Finance Made Simple: Understanding Ratios

📊 AI for Investment: AI Investment Bot Uncover Today’s Top 7 Assets & AI Investment Management: Alpha Hedge AI Algo Portfolio Review

Finance Made Simple: Understanding Ratios

As an investor, you know the frustration of market unpredictability. Whether it’s missing out on a prime opportunity or facing unexpected losses, navigating today’s volatile financial landscape can feel like driving a car without shock absorbers on a bumpy road.

Inconsistent returns, unpredictable trends, and market noise cloud your decision-making process.

But what if you could smooth out this ride?

An efficient strategy can offer a powerful solution to stabilize your portfolio’s performance, just like superior shock absorbers calm the chaos of a rough road. The solution is at your fingertips.

Insider-Level Insights Without Crossing Legal Boundaries

The problem of volatility is clear, but what if you could predict market movements before they happen?

Imagine a world where you have the precision and foresight that only the most privileged insiders once had.

With the Alpha Hedge AI Algorithm, you can. This AI-driven tool empowers investors like you, giving you an edge far beyond mere luck.

AI isn't just about speed; it's about leveling the playing field, offering you insights that were once available only through insider trading.

The Alpha Hedge AI Algorithm makes this kind of foresight available to everyone —legally, ethically, and with unmatched precision.

Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

Financial Stability Is Like Driving a Car with Shock Absorbers

The audio simplifies the concept of financial ratios, particularly the Sharpe and Sortino ratios.

This are Its Key Concepts:

Financial Ratios: These are critical tools used in evaluating portfolio performance but can often seem abstract and complex.

Sharpe and Sortino Ratios:

Sharpe Ratio: The Sharpe Ratio measures the risk-adjusted return of an investment by comparing its excess return (over a risk-free rate) to its standard deviation (volatility). A higher Sharpe Ratio indicates better risk-adjusted performance.

Sortino Ratio: The Sortino Ratio is similar to the Sharpe Ratio but only considers downside risk (negative volatility), ignoring upward volatility. It measures the risk-adjusted return relative to downside risk, providing a more focused view of performance in terms of managing losses.

The Alpha Hedge Portfolio:

In September, the Alpha Hedge Portfolio reported a Sharpe Ratio of 0.64 and a Sortino Ratio of 0.90, reflecting the portfolio's risk-adjusted returns.

Takeaways for Investors:

Steady Growth: High Sharpe and Sortino ratios lead to less dramatic fluctuations and more consistent, stable returns.

AI Investment Bot Uncover Today’s Top 7 Assets

The Alpha Hedge AI Algorithm has identified the top 7 assets of the day. These assets, carefully selected using advanced AI analytics, demonstrate the power of technology in spotting opportunities before the market even reacts. Whether you're looking to harness market volatility or capitalize on emerging trends, these assets are leading the charge today: UNFI 0.00%↑ INDO 0.00%↑ BABA 0.00%↑ BILI 0.00%↑ VST 0.00%↑ SE 0.00%↑ CALM 0.00%↑

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

But this is just the beginning. The real power of the Alpha Hedge AI Algorithm lies in its ability to consistently identify these opportunities and exponentially grow wealth by capturing trends while they’re still hot.

Let AI Manage Your Wealth for Exponential Growth and Stability

Imagine a portfolio that not only adapts to market changes but thrives in them. The Alpha Hedge AI Algo Portfolio does exactly that.

By leveraging cutting-edge AI technology, this portfolio identifies the best investment opportunities, mitigates market volatility, and optimizes for tax efficiency—all with radical transparency.

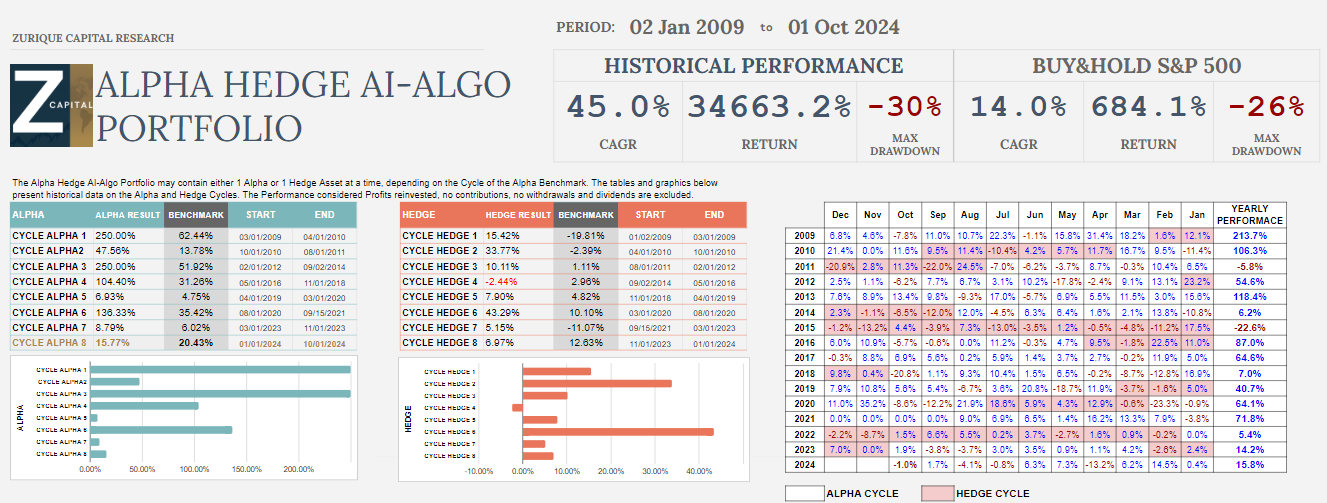

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 10/01/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 37 months, the Alpha Hedge Portfolio has delivered a total return of 39.3% (CAGR 11.5%), compared to the S&P 500's total return of 24% (CAGR 7.4%).

The portfolio is currently down 1.0% this month and has gained 15.8% year-to-date.

At a CAGR of 11.5%, the portfolio doubles capital in 6.3 years, whereas the S&P 500, with a 7.4% CAGR, takes 9.7 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Subscribe to the Wall Street Insider Report today and gain real-time access to the Alpha Hedge AI Algo Portfolio, daily insider-level AI analysis, and actionable insights that help you grow your wealth with confidence. The market waits for no one—why should you?

▶️Read what the Wall Street Insiders wrote about us↓