📊Have Your Investment Gains & Enjoy US Stocks All Time High

Inside Wall Street: Week #20/2024

Inside Wall Street: Week #20/2024

Inside Wall Street: Week #20/2024

Have Your Investment Gains and Enjoy with US Stocks All Time High

After 11 years of analyzing market cycles, I've noticed one thing when the market is at all-time highs: Most people struggle with knowing what to do. Here are two common questions:

1. Is it time to sell?

2. Is it time to buy more?

This uncertainty arises because most investors don't have clear buying and selling strategies.

There's an efficient way to address this:

1. Understand the market cycle.

Currently, the S&P 500 is in phase 3 of the market cycle.

2. Know the appropriate investor approach for each cycle.

The ideal buying point was in January 2024. At this point, investors should be allocated with a moderate risk tolerance.

3. Execute your rebalance (if needed) on the first Monday of each month.

Monitor the cycle by the end of the month.

Let’s dive in this week developments ↓

Historic Close

US Stocks rally, with the Dow Jones Industrial Average DIA 0.00%↑ closing at 40,000 for the first time. This milestone underscores strong investor confidence. The Dow gained 1.36%, the S&P 500 SPY 0.00%↑ edged up 1.65%, and the Nasdaq QQQ 0.00%↑ gained 2.19%. All major indexes recorded weekly gains, highlighting market resilience amid economic fluctuations.

Economic Resilience

Investor excitement grew this week due to promising April inflation data, raising hopes for interest rate cuts. However, Federal Reserve warnings on Thursday about prolonged high rates tempered this optimism. Despite this, the overall market trend remained positive, reflecting the delicate balance between inflation data and interest rate expectations.

Federal Reserve officials influenced market sentiment with their remarks. Fed Governor Michelle Bowman noted insufficient progress on inflation control, suggesting potential future rate hikes. Fed Chair Jerome Powell will address Georgetown University's Law School via pre-recorded video due to COVID-19. These insights are crucial for understanding the Fed's future actions.

Key Stocks Movements

Reddit RDDT 0.00%↑ (Phase 4 of the Market Cycle - short term) shares jumped 10% after announcing a partnership with OpenAI, nearing its March peak of $65.11. This collaboration integrates ChatGPT with Reddit's forums, enhancing user engagement and content delivery. The market's positive response highlights confidence in Reddit's growth and the transformative potential of artificial intelligence.

GameStop GME 0.00%↑ (Phase 2 of the Market Cycle) shares dropped over 19% after forecasting a decline in first-quarter sales. This followed a brief rally reminiscent of the 2021 meme stock surge. The shift towards online shopping challenges GameStop's retail model, highlighting the volatility of meme stocks and the need for adaptive market strategies.

Upcoming Focus

Fed Minutes and Speakers

The Federal Reserve will release the minutes of its April 30-May 1 meeting on Wednesday, shedding light on discussions about maintaining higher interest rates due to inflation. This follows recent data showing a slower-than-expected rise in U.S. consumer prices in April. Throughout the week, speeches from key Fed officials, including Raphael Bostic and John Williams, will provide further insights into monetary policy. The economic calendar is packed with reports on home sales, durable goods orders, and consumer sentiment, all of which will be closely monitored by investors.

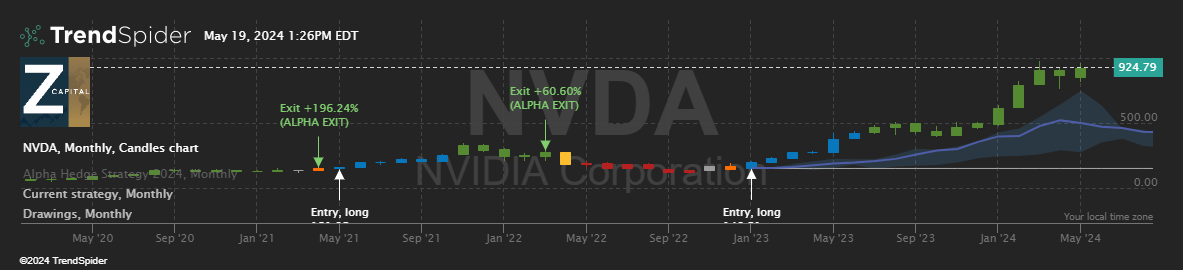

Nvidia Earnings

Nvidia NVDA 0.00%↑ (Phase 4 of the Market Cycle) is set to announce its quarterly earnings on Wednesday, a report that could significantly impact U.S. stock markets. Known for its pivotal role in AI technology, Nvidia is expected to showcase a substantial revenue increase to $24.8 billion from $7.2 billion a year ago, with earnings per share projected to soar to $5.57 from $1.09. With its stock up over 90% this year, Nvidia must meet or exceed these expectations to sustain its momentum. The results will not only influence Nvidia’s stock but also have broader implications for the tech sector.

PMI Data Releases

May PMI data from the U.S., China, the eurozone, and the U.K. will provide crucial insights into the global economic outlook. Signs of recovery are emerging in the euro area, U.S. inflation is trending downward, and China's first-quarter growth surpassed expectations. Despite this, rising U.S. tariffs on Chinese imports and potential retaliatory measures from China pose risks to global trade and growth. These geopolitical tensions could affect manufacturers, particularly in Germany, and potentially disrupt economic recovery trends and inflation dynamics.

Alpha Hedge Portfolio Evolution

Alpha Hedge Portfolio Evolution: 2013 to 05/17/2024

The Alpha Hedge Portfolio, is in Alpha Cycle, with a moderate risk tolerance, demonstrated a monthly performance of +7.9%.

Since its inception in March 2013, the portfolio has achieved a return of 1,208.3%, significantly outperforming the S&P 500's 271.8% gain over the same period.

Currently, the S&P 500 is in phase 3 of the market cycle, aligning with the portfolio's strong performance metrics.

In 2022, the Alpha Hedge Portfolio increased 10x, yielding over 900% return on the initial investment.

This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

Since the Alpha Hedge Portfolio's data was first made public on September 17, 2021, it has generated a return of +34.2%, compared to the S&P 500's +18.6% increase.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

Unlock the Alpha Hedge Portfolio ↓