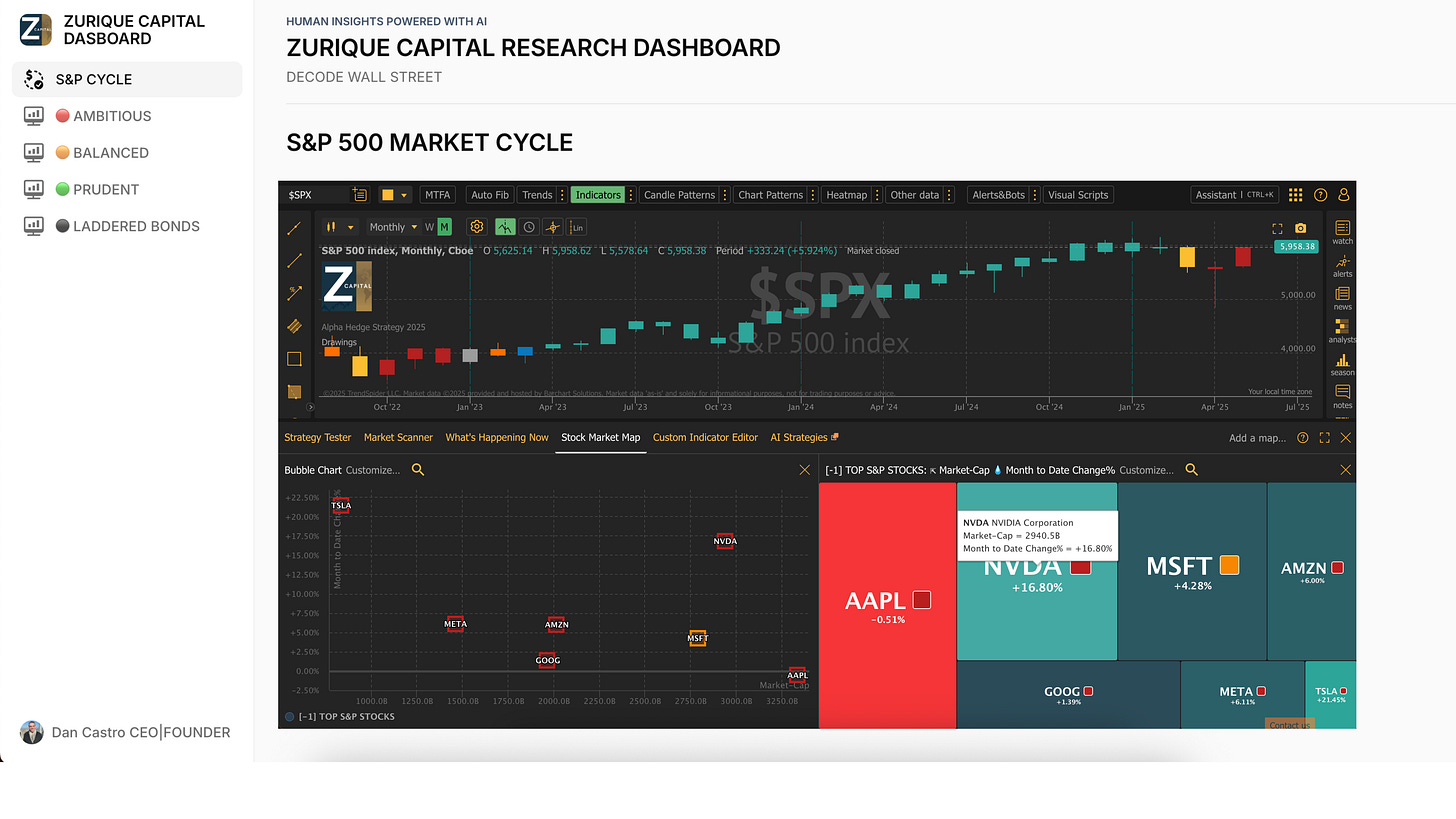

The Single-Handedly Stock Boosting the Market

Market cycles don’t move uniformly, they’re driven disproportionately by just a handful of key players.

NVIDIA’s NVDA 0.00%↑ outsized influence on the index isn’t just about performance, it’s about weight. As one of the top holdings in the S&P 500, its 16.8% surge in May delivered a disproportionate lift to the entire market.

While Tesla TSLA 0.00%↑ had the best individual return, its lower index weight muted its impact. NVIDIA, on the other hand, combined strong performance with significant index representation—making it the true driver behind the market’s recent move.

Apple AAPL 0.00%↑ , despite its heavy index weighting, lagged behind, delivering the weakest performance among the top seven stocks, though still ending positively.

Interestingly, Microsoft signaled a critical shift, moving into Phase 2—potentially marking the start of a new positive market cycle next month. The rest, including Apple, NVIDIA, Amazon AMZN 0.00%↑, Alphabet GOOG 0.00%↑, Meta META 0.00%↑, and Tesla TSLA 0.00%↑ , remain in Phase 6, implying declining momentum.

Monitoring these shifts allows investors to hedge risk intelligently and position aggressively at pivotal moments.

Portfolio Results

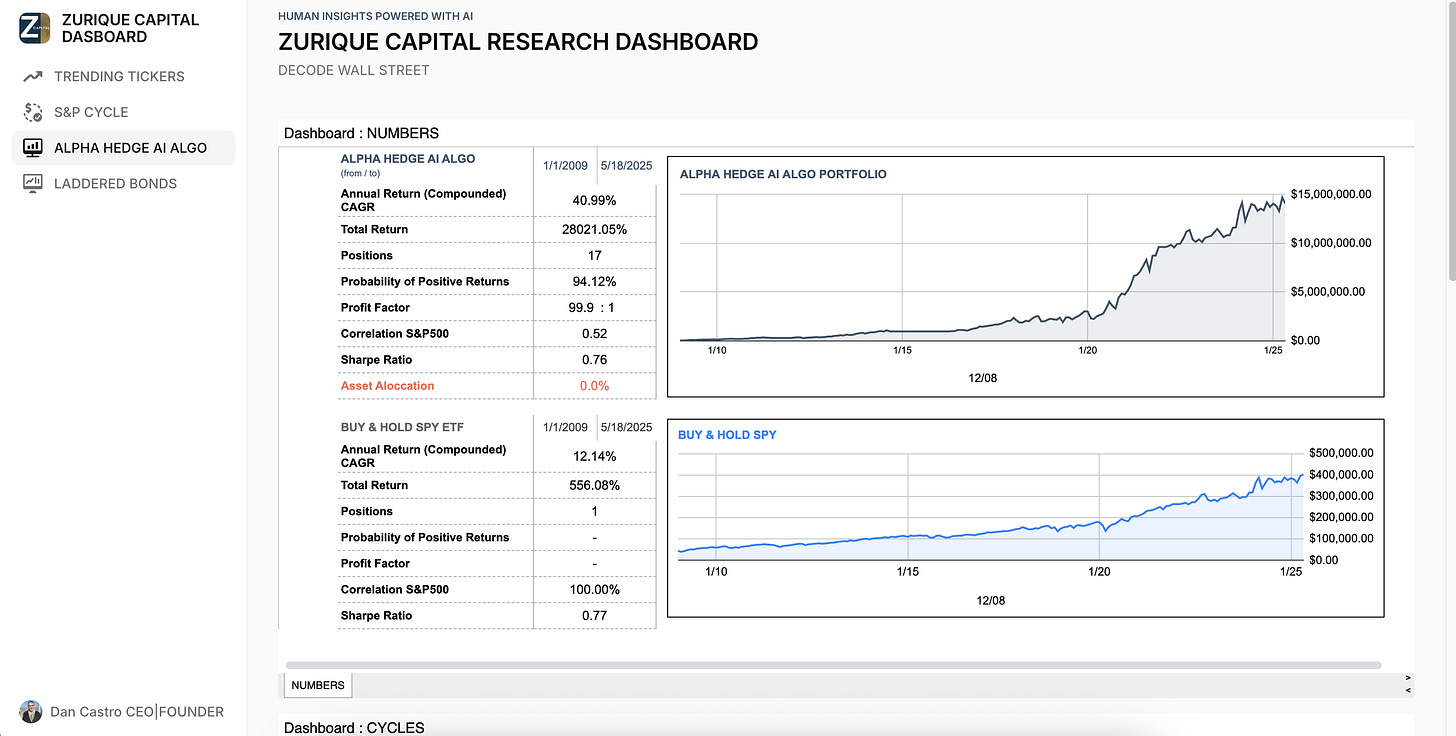

Cash Isn’t Lazy. It’s Strategic

Our algorithm remains in a protection cycle.

Why? Because the S&P 500 continues in Phase 6, a declining momentum zone. While many rush into positions hoping for a rebound, we’ve exited the market tactically, holding our capital in reserve through cash.

We only move into our alpha asset when our indicators confirm the right entry point. This disciplined approach is based on 17 complete portfolio reallocations since 2009, yielding a compound annual return of 40% with a Sharpe ratio of 0.76, closely tracking the S&P’s risk-return dynamics, but with significantly better downside protection.

Next decision point? June 2nd. If the S&P exits Phase 6 and our algorithm confirms it, we re-enter with conviction. Until then, capital preservation is the priority.

Unlock the Alpha Hedge AI Algo Portfolio ↓