How Headlines Predict Stock Success: AI for Investment

📊AI Investment Bot Identifies Today's Market Winners & AI Investment Management: Alpha Hedge AI Algo Portfolio Review

How Headlines Predict Stock Success: AI for Investment

Market volatility, complex investment choices, and the constant pressure to expand and preserve wealth can feel like an insurmountable challenge. The stakes are high, and one wrong move could significantly impact your financial future.

Consider this: you're navigating a sea of information, trying to discern which investments will safeguard and grow your assets. Yet, the complexity and sheer volume of options can leave you feeling uncertain and overwhelmed. The fear of making the wrong decision looms large.

But what if there was a way to cut through the noise? A method to anticipate market movements and make informed decisions with confidence?

In the groundbreaking study titled "Headline‑Driven Classification and Local Interpretation for Market Outperformance and Low‑Risk Stock Prediction," researchers explore innovative strategies to predict market trends and volatility.

Your Edge in Uncertain Times

Now, imagine turning these challenges into opportunities.

The Alpha Hedge AI Algorithm is a revolutionary tool empowering you to identify and anticipate market trends with unprecedented precision. This isn't just an advantage; it's a transformative leap that surpasses even the edge once held by those with illegal insider information.

Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

Picture a future where you're making investment decisions with the confidence and foresight of an insider—but through entirely legitimate means. The power of AI places global investors and market insiders with privileged insights on the same level.

Unlocking Market Outperformance: How Headlines Predict Stock Success

What if the key to outperforming the market is hidden in plain sight?

The recent study titled "Headline‑Driven Classification and Local Interpretation for Market Outperformance and Low‑Risk Stock Prediction" uncovers a groundbreaking approach to predicting stock trends and volatility using only financial news headlines.

Key Insights:

The paper investigates the potential of using financial news headlines to predict low-volatility stocks that outperform the market, specifically the S&P 500 Index.

The goal is to determine whether machine learning (ML) and natural language processing (NLP) can be used to classify stocks based on their future performance and volatility.

Key Research Questions

Can stock trends and volatility be predicted using only news headlines?

What text entities (words) in headlines have the most influence on predicting stock performance and volatility?

Methodology

The study solves three binary classification problems:

Identifying stocks that outperform the S&P 500.

Distinguishing low-volatility stocks with a positive trend.

Distinguishing low-volatility stocks with a non-positive trend.

Several ML models are used, including logistic regression, support vector machines (SVM), neural networks (NN), long-short term memory networks (LSTM), and FastText.

The best-performing models are analyzed using LIME (Local Interpretable Model-agnostic Explanations) to extract influential keywords in headlines.

Literature Review

Various studies have examined the connection between stock market movements and financial sentiment analysis from news and social media. However, few have explored the long-term impact of news headlines on stock volatility.

The study builds on earlier research, utilizing models like SVM, LSTM, and FastText, while also incorporating traditional models such as logistic regression.

Trend and Volatility Modeling

Stocks are classified based on their ability to outperform the S&P 500 and their volatility levels. Volatility is modeled using a stochastic differential equation (GBM), allowing the authors to estimate both the trend and volatility of stock prices.

Text Vectorization

For statistical learning methods (e.g., logistic regression, SVM), text inputs (headlines) are transformed using term frequency-inverse document frequency (TF-IDF).

Neural network models use text embeddings, while FastText handles text processing internally.

Results and Discussion

Trend Prediction: LSTM models showed the best performance, but overall accuracy was limited, suggesting that additional numerical financial data would improve results.

Volatility Prediction: Models performed better in predicting volatility than stock trends. FastText, neural networks, and logistic regression outperformed others in classifying volatility.

Key Findings:

Certain words, such as "dividends," "technology," and "revenues," increased the likelihood of stock outperformance.

Words associated with uncertainty, such as "pharmaceuticals," "therapeutics," and "oil," negatively impacted predictions.

Conclusion

The study demonstrates that news headlines can help predict stock performance and volatility, providing some contradiction to the Efficient Market Hypothesis (EMH), which argues that stock prices fully reflect all available information.

Despite modest accuracy, the models revealed useful insights, especially for risk-averse investors focusing on low-volatility stocks.

Future improvements could involve using more sophisticated text-classification models and additional financial indicators.

Potential Improvements

Incorporate more powerful pre-trained models from repositories like Hugging Face.

Use advanced text vectorization techniques (e.g., Word2Vec, Bag-of-Words).

Further analyze the sensitivity of singular vs. plural forms in headlines and enhance model interpretation using SHAP (SHapley Additive exPlanations).

AI Investment Bot Identifies Today's Market Winners

Imagine having access to an AI investment bot that sifts through endless market data to pinpoint the most promising assets—all in real-time. This is not a futuristic concept; it's what the Alpha Hedge Algorithm offers you today.

The TrendSpider platform allows investors to filter asset news using specific keywords such as "dividends," "technology," and "revenues."

Presenting the Top 7 Assets Identified Today: SBUX 0.00%↑ TSLA 0.00%↑ SMAR 0.00%↑ BABA 0.00%↑ JD 0.00%↑ LBRDA 0.00%↑ NVDA 0.00%↑

Here’s How We Find These Market Opportunities:

STEP 1: OPPORTUNITY MARKET SCANNER: The Alpha Hedge AI Algorithm decodes market trends, analyzing market movements to spot assets with high potential for long-term growth. Using sophisticated data processing, it scans thousands of assets to find the most promising opportunities with a focus on future profitability.

STEP 2: USING MATHEMATICS TO MAXIMIZE WEALTH: Mathematical precision is at the core of the Alpha Hedge Algorithm. By analyzing market cycles, it helps pinpoint the perfect moment to buy or sell. This ensures that we not only find high-potential assets but also maximize wealth with minimal risk—ensuring an ideal balance in your portfolio.

STEP 3: TOP MUST-WATCH ASSETS: The Alpha Hedge Algorithm prioritizes assets that are in market Phases 3 or 4, as these show the strongest quantitative data. Any assets outside these phases are excluded, allowing us to focus only on those with the highest potential for growth. Today’s top 7 assets were identified by this AI-powered process.

Our AI-driven process analyzes news headlines, financial reports, and market data to select these assets. It harnesses market volatility, turning potential risks into opportunities by capturing trends as they emerge.

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

But here's the exciting part: while these assets are valuable on their own, there's an even more efficient way to grow your wealth exponentially with the help of AI.

Exponentially Grow Your Wealth with the Alpha Hedge AI Algo Portfolio

We've explored how AI can identify top-performing assets daily. Now, envision integrating this power into a comprehensive strategy designed for long-term success.

Introducing the Alpha Hedge AI Algo Portfolio—your hands-off solution leveraging AI to navigate the complexities of the market and grow your wealth exponentially.

Key Benefits:

Market Volatility Management: Our AI adapts to market changes in real-time, mitigating risks and capitalizing on opportunities to safeguard and expand your wealth.

Wealth Exponential Expansion: By identifying high-growth opportunities ahead of the curve, the algorithm accelerates your wealth-building journey.

Tax Optimization: Strategically structured to maximize after-tax returns, ensuring you retain more of your gains.

Transparency: Access to a live brokerage account offers radical transparency, allowing you to monitor performance and strategies with confidence.

Our commitment to data-driven strategies and independent analysis means you can trust that your investments are managed with the utmost expertise and integrity.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

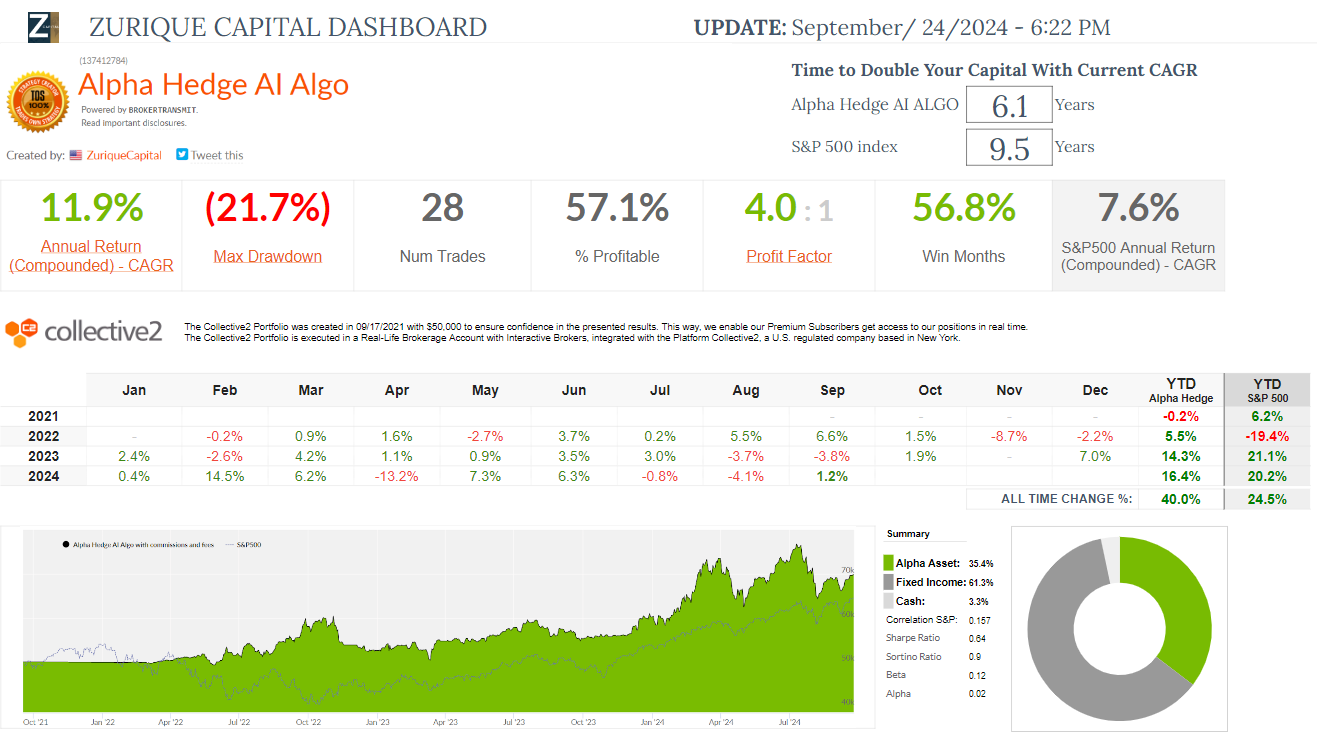

Alpha Hedge AI-Algo Portfolio Review: 09/24/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 40% (CAGR 11.9%), compared to the S&P 500's total return of 24.5% (CAGR 7.6%).

The portfolio is up 1.2% this month and has gained 16.4% year-to-date.

At a CAGR of 11.9%, the portfolio doubles capital in 6.1 years, whereas the S&P 500, with a 7.6% CAGR, takes 9.5 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Ready to transform your financial future?

Subscribe to the Wall Street Insider Report Premium for real-time access to the Alpha Hedge AI Algo Portfolio. Gain daily insider-level AI analysis and monthly actionable insights tailored to help you achieve your investment goals.

Elevate your investment strategy today.

▶️Read what the Wall Street Insiders wrote about us↓