Day 1,236 Managing a Concentrated Portfolio In Wall Street

S&P Cycle Analysis + Top Market Cap Stocks + Alpha Hedge AI Algo Portfolio Review

Day 1,236 Managing a Concentrated Portfolio In Wall Street

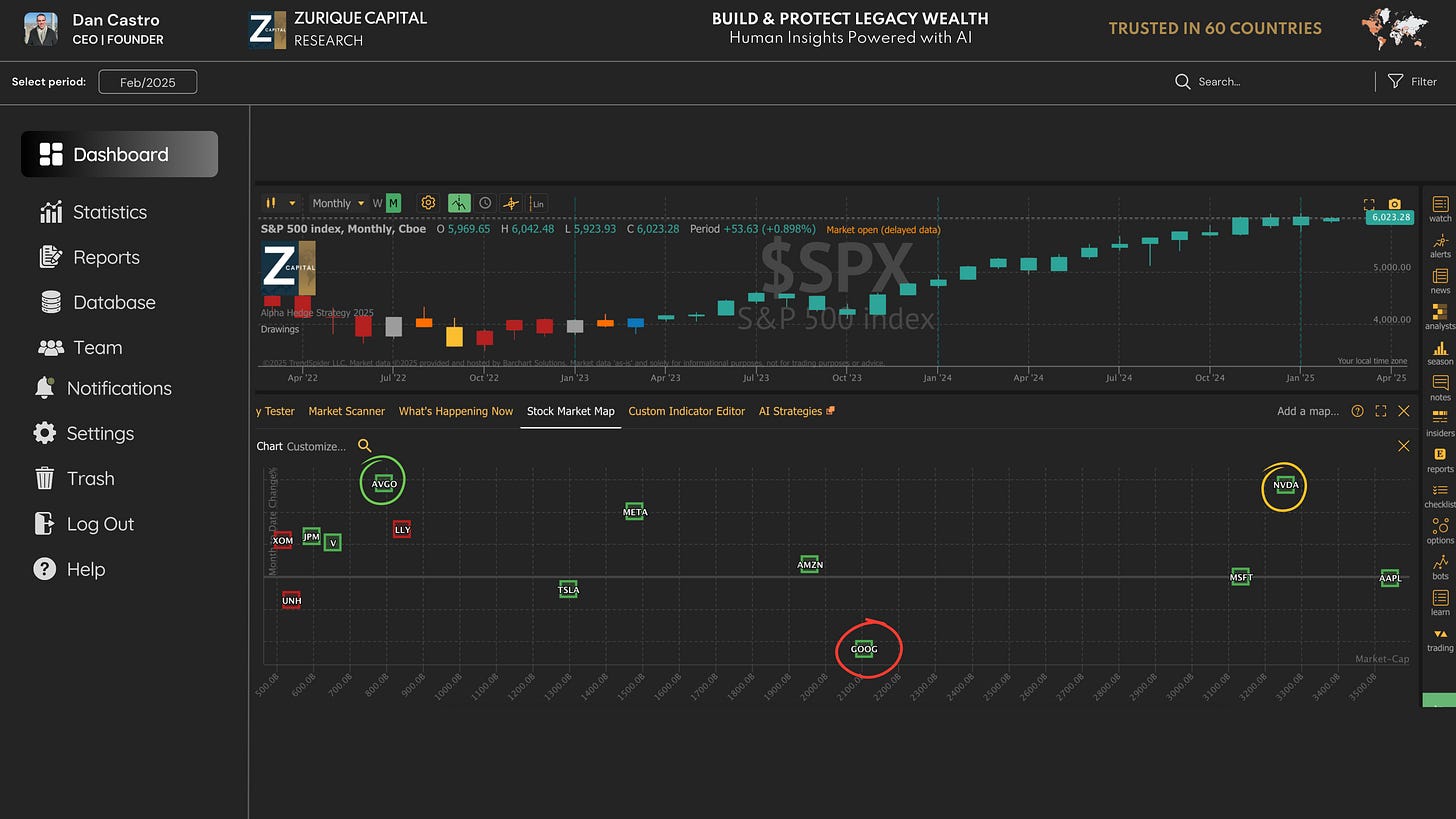

S&P Cycle Analysis + Top Market Cap Stocks

The S&P 500 is still navigating in Phase 4 of the cycle this month.

Every day, our algorithm scans the highest market cap stocks, mapping their individual cycles to anticipate broader shifts in the S&P 500. These trends offer a strategic edge, revealing crucial market movements that shape our portfolio positioning.

AAPL 0.00%↑ NVDA 0.00%↑ MSFT 0.00%↑ AMZN 0.00%↑ META 0.00%↑ TSLA 0.00%↑ AVGO 0.00%↑ GOOG 0.00%↑ JPM 0.00%↑ LLY 0.00%↑ V 0.00%↑ UNH 0.00%↑ XOM 0.00%↑

So far, the market’s structure remains intact. The standout performer this month is AVGO 0.00%↑ , while GOOG 0.00%↑ lags behind, today NVDA 0.00%↑ gained strength.

Subscribe the Wall Street Inr Report for real-time AI-driven market insights.

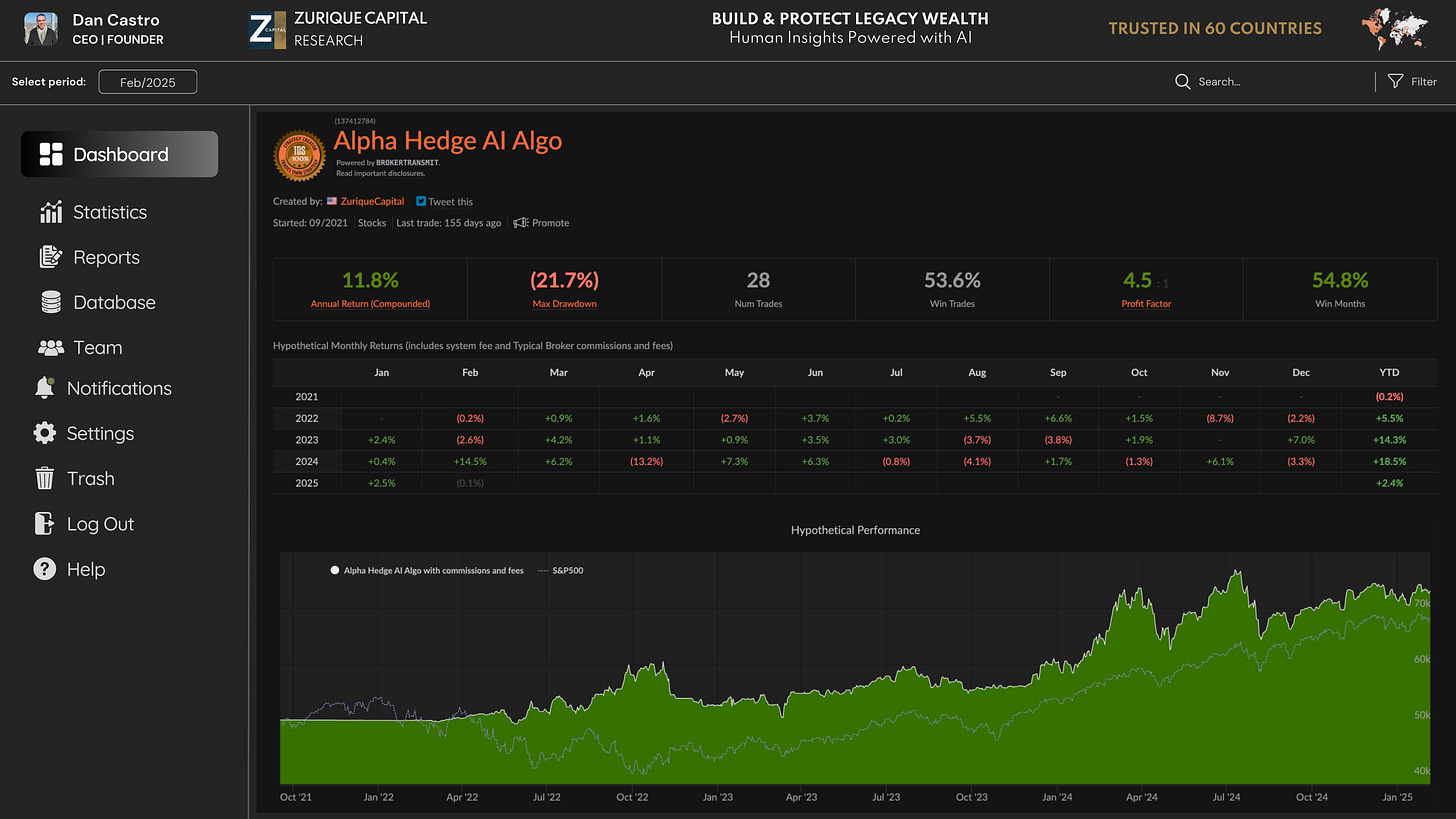

Alpha Hedge AI Algo Portfolio Review

The Alpha Hedge AI Algo Portfolio

This portfolio operates on a clear principle: adapt to the market cycle.

It holds one asset at a time, selecting an Alpha when the trend favors growth and shifting to a Hedge when conditions turn defensive. This tactical approach aligns with the S&P 500’s broader movements, aiming to keep returns strong while managing risk.

Here’s how this approach is playing out in real time:

1,236 Days Since Launch

Here’s how this precision strategy is playing out in real time:

Total Return: 51.8% | CAGR: 11.8%

S&P 500 Over Same Period: 36.2% | CAGR: 8.1%

This outperformance underscores the power of a concentrated, high-conviction approach. Instead of unnecessary diversification, we focus on holding one strong asset at a time, ensuring efficiency and flexibility in any market cycle.

See the full Alpha Hedge AI Algo Portfolio — Subscribe to the Wall Street Insider Report.

▶️Read what the Wall Street Insiders wrote about us↓