How to Navigate Investment Decisions in a Sea of News

+AI Investment Bot: Tech Stocks Trends & Alpha Hedge AI-Algo Portfolio Review: 10/28/24

How to Navigate Investment Decisions in a Sea of News

New York Call

Every business day, we hold a live meeting with our Brazilian clients, called the New York Call, where we analyze the market, our portfolio, and assets on demand. This is an excerpt from the meeting on 10/28/24. Below is an audio file with an automatic English translation.

Audio Automatically Translated to English

Investors often find themselves overwhelmed with choices and uncertainties about where to channel their investments. The sheer volume of information available—from news reports to online forums—can be both a blessing and a curse when trying to navigate through the investment landscape. This post explores how these resources can be used effectively to assist in investment decision-making.

The Overwhelming Sea of Information

Picture this: An investor is in a dilemma, unsure of where to invest their hard-earned money. They start by researching news articles, eagerly searching for insights and trends that might guide them. Additionally, forums become a hotspot for discussion, offering perspectives and opinions from other investors and enthusiasts.

But the question arises: Are these news pieces and forum discussions reliable sources for making investment decisions? Or do they merely add to the confusion?

The Role of Analysis in Investment Decisions

This is where a deeper analysis comes into play—an approach that not only considers the latest news but also evaluates the buzz in forums. It's a strategy designed to provide investors with a clearer sense of direction.

For instance, have you recently encountered reports about big names like Meta META 0.00%↑ or Tesla TSLA 0.00%↑ ? Last week's news might have sparked your curiosity, making you wonder:

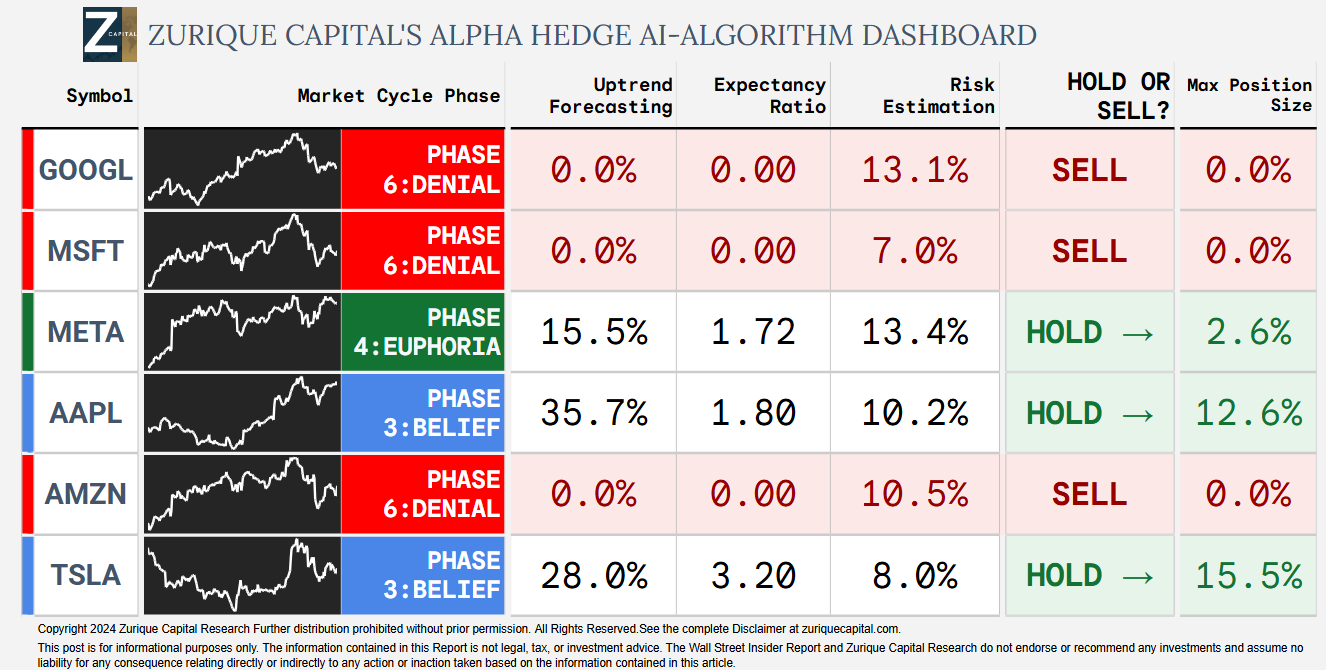

What phase is Tesla in currently? Is it the right time to invest, or should you hold off? Our report is crafted to address such questions, helping investors determine if it's the right move, whether they should invest at all, and even how much to consider investing.

Guidance through Algorithms

The backbone of this approach is an algorithm that synthesizes information from various sources, offering a comprehensive analysis tailored for investors. It provides the much-needed clarity and confidence to make informed decisions amidst the noise of market speculation.

In conclusion, while navigating the vast sea of investment information can be daunting, leveraging a structured analysis and algorithmic guidance can empower investors to make more informed, strategic decisions. Whether you're considering Meta, Tesla, or another investment, let well-researched data be your compass in the investment journey.

AI Investment Bot: Tech Stocks Trends

GOOGL 0.00%↑ MSFT 0.00%↑ META 0.00%↑ AAPL 0.00%↑ AMZN 0.00%↑ TSLA 0.00%↑

Alpha Hedge AI Algo Portfolio Review

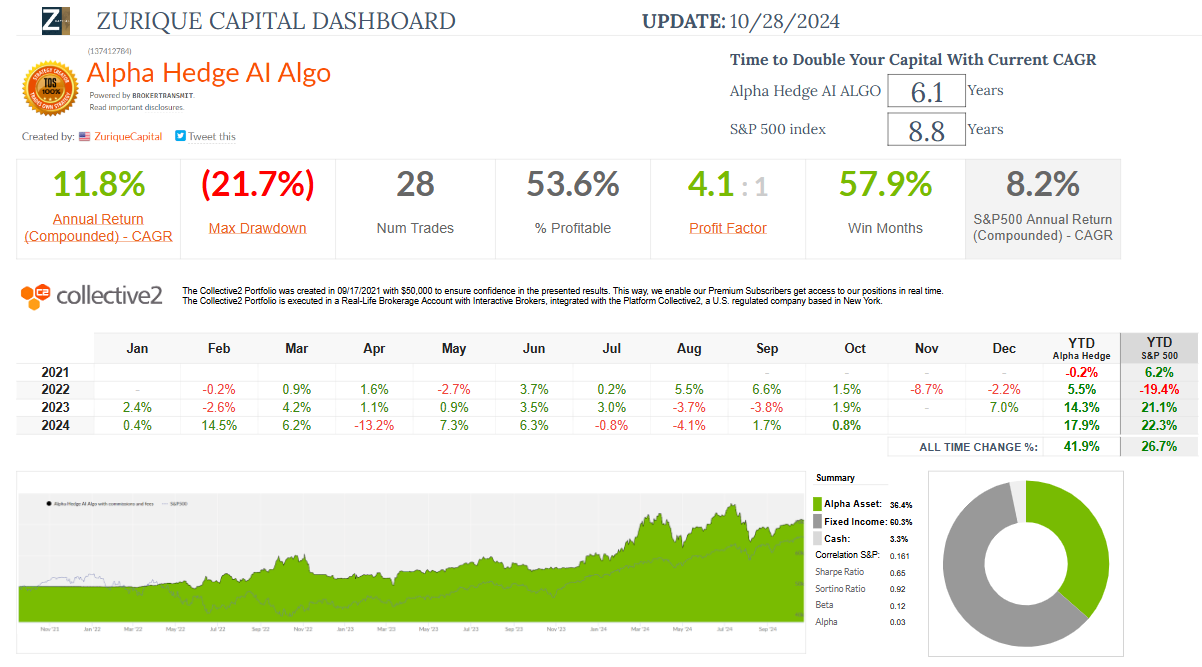

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/28/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge AI Algo Portfolio has delivered a total return of 41.9% (CAGR 11.8%), compared to the S&P 500's total return of 26.7% (CAGR 8.2%).

The portfolio is currently up 0.8% this month and has gained 17.9% year-to-date. At a CAGR of 11.8%, the portfolio doubles capital in 6.1 years, whereas the S&P 500, with an 8.2% CAGR, takes 8.8 years to do the same.

The portfolio has experienced a maximum drawdown of 21.7% and has been profitable in 53.3% of its 28 trades, with a profit factor of 4.1.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now, and let AI work for your financial future.

▶️Read what the Wall Street Insiders wrote about us↓