Wall Street Insider Report

Join +1,4k Wall Street Insiders across 25 US states and 45 countries who are scaling 10x their investments demystifying the Psychology of the Market Cycles.

Bond Market on Alert for 2024 Rate Cuts

As whispers of Jerome Powell's latest remarks on inflation ripple through the bustling streets of the financial district, the air is thick with speculation.

Investors and analysts alike are parsing every word for hints about the future of interest rates, with a keen eye on the bond market's response to unexpected inflation readings. It's a cautious dance of predictions and strategies, all hanging on the Fed's next move in 2024.

But before we dive into the Bond Cycle, let's review today's market and how my Portfolio responded to today's movements↓

The Nasdaq Composite QQQ 0.00%↑ led the charge with an increase of nearly 0.6%, primarily driven by a resurgence in technology stocks, which had suffered a steep sell-off just a day earlier. Similarly, the S&P 500 SPY 0.00%↑ saw a healthy uplift of 0.5%, while the Dow Jones Industrial Average DIA 0.00%↑ posted a modest gain of 0.2%, both indexes recovering from losses exceeding 1%.

This market turnaround reflects investor optimism and a renewed confidence in the tech sector, marking a positive shift in market dynamics.

My Alpha Hedge Portfolio closed the day with a positive 3.1% gain, with all portfolios showing positive returns.

The Crypto Portfolio led the performance with an impressive +7.45%, followed by the Growth Portfolio at +1.73%, Equity Portfolio at +1.67%, Currency Portfolio at +0.39%, and Bond Portfolio at +1.65%.

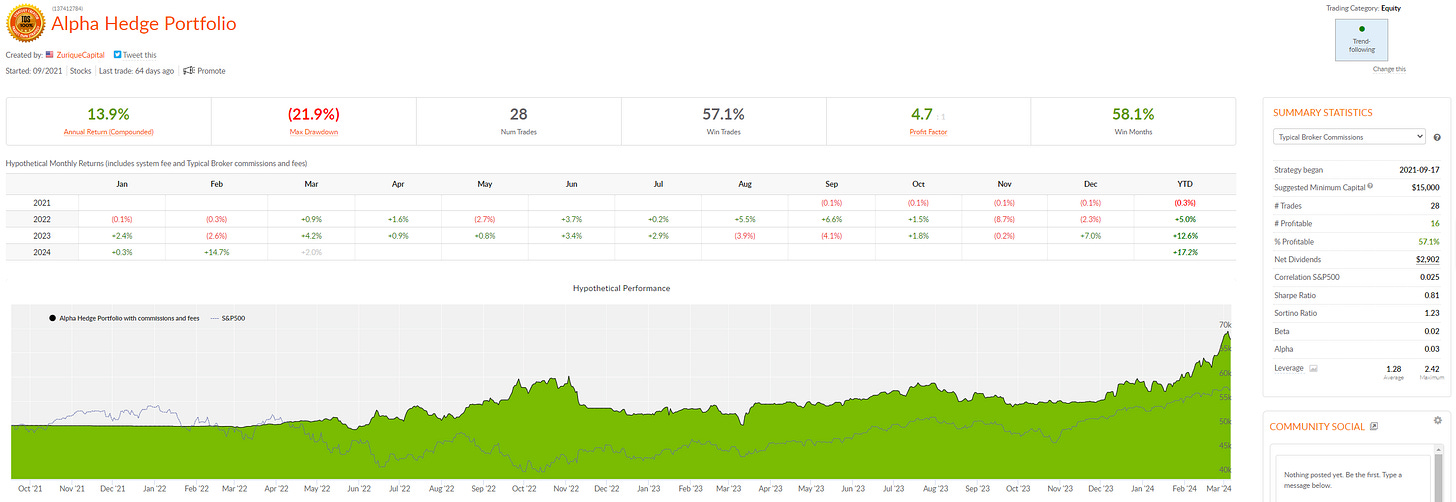

Alpha Hedge Collective2 Portfolio

click the image to access the evolution of the Alpha Hedge Collective2 Portfolio↑

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

In 2021, we restarted the 10x journey with the Alpha Hedge Collective2 Portfolio.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alfa Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Bond Market Spotlight

Powell Signals Cautious Path Forward Amid Inflation Woes

Jerome Powell's discussion highlights significant concerns regarding inflation and its impact on monetary policy, directly influencing the bond market.

The higher-than-expected inflation readings, including the Consumer Price Index (CPI), Producer Price Index (PPI), and the core Personal Consumption Expenditures (PCE) index, signal a cautious approach towards lowering interest rates.

This approach can affect bond yields, as expectations of future interest rate cuts or hikes influence current bond prices.

The indication that rate cuts may occur "at some point" in 2024 but with a cautious stance due to fluctuating economic indicators could lead to increased volatility in the bond market, as investors recalibrate their expectations based on inflation trends and the Fed's policy decisions.

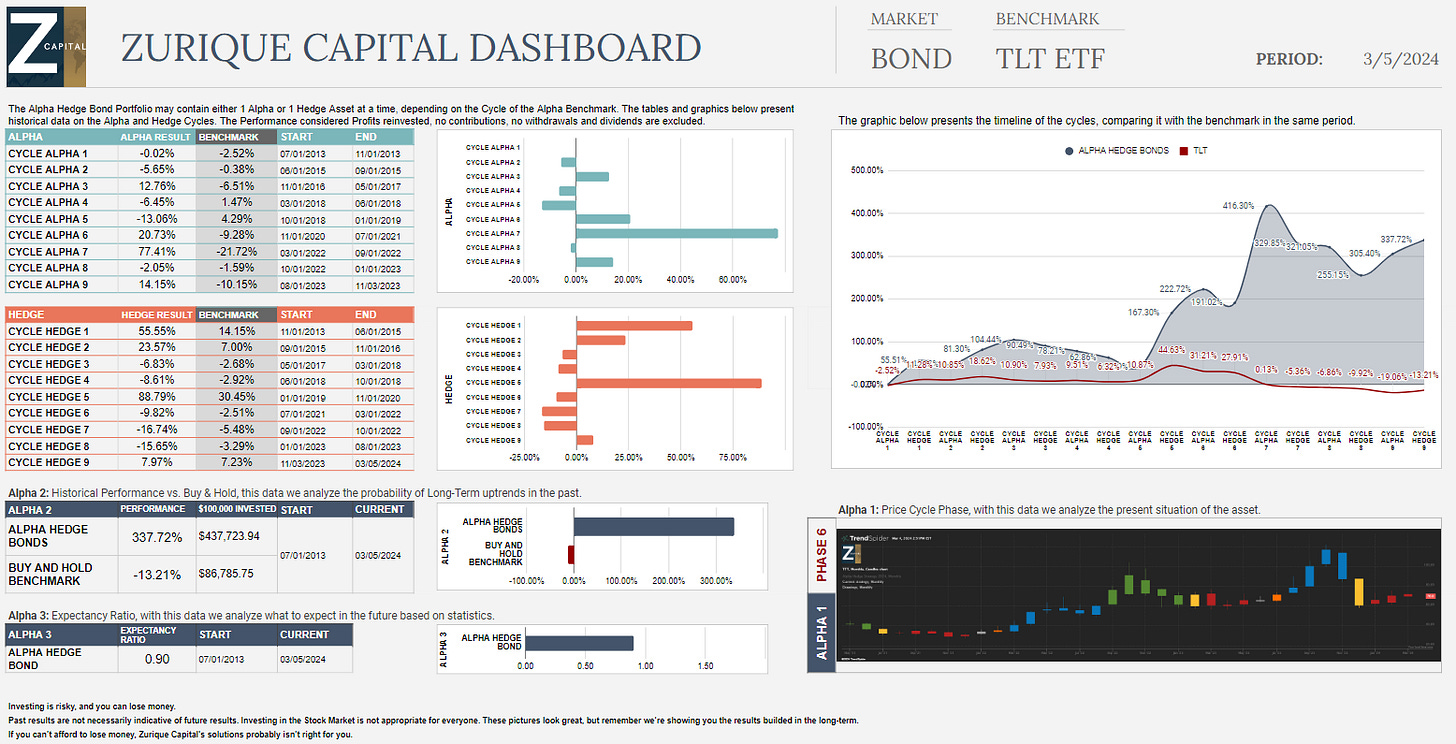

Alpha Hedge Bond Portfolio

The Bond Market's driving force is the 20-Year Rate, currently in Phase 6 (Denial Phase). A Hedge Position was established in November 2023. As of March 05, 2024, this Hedge Cycle experienced a return of 7.97%, the Alpha Hedge Bond Portfolio has yielded 337.72% since July 2013*.

The benchmark for this portfolio is the TLT 0.87%↑ ETF, which recorded a -13.21% performance since July 2013**.

Market Cycle Mastery

If you want to know more details about the Alpha Hedge Strategy and Portfolio, learn about the importance of recognizing trends, understanding how timing is crucial in investments, and how the right strategy can make all the difference in your financial growth, join the Market Cycle Mastery Summit: