📊From Theory to Reality: Challenging the Buy&Hold Strategy

Alpha Hedge Strategy Breakthrough - Part 2

WALL STREET INSIDER REPORT

Join our community of global Investors in 44 countries who are anticipating the Market demystifying the Market Cycle and investing smarter in Wall Street👇

From Theory to Reality: Challenging the Buy&Hold Strategy (with Historical Evidence)

Click HERE or in the image☝️ to watch.

https://x.com/zuriquecapital/status/1747392493283332298?s=20

This article offers an insightful exploration of the popular 'Buy and Hold' investment strategy, questioning its efficacy and adaptability in the face of historical market trends and real-world economic challenges.

It aims to provide readers with a balanced understanding of the strategy, highlighting the importance of timing, valuation, and personal financial realities.

First, let’s define into the Alpha 2 Indicator of the Alpha Hedge Strategy.

ALPHA 2: Historical Performance vs. Buy & Hold, this data we analyze the probability of Long-Term uptrends in the past.

We select the assets in our Portfolio with probability of Long-Term uptrends are those that the Alpha Hedge Performance overtakes the Buy & Hold Performance.

The "buy and hold" strategy is often touted as a surefire path to financial success.

But is it really the one-size-fits-all solution it's made out to be?

Let's dive into the intricacies of this approach and explore whether it's the golden ticket it's often thought to be.

The Myth of Average Returns

Picture this: historical data waving its hands, boasting an average annual return of about 10% since 1900. Impressive, right?

But here's the catch – the market's a rollercoaster, not a merry-go-round. Those average figures mask the peaks and troughs that can turn an investor's hair grey overnight. Inflation's sneaky fingers also play a part, pinching your profits until they're slimmer than they appeared at first glance.

A substantial difference exists between average and actual returns. The influence of losses significantly undermines the annual compounded effect on investments.

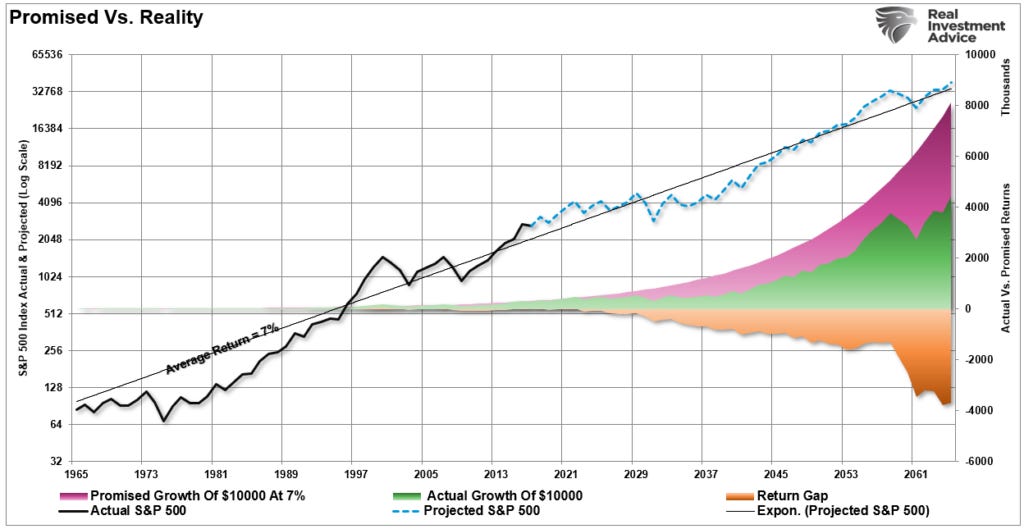

To demonstrate this, the purple shaded area in the graph indicates an average return of 7% per year. However, the discrepancy between the anticipated return and the actual return is where the gap lies. There is a considerable long-term variance between what investors were promised (highlighting a critical flaw in financial planning) and the actual returns achieved

The Reality of Economic Challenges

It's a hard pill to swallow, but the average Joe and Jane aren't sitting on piles of cash. Many are juggling bills, living paycheck to paycheck, and facing retirement savings that are as thin as soup. So when we talk about "buy and hold," it's essential to remember that it's not just about market trends; it's about real people with real financial pressures. The strategy needs to be more adaptable, more in tune with the economic realities of the day.

Timing and Valuation: The Crux of the Matter

Let's cut to the chase: timing is everything. Dive into the market when valuations are as high as skyscrapers, and your "buy and hold" strategy might just hold you back. It's like catching a train – timing your entry and exit can make all the difference. And don't forget about life expectancy. It's a grim thought, but if you're playing the long game, you've got to ask yourself, "Will I be around to see these returns?"

The likelihood is high that one would not live long enough to witness the average long-term return rate.

The chart below illustrates an investment of $1,000 across various starting periods. The holding period for the return spans 35 years until death, based on actuarial tables, with no withdrawals made. The orange line represents a annualized compounded returns of 6%. In contrast, the black line shows the actual outcomes. The bar chart at the bottom indicates the surplus or deficit relative to the 6% annualized return goal.

Life Expectancy Time Windows for 6% Returns At the time of death, the invested capital falls short of the promised target in nearly every instance, except for the current cycle that began in 2009. However, this cycle is yet to complete, and any significant market downturn in the future is likely to erase most, if not all, of these gains.

A Strategy, Not a Dogma

So there you have it. "Buy and hold" is a strategy, not a religion. It's about being savvy, understanding when to buy and hold according to the cycle of the market, and knowing which assets buy though the Alpha 2 analysis.

📈Wall Street Insider Report Premium

Every day, our premium subscribers send assets for case studies, and we share these analyses with all the premium subscribers.

Became a Premium Subscriber and take your investing to the next level with the Wall Street Insider Report.

As a subscriber, not only will you gain in-depth insights into market trends and cycles, and you'll also have the unique opportunity to send in your assets for personalized analysis.

Elevate your portfolio following the Alpha Hedge Portfolio from a Real-Life Brokerage Account in Real Time.

Join our community of global Investors in 44 countries who are anticipating the Market demystifying the Market Cycle and investing smarter in Wall Street.👇