How AI Is Trained to Predict Stock Market Trends

LESSON 4/5: Breaking Down AI’s Role in Stock Market Predictions [Free Course]

Breaking Down AI’s Role in Stock Market Predictions [FREE COURSE: Lesson 4/5]

Why Accuracy Isn’t Enough—Your Investment Model May Be Failing You

Many investors believe that if their model can predict market movements accurately, they’re set for success.

But time and time again, they fall short of real-world profitability. The truth is, statistical accuracy doesn’t always translate to profits in the stock market. In fact, most models out there don’t take into account what really matters—profitable, actionable insights for real trading scenarios.

That’s where the game changes. In "How AI Is Trained to Predict Stock Market Trends," we explore how my approach bridges this gap. Are your predictions falling short? Maybe it’s time to rethink your strategy.

What if you had access to a tool that not only accurately predicts stock movements but also translates those predictions into real profits?

From Prediction to Profit—How Alpha Hedge AI Gives You an Edge

Imagine having the same kind of market foresight that insider traders* rely on—but entirely legal and ethical.

My Alpha Hedge AI Algorithm can give you that edge by identifying and anticipating market trends with unprecedented precision. This AI-driven technology levels the playing field, giving you access to the same level of insight that historically was only available to a select few.

You don’t need "insider information" anymore—AI has changed the game.

*Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

Ready to see how AI’s power translates into profits? Let me walk you through the process.

How AI Is Trained to Predict Stock Market Trends

Training Algorithms: Training is the process of teaching AI models to recognize patterns in stock market data. The most commonly used training algorithms in stock market forecasting include:

Backpropagation (BP): A widely adopted training algorithm where the model learns from its past errors by adjusting weights to minimize prediction errors. Backpropagation is used in neural networks to make models more reliable.

Genetic Algorithms (GA): Some hybrid models incorporate genetic algorithms to optimize the learning process. GAs simulate the process of natural selection to find the most effective model parameters.

Performance Evaluation: After training, AI models are evaluated based on how accurately they can predict stock movements. The evaluation is typically done using a variety of performance measures, such as:

Statistical Measures: Mean Squared Error (MSE), Mean Absolute Error (MAE), and Root Mean Squared Error (RMSE) are used to quantify the differences between predicted and actual stock prices.

Profitability: Some studies go beyond statistical measures and evaluate the models based on how much profit their predictions could generate in real-world trading scenarios.

Model Comparisons: it’s important comparing AI models with both traditional methods (like ARIMA or GARCH models) and other AI techniques to determine the most effective approach. Hybrid models, which combine multiple AI techniques, typically outperform standalone models and traditional approaches, especially in terms of prediction accuracy and profitability.

But don’t just take my word for it. Let me show you the results.

AI Investment Bot: Real Results, Real Assets—Harnessing Market Volatility Today

Today’s markets are unpredictable—but that’s exactly where my Alpha Hedge AI Algorithm shines.

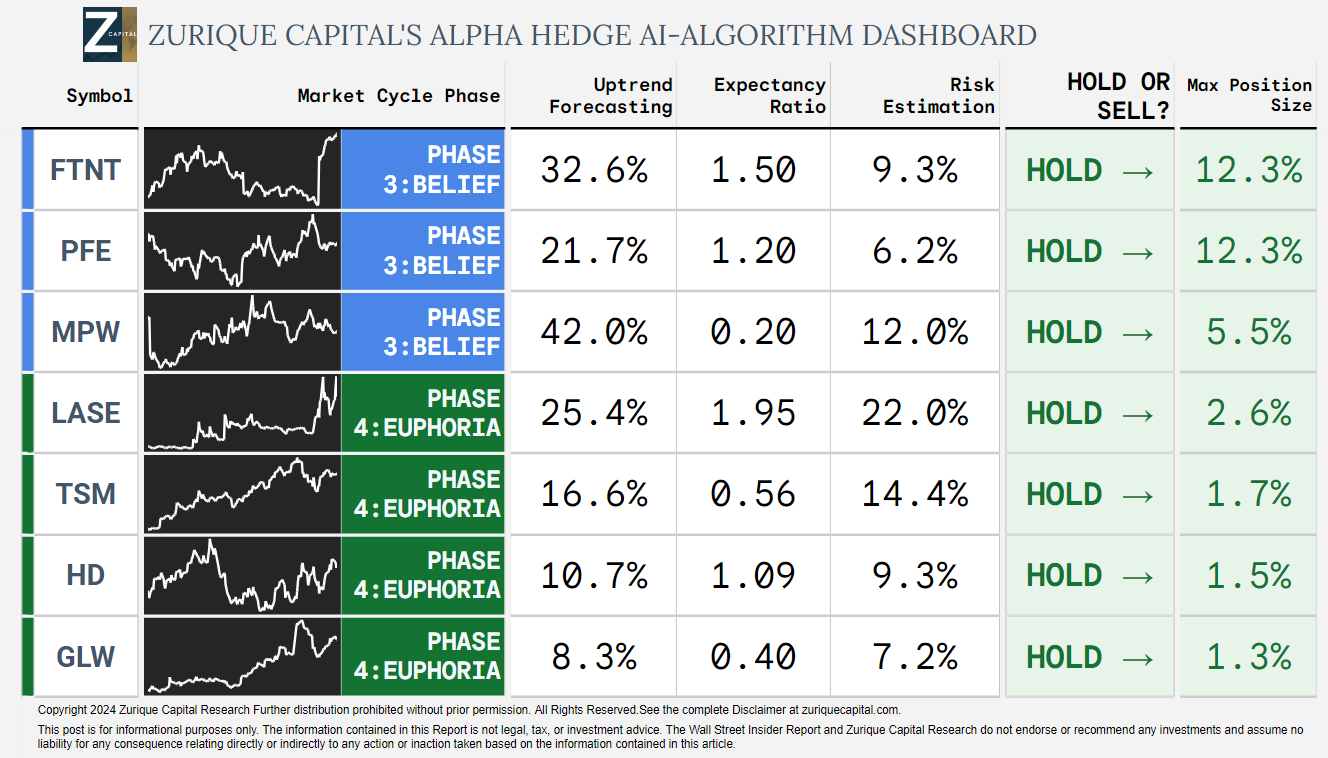

By analyzing thousands of data points, this AI-driven system consistently identifies the top assets poised for growth. Here are the top 7 assets the AI picked today, based on real-time market data:

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

These aren’t just random picks—they are the result of a rigorous, data-driven process designed to capture opportunities even in volatile markets. And while these assets are valuable on their own, there’s an even better way to grow wealth exponentially with AI. I’ll reveal it next.

Ready to learn more about how to harness the full power of AI for your portfolio?

Alpha Hedge AI Portfolio—Your Hands-Off Solution to Exponential Wealth

The Alpha Hedge AI Algo Portfolio is the key to unlocking a hands-off, long-term wealth-building strategy. Powered by AI, this portfolio dynamically adjusts to market conditions, making informed decisions in real time to capture the best opportunities. It’s not just about picking the right assets—it’s about managing them effectively for exponential growth.

And the best part? You can watch it in action through a live brokerage account, with full transparency, ensuring you’re always in the know about your investments.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/08/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge Portfolio has delivered a total return of 40.3% (CAGR 11.7%), compared to the S&P 500's total return of 24.9% (CAGR 7.7%).

The portfolio is currently down 0.3% this month and has gained 16.6% year-to-date.

At a CAGR of 11.7%, the portfolio doubles capital in 6.2 years, whereas the S&P 500, with a 7.7% CAGR, takes 9.4 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe to the Wall Street Insider Report Premium today, and gain real-time access to the Alpha Hedge AI Algo Portfolio, daily insights, and monthly actionable strategies to grow your wealth.

Take control of your financial future—subscribe now and start leveraging the power of AI to build legacy wealth.

▶️Read what the Wall Street Insiders wrote about us↓