How Big Data Drives AI Stock Market Models

LESSON 3/5: Breaking Down AI’s Role in Stock Market Predictions [Free Course]

Breaking Down AI’s Role in Stock Market Predictions [FREE COURSE: Lesson 3/5]

The Silent Killer of Stock Predictions: Poor Data Quality

Inaccurate stock predictions are often a result of one major issue: poor data quality.

Investors frequently rely on incomplete or irrelevant data, leading to flawed predictions and costly mistakes. Imagine thinking you’ve identified the next big stock, only to realize the data behind your analysis was misleading.

Our lesson "How Big Data Drives AI Stock Market Models" addresses this critical problem by highlighting how the right combination of stock market data, economic variables, and technical indicators can lead to more accurate predictions. Don’t let faulty data sabotage your investments.

How can AI eliminate the guesswork and put you ahead of the market? Let’s dive into the solution.

AI – Your Ethical Edge in the Market

Investors today face a major disadvantage against those with privileged insights.

However, the Alpha Hedge AI Algorithm levels the playing field. It allows you to identify and anticipate market trends with insider-like precision, without breaking the law.

This AI technology empowers you to achieve what was once only possible for those involved in unethical practices like insider trading*. But with AI, you can now make legally sound and data-driven decisions with insider-level foresight.

Curious how we feed data into AI for stock predictions? Here's how our lesson breaks it down.

*Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

How Big Data Drives AI Stock Market Models

How to feed data into AI models effectively for stock market predictions.

It begins by categorizing the various types of input data:

Stock Market Data: Historical stock prices, volumes, highs/lows, and dividend yields are used to predict future price movements.

Economic Variables: Indicators like interest rates, inflation, exchange rates, and commodity prices help AI models understand broader market influences.

Technical Indicators: Tools like Moving Average (MA), RSI, and Bollinger Bands track market momentum and trends.

Textual Data and Sentiment Analysis: AI uses NLP to analyze news, social media, and company reports, predicting market movements based on sentiment.

Poor data choices can lead to inaccurate results.

Data preprocessing techniques are vital for preparing raw data for analysis:

Normalization: Scaling data to a uniform range to help the AI process it more efficiently.

Dimensionality Reduction (PCA): Reducing input variables while preserving essential information.

Noise Reduction and Smoothing: Techniques like Z-scores and moving averages filter out irrelevant fluctuations, making patterns clearer for AI models.

By combining these data types and preprocessing them with techniques like normalization and noise reduction, AI improves both its accuracy and reliability. This is how we consistently achieve results others can’t.

Ready to see how this works in action? Let’s look at the top-performing assets selected by our AI.

Top 7 Assets of the Day – Selected by Our AI Investment Bot

AI Investment Bot identifies the top 7 assets of the day, leveraging advanced algorithms to capture opportunities in volatile markets: SAVA 0.00%↑ DOCU 0.00%↑ TTD 0.00%↑ CVNA 0.00%↑ PTCT 0.00%↑ PANW 0.00%↑ PLTR 0.00%↑

These assets have been selected using real-time data analysis, identifying key trends that others miss.

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

While these daily insights offer immediate value, the true power lies in the long-term wealth-building potential of the Alpha Hedge AI Algorithm. Imagine having this kind of insight at your fingertips, consistently working to grow your wealth.

Curious about the Alpha Hedge AI Algo Portfolio that offers a hands-off approach to exponential growth?

Presenting the Alpha Hedge AI Algo Portfolio – Your Gateway to Exponential Wealth

The Alpha Hedge AI Algo Portfolio is more than just daily stock picks. It’s a long-term, hands-off investment strategy that leverages AI to grow your wealth exponentially.

With access to a live brokerage account and radical transparency, you can watch your portfolio grow in real-time, benefiting from AI-driven analysis that adapts to market cycles. Stop relying on guesswork and start leveraging cutting-edge AI technology for sustainable financial growth.

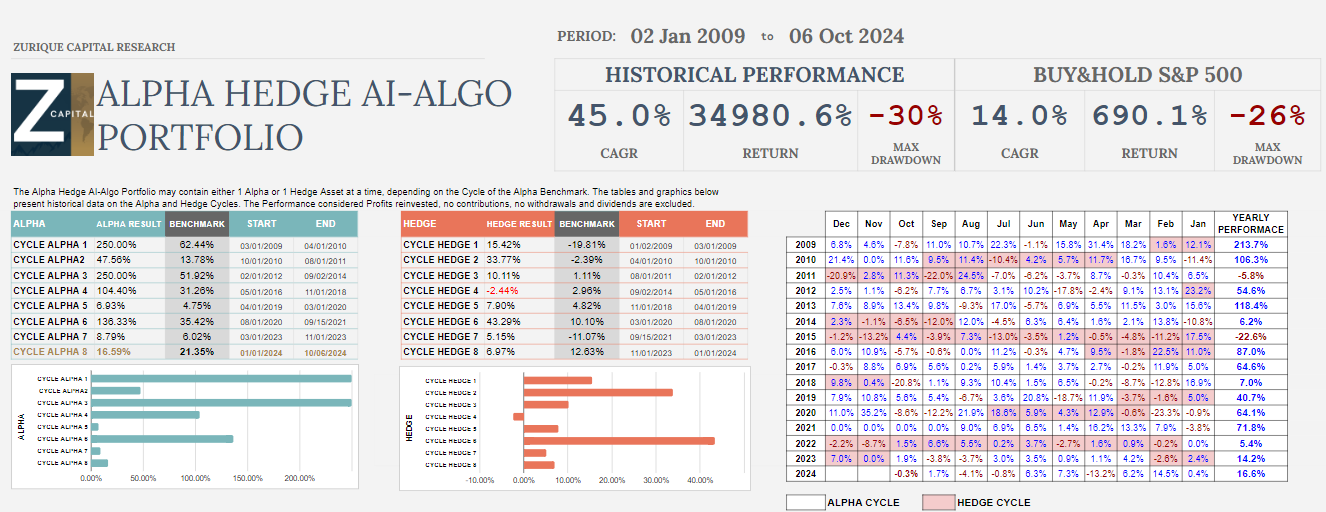

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/07/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge Portfolio has delivered a total return of 38.9% (CAGR 11.3%), compared to the S&P 500's total return of 24.2% (CAGR 7.5%).

The portfolio is currently down 1.3% this month and has gained 15.4% year-to-date.

At a CAGR of 11.3%, the portfolio doubles capital in 6.4 years, whereas the S&P 500, with a 7.5% CAGR, takes 9.6 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe now to the Wall Street Insider Report Premium for exclusive access to the Alpha Hedge AI Algo Portfolio, daily AI analysis, and actionable insights that put you ahead of the market.

▶️Read what the Wall Street Insiders wrote about us↓