How AI-Driven Investment Strategies Compare to Traditional Methods

📊 Closing Bell Overview: Top 7 Assets of the Day

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

How AI-Driven Investment Strategies Compare to Traditional Methods

Artificial intelligence (AI) is rapidly transforming the investment landscape, offering substantial advantages over traditional investment methods.

As AI continues to evolve, its impact on investment strategies is becoming increasingly evident, providing investors with a more efficient and effective way to manage their portfolios.

Below, we compare key aspects of AI-driven strategies with traditional methods, highlighting how AI is disrupting the investment industry.

Data Processing and Analysis

AI systems excel in processing vast amounts of data with unmatched speed and accuracy. They can swiftly analyze financial reports, news articles, social media sentiment, and economic indicators in real-time, identifying patterns and trends that human analysts might overlook (we share our analysis all day long in our X Profile).

This capability enables more informed and data-driven investment decisions, potentially leading to higher returns. Unlike traditional methods that may rely on slower, manual analysis, AI's comprehensive approach offers investors a significant edge in understanding market dynamics.

Speed and Efficiency

AI algorithms can execute trades at speeds far beyond human capabilities, making split-second decisions that capitalize on market inefficiencies. In volatile markets, where timing is crucial, AI’s rapid execution is particularly advantageous.

Traditional methods, which depend on human analysis and slower decision-making processes, often miss these fleeting opportunities. The ability of AI to act instantly on emerging data provides a critical advantage in fast-moving markets.

Risk Management

AI-driven strategies often incorporate advanced risk management techniques, utilizing predictive analytics to foresee market volatility and adjust trading strategies in real-time. This proactive approach helps mitigate potential losses, providing a more dynamic response to changing market conditions.

In contrast, traditional strategies can be more rigid, which may expose investors to greater risks during periods of market turbulence.

Elimination of Human Bias

Human emotions and biases can significantly influence investment decisions, sometimes leading to irrational outcomes. AI systems, however, are designed to make decisions based solely on data, eliminating the emotional biases that often cloud judgment in traditional investing. This objectivity enhances the overall effectiveness of investment strategies, allowing AI-driven approaches to outperform those that are swayed by investor sentiment.

Accessibility of Advanced Strategies

AI technology has democratized access to sophisticated investment strategies that were once the domain of institutional investors. Today, AI-driven platforms offer retail investors the same advanced tools, broadening the investment landscape and leveling the playing field. This increased accessibility allows a wider range of investors to benefit from cutting-edge strategies previously out of reach.

Bottom Line

AI-driven investment strategies offer numerous advantages, including enhanced data analysis, speed, risk management, and reduced bias. However, it's essential to recognize the potential risks associated with over-reliance on algorithms.

A balanced approach that integrates human expertise with AI capabilities is likely to yield the best investment outcomes. As AI technology continues to advance, it is poised to redefine the investment landscape, offering investors who embrace it the potential for significant rewards.

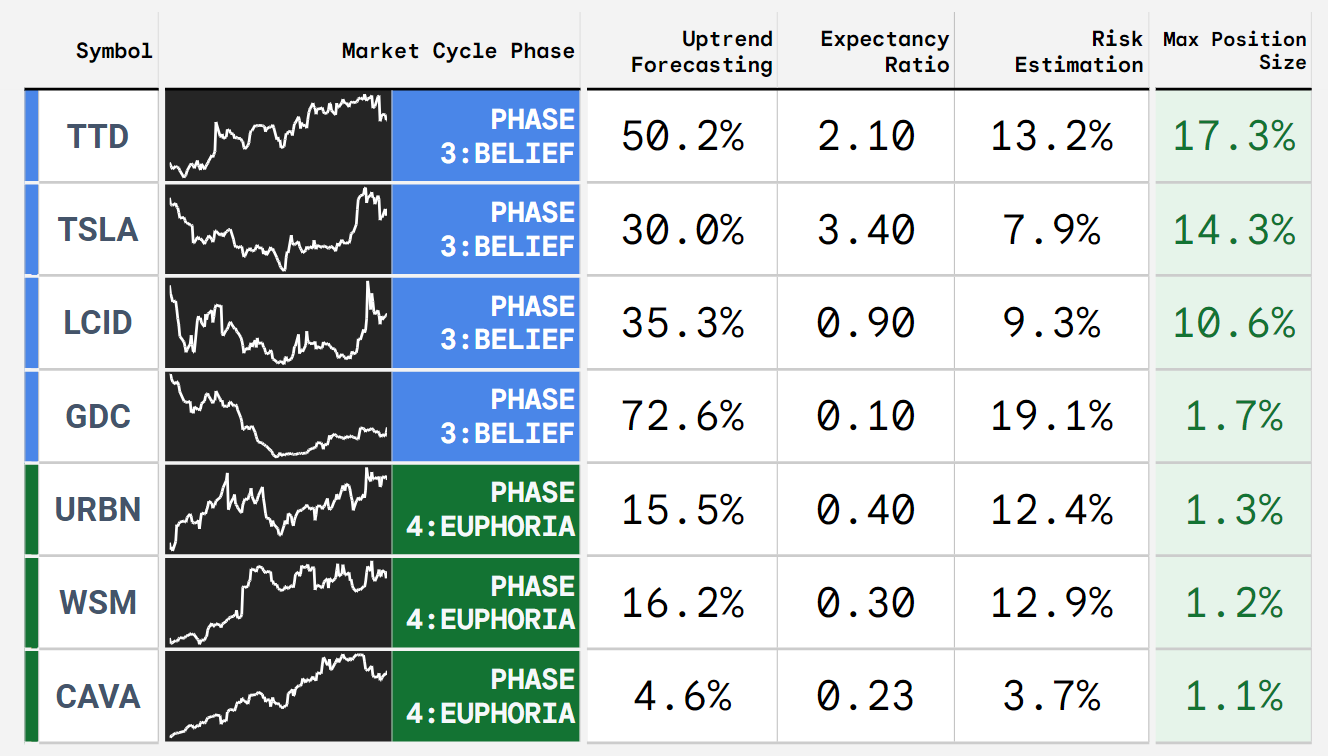

TOP 7 ASSETS - CLOSING BELL OVERVIEW: 08/22/2024

The Alpha Hedge Algorithm decodes market movements to identify assets with high long-term growth potential. Today, it identified 48 assets; here are the Top 7:

TTD 0.00%↑ TSLA 0.00%↑ LCID 0.00%↑ GDC 0.00%↑ URBN 0.00%↑ WSM 0.00%↑ CAVA 0.00%↑

Follow Zurique Capital on X for exclusive access all the findings of the day:

Zurique Capital on X: https://x.com/zuriquecapital

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

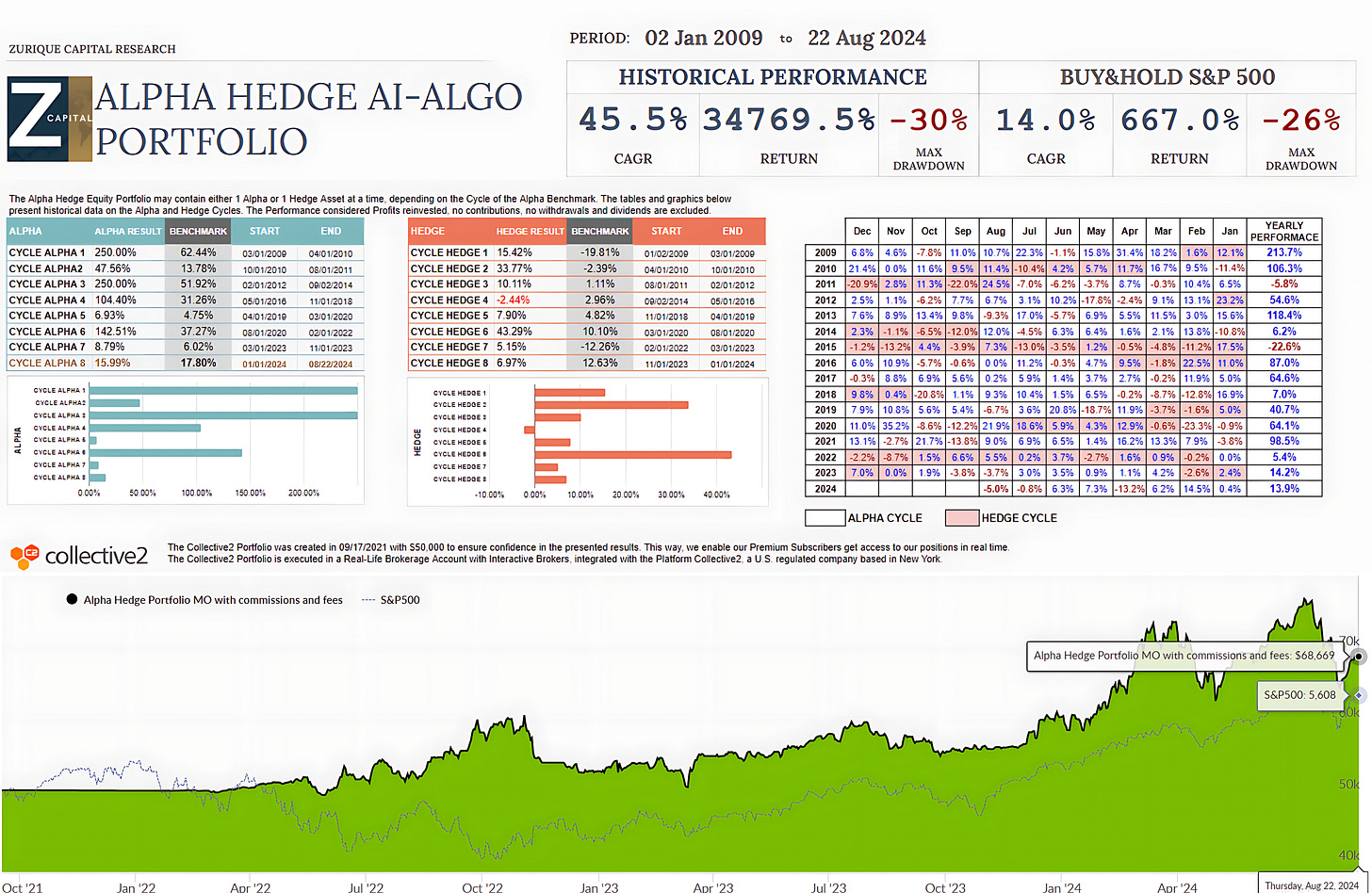

ALPHA HEDGE PORTFOLIO REVIEW:08/22/2024

The Alpha Hedge Portfolio is down 5% this month, with a year-to-date gain of 13.9%. Over 188 months, it has returned 34,769.5% (CAGR 45.5%), compared to the S&P 500's 667% (CAGR 14.0%).