Deep Reinforcement Learning Explained: Boost Returns with AI

📊 AI for Investment: Today’s Top 7 Assets You Need to Watch & AI Investment Management: Alpha Hedge AI Algo Portfolio Review

Why Traditional Stock Market Strategies Fail in a Rapidly Changing Market

The stock market is evolving faster than ever, influenced by global volatility, political instability, and unpredictable financial trends. Even seasoned investors often find themselves blindsided by sudden shifts, struggling to keep up with these rapid changes.

Relying solely on traditional strategies or even human-driven analysis leaves you vulnerable to missed opportunities and increased risk.

According to cutting-edge research outlined in the paper Dynamic Stock-Decision Ensemble Strategy Based on Deep Reinforcement Learning, the problem lies in the outdated methods used to make decisions in today’s dynamic stock markets.

Without AI-driven insights, investors are left behind, constantly reacting to the market instead of predicting it. This results in suboptimal returns, increased volatility, and lost wealth potential.

But what if you had a solution designed specifically for today’s unpredictable market? A strategy that adapts in real time, delivering superior results and managing risk effortlessly?

How AI is Revolutionizing Wealth Creation—The Secret Advantage of the Alpha Hedge AI Algorithm

Imagine being able to anticipate market trends with the precision of an insider but without crossing any ethical or legal boundaries. The Alpha Hedge AI Algorithm gives you that power—allowing investors to gain insights that go beyond the conventional.

Here’s the advantage: historically, insider trading (see insider trading definition) was the only way to gain an edge. But AI changes everything. By analyzing massive datasets and continuously learning from the market’s movements, our algorithm provides the foresight you need to stay ahead. You’re no longer guessing or reacting—you’re strategizing with data-backed decisions.

Insider Trading Definition

It refers to trading a public company's stock or other securities by individuals with access to non-public, material information about the company.

The future is here, and the Alpha Hedge AI Algorithm levels the playing field, putting you on par with even the most privileged insiders. In the next post, I’ll dive deeper into the groundbreaking research that fuels this revolutionary approach.

Deep Reinforcement Learning Explained: Boost Returns with AI

The Dynamic Stock-Decision Ensemble Strategy Based on Deep Reinforcement Learning shows that investors who harness AI see superior results.

By integrating three advanced AI models—Advantage Actor Critic (A2C), Deep Deterministic Policy Gradient (DDPG), and Soft Actor Critic (SAC)—this strategy dynamically selects the best decision-making model for current market conditions.

The key points of the research are:

Introduction

The stock market is highly complex, volatile, and influenced by numerous factors, making stock trading decision-making a challenging task.

This paper presents two advanced stock trading strategies using deep reinforcement learning (DRL):

Nested Reinforcement Learning (Nested RL)

Weighted Random Selection with Confidence (WRSC).

These strategies aim to assist investors in making dynamic trading decisions and are validated using stock data from the U.S., Japan, and Britain.

Key Contributions

Nested RL Method:

Utilizes three DRL models: Advantage Actor Critic (A2C), Deep Deterministic Policy Gradient (DDPG), and Soft Actor Critic (SAC).

Dynamically selects decision-makers according to the current market conditions to generate optimal trading strategies.

Enhances flexibility by switching decision-makers based on annualized returns.

WRSC Strategy:

Inherits the advantages of the three DRL models but introduces a confidence factor to improve decision-making.

Implements a weighted random selection based on the confidence of each model's performance, optimizing profits and risk management.

Methodology

Reinforcement Learning Models:

A2C: Balances large datasets and multiple stock scenarios efficiently.

DDPG: Adjusts portfolio weight dynamically in high-dimensional action spaces.

SAC: Adopts a stochastic policy, making it robust in volatile markets.

Ensemble Strategy:

The Nested RL method selects the best performing agent (A2C, DDPG, SAC) based on the current environment, allowing for real-time adjustment of trading strategies.

WRSC further refines this by incorporating the confidence level, selecting the strongest model or making weighted random choices when confidence is low.

Experimental Results

Evaluation Metrics:

Performance indicators include annualized return, cumulative return, Sharpe ratio, volatility, and maximum drawdown.

Both the Nested RL and WRSC methods outperform baseline models (traditional weighted average and random selection) in multiple stock markets (U.S., Japan, and Britain).

Superior Performance:

U.S. stocks: WRSC achieved the highest annualized return and Sharpe ratio.

Japanese and British stocks: Nested RL and WRSC showed higher returns and lower risk compared to traditional methods.

Case Studies

Real-world application on CSCO stock:

The WRSC and Nested RL models captured more trading opportunities and made more accurate buy/sell decisions, demonstrating better performance in volatile market conditions.

Conclusion

The proposed ensemble strategies, Nested RL and WRSC, can optimize stock trading decisions by dynamically adapting to market conditions.

These methods offer higher returns with controlled risks and are more effective than traditional models.

Future work could explore integrating more decision-makers and external factors like political news or market sentiment to further refine the model.

AI can help you outperform the market consistently, no matter the environment. But don’t just take my word for it—let me show you how we identify the top assets of the day using our AI investment bot.

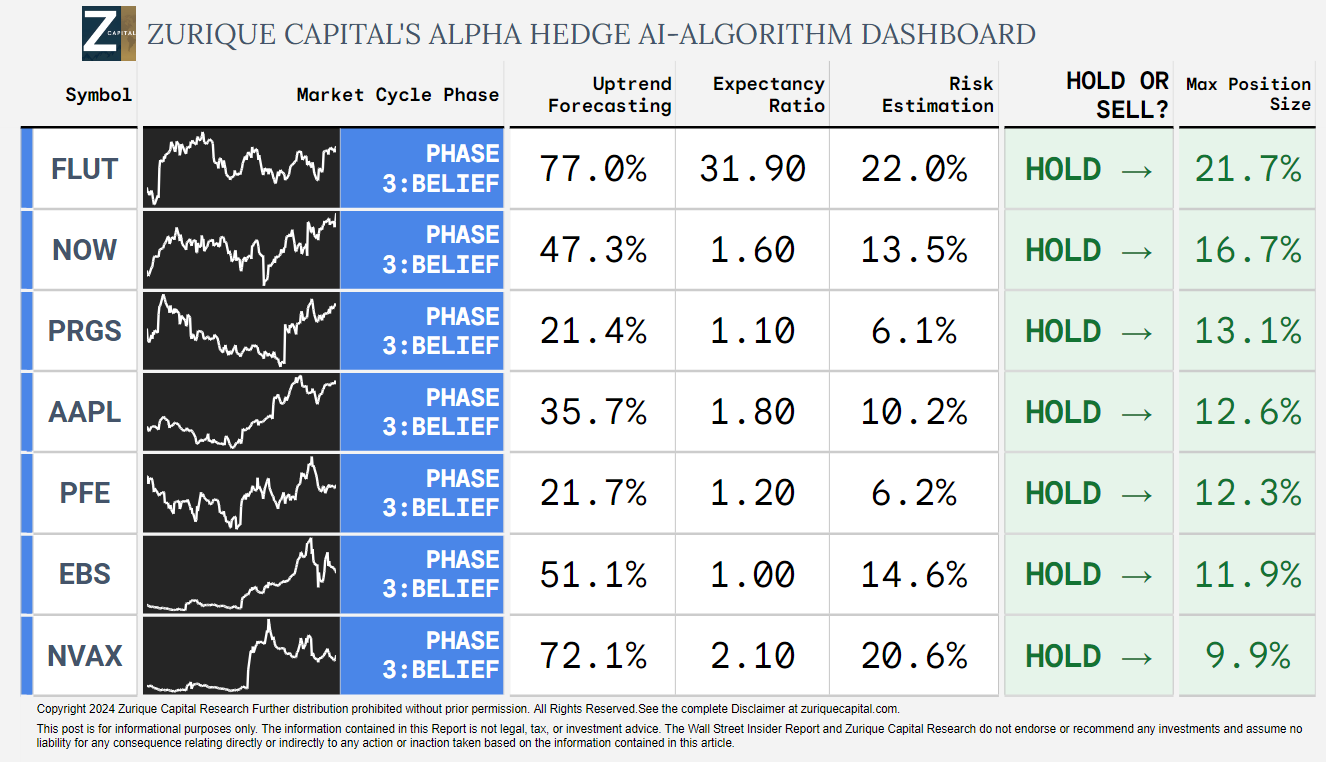

The Power of AI Investment Bot: Today’s Top 7 Assets You Need to Watch

Today, our AI investment bot has identified seven top-performing assets that are poised to capitalize on current market conditions.

These assets were selected through a process that analyzes market volatility, historical data, and projected trends to ensure that your portfolio is optimized for success.

Here are the top 7 assets: FLUT 0.00%↑ NOW 0.00%↑ PRGS 0.00%↑ AAPL 0.00%↑ PFE 0.00%↑ EBS 0.00%↑ NVAX 0.00%↑

Here’s How We Find These Market Opportunities:

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our Notes and access all the assets analyzed in the day:

While these assets are valuable, the true strength of AI lies in how it helps you harness market volatility and identify exponential growth opportunities. But there’s an even better way to ensure wealth expansion, and I’ll reveal that in my next post: the Alpha Hedge AI Algo Portfolio.

Grow Your Wealth Exponentially with the Alpha Hedge AI Algo Portfolio

AI Algo Portfolio is not just another investment strategy—it’s a revolutionary way to grow your wealth exponentially, using AI to navigate market volatility and optimize your returns.

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 09/25/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 39.3% (CAGR 11.7%), compared to the S&P 500's total return of 24.8% (CAGR 7.7%).

The portfolio is up 0.7% this month and has gained 15.8% year-to-date.

At a CAGR of 11.7%, the portfolio doubles capital in 6.2 years, whereas the S&P 500, with a 7.7% CAGR, takes 9.4 years to do the same.

Why Choose the Alpha Hedge AI-Algo Portfolio?

AI Investment Management: Our AI algorithms continuously adapt to market conditions, mitigating risks associated with unpredictable fluctuations.

Wealth Exponential Expansion: By harnessing AI's predictive capabilities, the portfolio seeks out high-growth opportunities, accelerating your wealth accumulation.

AI Investment Advisor for Tax Optimization: Strategic investment choices are made with tax efficiency in mind, maximizing your net returns.

Transparency: We operate with radical transparency, offering you full visibility into a live brokerage account. Monitor your investments in real-time and see exactly how your assets are managed.

Don’t miss out on the opportunity to put AI to work for your financial future. Subscribe now to the Wall Street Insider Report Premium and gain access to the Alpha Hedge AI Algo Portfolio—your ticket to insider-level insights, daily analysis, and monthly actionable strategies. Join today and watch your wealth grow with the precision of AI.

▶️Read what the Wall Street Insiders wrote about us↓