📊ETF vs ETN

Explore the key differences between ETF and ETN. Understand their unique characteristics, risks, and benefits with a case study.

#keypoints

Daily Educational Content [Free]:

ETF vs ETN

What's the difference between ETF and ETN?

Tax Implications

Case Study [Free]

ETN FNGU 0.00%↑ vs ETF TQQQ 0.00%↑

FAQ

Is ETN better than ETF?

Are ETNs more risky than ETFs?

What are the disadvantages of ETNs?

Do ETN pay interest?

What is the benefit of an ETN over an ETF?

Bottom Line

ETF vs ETN

A mentored sent me this question:

In English this means: Daniel, could you analyze the FNGU ETF? Thank you.

As the FNGU 0.00%↑ is an ETN, not an ETF, before the analysis we have to first know:

What's the difference between ETF and ETN?

Let's dive in and unravel these differences.

Have a question too? You can leave a comment:

The Basics of ETFs and ETNs

Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) are both types of Exchange-Traded Products (ETPs) that trade on major exchanges just like stocks. However, their similarities pretty much end there.

ETFs are investment funds that track the performance of a specific index, sector, or commodity. They're like a basket of various assets, including stocks, bonds, or commodities. On the other hand, ETNs are unsecured debt securities issued by a financial institution. They promise to pay a return linked to a specific index or other investment strategy.

Ownership Structure

One of the key differences between ETFs and ETNs lies in their ownership structure. When you invest in an ETF, you essentially own a piece of the fund's underlying assets. It's like owning mini-shares of all the assets within the fund's portfolio.

On the flip side, ETNs don't give you ownership of any assets. Instead, they're more like bonds, where you're lending your money to the issuing institution. The issuer, usually a bank, promises to pay you a return based on the performance of a specific index or strategy.

Credit Risk

When it comes to risk, ETFs and ETNs are worlds apart. ETFs, like mutual funds, are subject to market risk. If the value of the assets within the fund decreases, so does the value of your investment.

ETNs, however, carry an additional layer of risk: credit risk. Since ETNs are unsecured debt, if the issuer defaults or goes bankrupt, you could lose your entire investment. It's like lending money to a friend; if they can't pay you back, you're out of luck.

Tax Implications

ETFs and Taxes

ETFs are subject to capital gains tax, just like stocks. When you sell your ETF shares for a profit, you'll have to pay capital gains tax on your earnings. Additionally, any dividends you receive from the fund are also subject to tax.

ETNs and Taxes

ETNs offer a unique advantage when it comes to taxes. Since you don't actually own any assets when you invest in an ETN, you won't receive any dividends. This means you won't have to pay any taxes until you sell your ETN shares. However, when you do sell, your profits will be subject to capital gains tax.

Case Study:

ETN FNGU 0.00%↑ vs ETF TQQQ 0.00%↑

“ FNGU 0.00%↑ offers 3x leveraged exposure to an index of FANG companies (Facebook, Apple, Amazon, Netflix, and Google [Alphabet Inc.]) and other companies that exhibit similar characteristics. Presumably, the index will always include these five companies, an index committee is responsible for selecting the additional names. Eligible stocks must be listed on a US exchange (although ADRs are acceptable), classified in either the technology or consumer discretionary sectors, and exhibit similar traits to other technology and internet companies. At least ten stocks must be included in the index, the number it held when the note launched so investors can expect a high level of concentration. All holdings are equally weighted.”

“TQQQ 0.00%↑ is a levered fund that delivers 3x exposure only over a one-day holding period of NASDAQ-100 stocks. The underlying index includes 100 of the largest non-financial companies listed on NASDAQ based on market capitalization. Historically, technology companies have dominated TQQQ’s underlying index, so, its future performance might be closely tied to the performance of the tech industry. The fund uses a mathematical approach to determine the type, quantity and mix of investment positions that it believes will produce daily returns consistent with its investment objective. Like many levered products, the fund is not a buy-and-hold ETF as it's a very short-term tactical instrument.”

Source: etf.com/fngu & https://www.etf.com/TQQQ

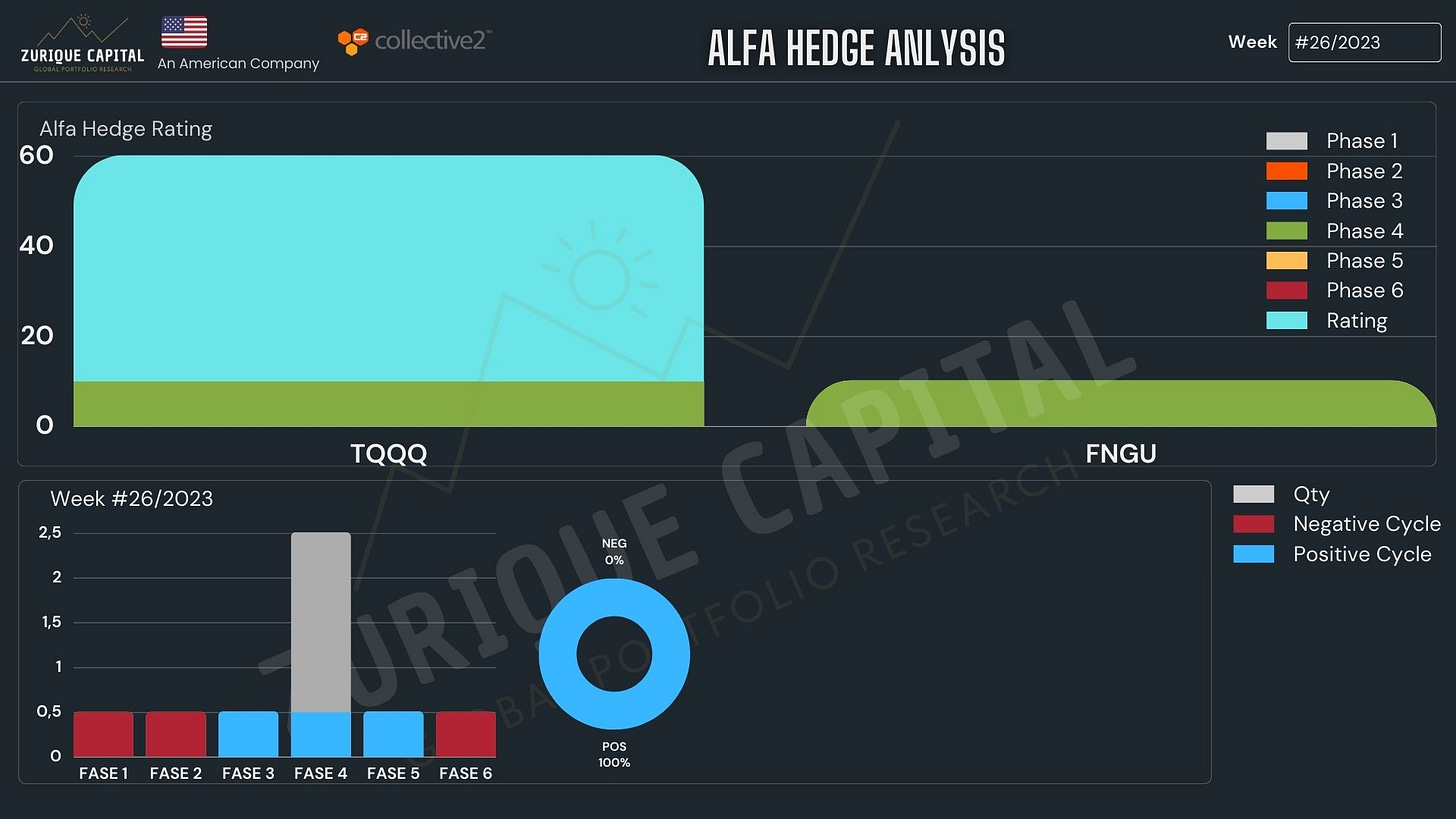

When we analyze an asset, we test 3 variables:

Highest historical positive volatility (highest probability of Long-Term uptrends), with this data we analyze the past.

Highest expectancy ratio, with this data we analyze what to expect in the future, based on statistics (not astrology or opinions).

Market Cycle Phase

We combine this data and get the Alfa Hedge Rating. By doing this we can objectively decide to invest or not in an asset.

One of our benchmarks for technology sector is the Leveraged ETF TQQQ 0.00%↑ . So, let’s compare this 2 assets, knowing that the TQQQ 0.00%↑ is an ETF and FNGU 0.00%↑ is an ETN.

Graphically you can see that the FNGU 0.00%↑ (blue line), because is more concentrated, have a higher volatility than the TQQQ 0.00%↑ (orange line).

You can also observe that their Correlation Coefficient is 0.94, in other words they are practically perfectly correlated. Which means that you should have only one of them in your Portfolio.

As seen, accordingly with our algorithm both are on Phase 4 Public.

In this case study, based on data, not in suppositions, the best alternative would be to invest on TQQQ 0.00%↑ accordingly with our Data Analysis.

This analysis are not investment recommendations and investors must do their own research (please read the Disclaimer section).

We invest our own money and share our Portfolio with Premium Subscribers.

Premium Subscribers have full access to our Alfa Hedge Portfolio II in a Real-Life Brokerage Account in Real Time.

FAQ

Is ETN better than ETF?

The answer to whether an ETN (Exchange-Traded Note) is better than an ETF (Exchange-Traded Fund) largely depends on an individual's investment goals and risk tolerance. ETNs can provide access to niche markets and may offer tax advantages. However, they carry additional credit risk, as they are unsecured debt securities issued by a financial institution. On the other hand, ETFs offer diversification and are generally considered less risky than ETNs.

Are ETNs more risky than ETFs?

Yes, ETNs are generally considered more risky than ETFs. This is because ETNs carry an additional layer of risk known as credit risk. Since ETNs are unsecured debt, if the issuer defaults or goes bankrupt, investors could lose their entire investment. ETFs, on the other hand, are subject to market risk, which is tied to the performance of the underlying assets.

What are the disadvantages of ETNs?

ETNs carry several disadvantages. The most significant is credit risk. If the issuer of the ETN defaults or goes bankrupt, investors could lose their entire investment. Additionally, ETNs may not be as liquid as ETFs, meaning it could be harder to buy and sell shares quickly. Finally, the performance of ETNs is tied to the performance of a specific index or strategy, which can be risky if the index or strategy performs poorly.

Do ETN pay interest?

No, ETNs do not pay interest. Unlike bonds, which pay interest to investors, ETNs promise to pay a return based on the performance of a specific index or strategy. This means that the return on an ETN can be positive or negative, depending on the performance of the underlying index or strategy.

What is the benefit of an ETN over an ETF?

One of the main benefits of an ETN over an ETF is its tax treatment. Since ETNs don't actually own any assets, they don't pay dividends, which means investors won't have to pay any taxes until they sell their ETN shares. However, when sold, profits will be subject to capital gains tax. Additionally, ETNs can provide access to niche markets that may be difficult to reach with traditional ETFs.

Bottom Line

Which is Better, ETF or ETN?

The answer to this question largely depends on your individual investment goals, risk tolerance, tax situation, and, as seen market conditions.

ETFs offer diversification and are generally considered less risky than ETNs. However, ETNs can provide access to niche markets and may offer tax advantages.

Remember, investing always involves risk, and it's important to do your homework before diving in.

Whether you choose ETFs, ETNs, or a mix of both, make sure your investment choices align with your overall financial plan.

If you liked this content, you will love our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing