How to Use AI for Investment Decisions? A Practical Guide

📊 Closing Bell Overview: Top 7 Assets & Alpha Hedge AI Algo Portfolio Review

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

How to Use AI for Investment Decisions? A Practical Guide

In this guide, we'll explore how to harness AI for smarter investment decisions.

By leveraging AI-powered tools and data-driven strategies, you can enhance your ability to analyze market trends, optimize portfolios, and make more informed, efficient decisions.

Step 1: Leverage AI for Wealth Growth

AI cuts through the noise of information overload, offering precise data analysis and trend forecasting—capabilities once reserved for insider traders. AI provides investors with a powerful advantage for making data-driven decisions.

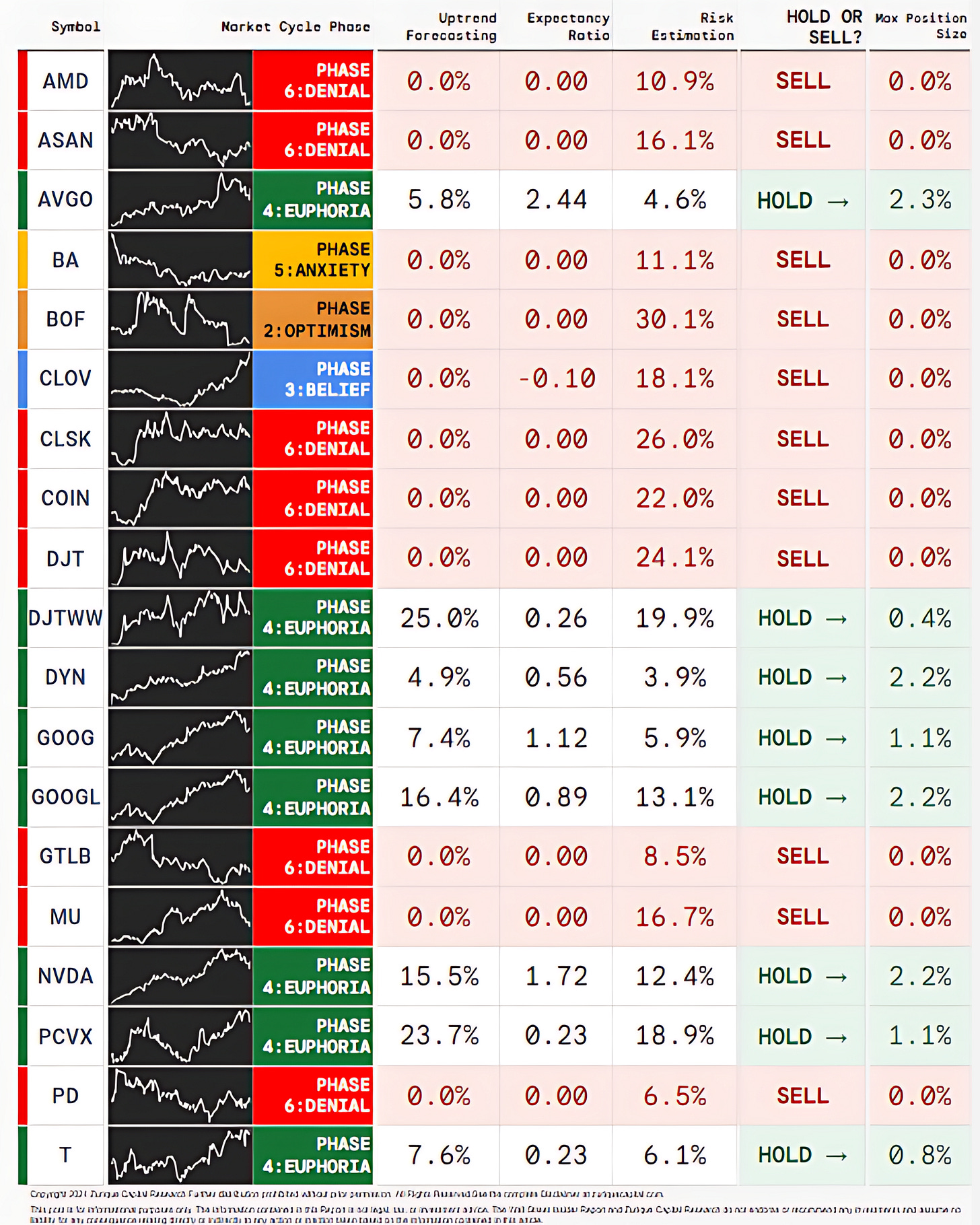

The Alpha Hedge AI Algorithm is designed to help investors filter out irrelevant information and make informed, timely decisions. By analyzing market cycles, it pinpoints assets with strong potential for long-term growth.

Step 2: Anticipate Market Cycles with AI

AI enhances market cycle predictions, enabling investors to confidently navigate market swings, avoid emotional reactions, and strategically enter and exit positions, minimizing missed opportunities.

Assets in Phases 3 or 4 of the cycle are set to hold.(understand the phases of the cycle here).

Step 3: Build an AI-Optimized Portfolio

AI and machine learning optimize portfolios by identifying key signals such as market cycles and past performance, ensuring a data-driven approach to wealth management.

Tools like the Kelly Formula help optimize position sizing and manage risk effectively. By adjusting position sizes based on risk tolerance, investors can maintain a sound, profitable strategy, with larger allocations given to assets that demonstrate stronger quantitative metrics.

AI empowers investors to make smarter, more strategic decisions based on objective data. By incorporating AI into your investment process, you'll be better positioned to navigate market fluctuations, minimize risks, and achieve long-term financial success.

CLOSING BELL OVERVIEW

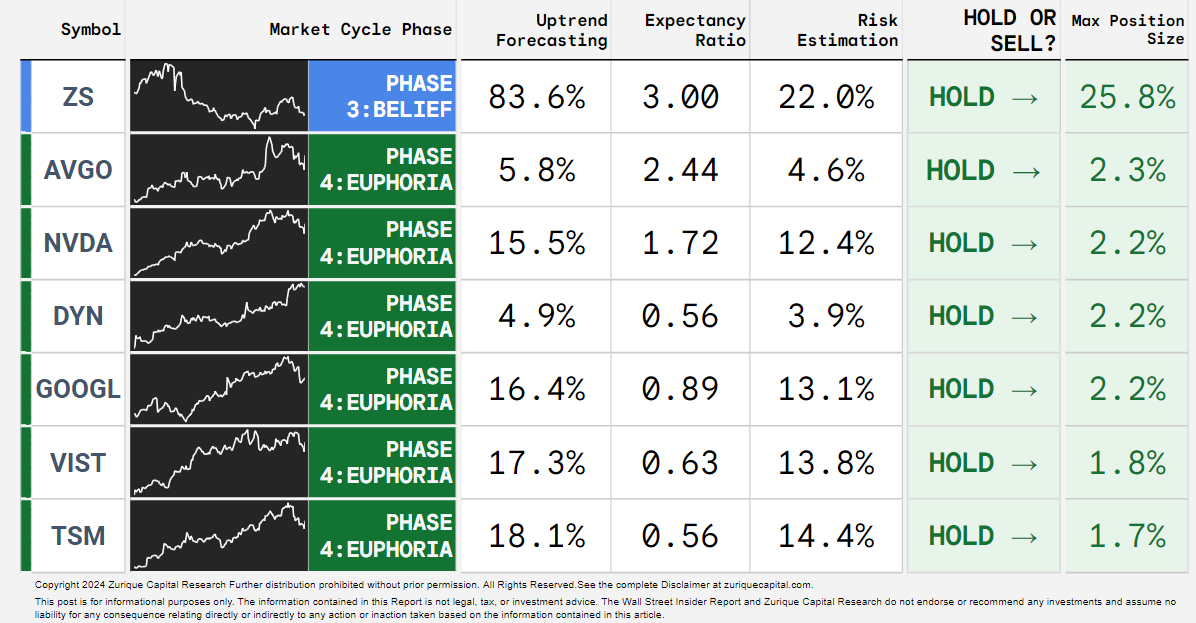

TOP 7 ASSETS OF THE DAY: 09/04/2024

The Alpha Hedge Algorithm decodes market movements to identify assets with high long-term growth potential. Today, it identified 54 assets; here are the Top 7:

ZS 0.00%↑ AVGO 0.00%↑ NVDA 0.00%↑ DYN 0.00%↑ GOOGL 0.00%↑ VIST 0.00%↑ TSM 0.00%↑

Follow our notes and access all the analyzed assets of the day:

https://substack.com/@wallstreetinsider

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

▶️Read what the Wall Street Insiders wrote about us↓

Subscribe today to the Wall Street Insider Report Premium and join 1.9K+ Global Investors across 60 countries who are building legacy wealth. Gain access now to:

Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

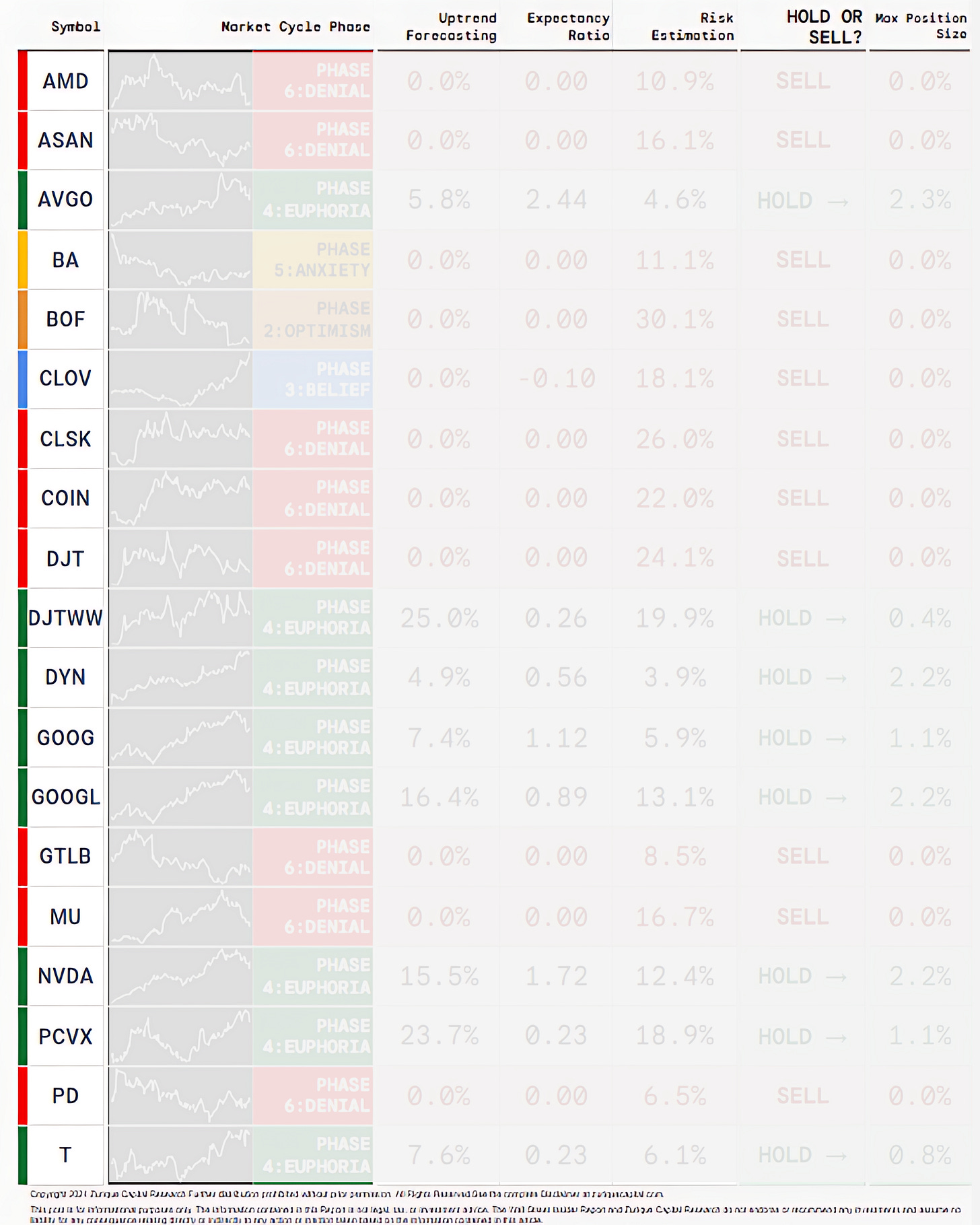

ALPHA HEDGE PORTFOLIO REVIEW: 09/04/2024

The Alpha Hedge Portfolio is down 2.5% this month, with a year-to-date gain of 12.2%.

Over 36 months, it has returned 35% (CAGR 10.5%), compared to the S&P 500's 20% (CAGR 6.3%).

The portfolio is estimated to double capital in 6.8 years, compared to 11.5 years for the S&P 500.