Building an AI-Optimized Investment Portfolio [Lesson 5/7]

Free 7 Lesson Course: How to Build Legacy Wealth with AI

Meet Your Instructor

Dan Castro

Investment Management Specialist (University of Geneva/Switzerland), graduated in Electronic Engineering.

Founder and CEO of Zurique Capital Research, an American company specialized in Data Analysis, Investment Portfolio construction, Investors Training and Consulting.

Guide of over 1.8K Investors in 55 Countries.

Building an AI-Optimized Investment Portfolio

Building an AI-Optimized Investment Portfolio

Welcome back to our course on "How to Build Legacy Wealth with AI." Today, we're exploring how to construct an AI-optimized investment portfolio.

This lesson will provide you with insights into maximizing wealth through advanced AI strategies and the sophisticated use of neural networks and signal-based models.

1. Maximizing Wealth: AI-Driven Market Cycle Strategies

Investment management has always been about decoding complex patterns and anticipating market trends.

With the advent of AI, machine learning and neural networks, these anticipations have become more accurate and insightful. Let's delve into how these technologies are harnessed to enhance investment returns.

1.1. The Foundation: Understanding Signals in Investment Management

Before we dive into the complexities of neural networks, it's essential to grasp the concept of signals in investment management. Signals are firm-specific variables that have shown a higher probability of anticipating future returns. The Alpha Hedge Algorithm leverages several key signals to guide investment decisions:

1.1.1. Key Signals and Their Impact

Market Cycle: By analyzing market cycle phases, the algorithm adjusts its strategies to align with current stock market conditions. Recognizing whether the market is in an expansion, peak, contraction, or trough phase allows the algorithm to anticipate general market trends and position the portfolio accordingly.

Past Return Performance: This signal gauges the momentum of specific investments. Historical performance data, contextualized with current market conditions, helps identify trends and patterns in asset returns, enabling informed investment decisions.

Expectancy: This signal focuses on the statistical characteristic of expectancy, which is integral for transforming uncertainty into certainty. By evaluating the probability of profit per dollar risked, expectancy helps ensure that investments are made based on data-driven confidence, leading to more consistent and reliable returns.

Understanding these signals helps identify potentially profitable opportunities. However, the real magic happens when these signals are combined and analyzed through advanced models like neural networks.

2. Introduction to Neural Networks in Finance

Neural networks, a core component of AI, mimic human brain operations to solve complex problems. In finance, they process and analyze vast amounts of data, identifying patterns that are not immediately obvious to human analysts.

2.1. Simple Neural Network Setup

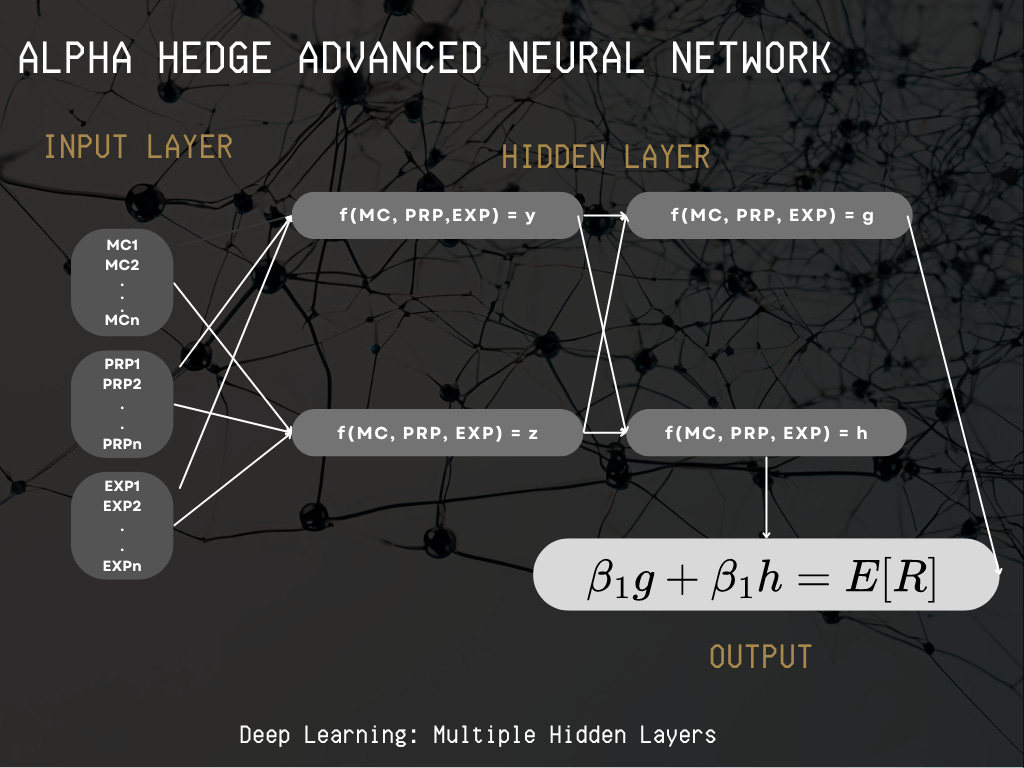

To understand how neural networks operate, consider a basic example involving only three inputs: Market Cycle, Past Return Performance, and Expectancy. Here's a simple neural network structure to forecast returns:

Input Layer: Consists of initial data points such as Market Cycle (MC), Past Return Performance (PRP), and Expectancy (EXP).

Hidden Layer: Processes the inputs using weighted sums and biases, forming a linear combination of the inputs.

Output Layer: Produces the final prediction, the expected future returns of the assets.

This simplified setup illustrates the fundamental operations of a neural network, setting the stage for more complex applications.

2.2. Enhancing Portfolio Optimization Accuracy with Neural Networks

The power of neural networks in investment management lies in their ability to refine portfolio optimization through a process known as training. The network learns from historical data, adjusting its parameters to minimize errors between predicted and actual returns.

2.3. Training Process

Forward Propagation: The network applies weights to the inputs to calculate returns.

Loss Function Evaluation: It calculates the returns using a loss function, typically the mean squared error.

Backpropagation: The network adjusts its weights to reduce the loss, improving the accuracy of returns over time.

By iteratively refining its portfolio optimization, a neural network can offer more precise forecasts than traditional models.

2.4. From Simple Regressions to Deep Learning

While initial neural network models may resemble simple regression analyses, they can evolve into more complex structures known as deep learning models. Deep learning involves multiple layers of neurons, each adding a layer of analysis and abstraction.

2.5. Advancing to Multiple Layers

Multiple Hidden Layers: Each layer learns different aspects of the data, from basic patterns to complex interactions.

Activation Functions: Functions like sigmoid or ReLU determine whether a neuron should be activated, introducing non-linear dynamics to the model.

These enhancements enable neural networks to handle complex, non-linear relationships in the data, often missed by simpler models.

3. Practical Implementation and Challenges

Implementing neural networks in investment management isn't without its challenges. It requires a robust dataset and careful tuning of parameters. Moreover, the choice of activation functions and the network's architecture significantly impact performance.

3.1. Steps in Implementation

Training Sample: Used to fit the initial model.

Validation Sample: Helps fine-tune the model by testing its performance on unseen data.

Test Sample: Evaluates the final model’s performance to ensure it generalizes well to new data.

3.2. Common Challenges

Overfitting: When a model is too closely fitted to the training data, it may fail to perform well on new, unseen data.

Computational Demands: Deep learning models require significant computational power.

4. Case Study: Building the Alpha Hedge Portfolio Following the Market Cycles

4.1. Step 1

Market Cycle Analysis, involves determining the current state of the market—whether it's in a Positive Cycle (bullish) or a Negative Cycle (bearish). This analysis guides the selection of assets—choosing an Alpha asset during a Positive Cycle and a Hedge asset during a Negative Cycle—according to the prevailing market conditions.

4.2. Step 2

The Alpha Hedge Algorithm focuses on the S&P 500 cycle. During S&P 500 Positive Cycles, an ETF that tracks this index is chosen based on the Alpha 1, Alpha 2, and Alpha 3 indicators. When the S&P 500 is in a Negative Cycle, a Hedge Asset is selected.

This process is repeated on a monthly basis. The average cycle lasts 17 months.

4.3. Step 3

Portfolio Composition. The Alpha Hedge Portfolio may include either an Alpha or a Hedge based on the S&P500 Market Cycle. We analyze statistical data, prioritizing assets with superior Alpha Indicators.

4.4. Step 4 (This Step will be detailed in the next lesson)

Optimizing Position Size to Minimize Risks. Regarded as the financial market's Holy Grail, the optimal position size was developed by computer scientist John Kelly in his 1956 paper, cited in William Poundstone’s book Fortune's Formula and was popularized by Edward Thorpe in blackjack. It has also been applied by Jim Simons, founder of the Medallion and Renaissance hedge funds.

4.5. Step 5

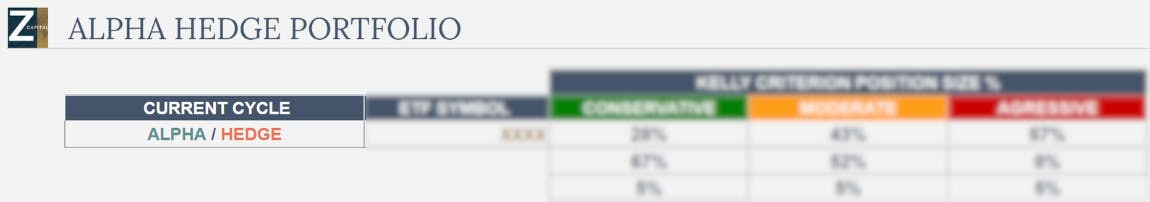

Risk Tolerance: Investors must decide their risk tolerance level: Conservative, Moderate, or Aggressive. According to historical statistical data, an efficient parameter to define your risk tolerance is the drawdown you are willing to accept.

"Drawdown is the measure of a decline in the value of an investment portfolio or individual asset from its peak to its lowest point over a specific period. It represents the difference between the highest value achieved and the subsequent lowest value before the investment recovers, indicating the extent of financial loss during that downturn."

Aggressive: Approximately 30% drawdown

Moderate: Approximately 20% drawdown

Conservative: Approximately 10% drawdown

4.6. Step 6

Portfolio Rebalancing. On the first Monday of each month, a review is conducted to assess the Alpha Indicators of specified markets, leading to any necessary adjustments based on the cycle.

Our assets are generally held for months or years. Premium Subscribers of the Wall Street Insider Report receive a spreadsheet on the first Monday, allowing them to access the Alpha Hedge Portfolio in real time from an actual brokerage account.

The spreadsheet columns are defined as follows:

1: Current market cycle (Alpha or Hedge);

2: ETF Symbol (Ticker of the ETF);

3: Position (Indicates if there's a current position in the asset: On or Off respectively);

4: Last month's closing price;

5: Protective sell order price (for abrupt market falls);

6: Size of the optimized position size depending on the risk tolerance of the investor.

7: If there was an adjustment to the Stop Price Sell order from last month, the Protective Sell Order price will be highlighted in red.

Conclusion: The Future of Investment Management with AI

As neural networks become more sophisticated, their potential to revolutionize investment management grows. These technologies allow for a deeper understanding of market dynamics, offering predictions that are not only accurate but also timely.

While challenges remain, the integration of AI in financial analysis signals a shift towards more data-driven, objective investment strategies. The future of investment management looks promising, with AI leading the way towards more informed and effective decision-making processes.

In our next lesson, we'll focus on minimizing risks with AI-driven strategies. Thank you for joining me today, and I look forward to continuing this journey with you. If you have any questions or comments, please leave them below. Let's keep pushing the boundaries of what's possible in wealth management.