📊Bond Market Anticipates Interest Rate Impact

Inside the Cycle of the Bond Market

Wall Street Insider Report

Join +1,4k Wall Street Insiders across 25 US states and 45 countries who are scaling 10x their investments demystifying the Psychology of the Market Cycles.

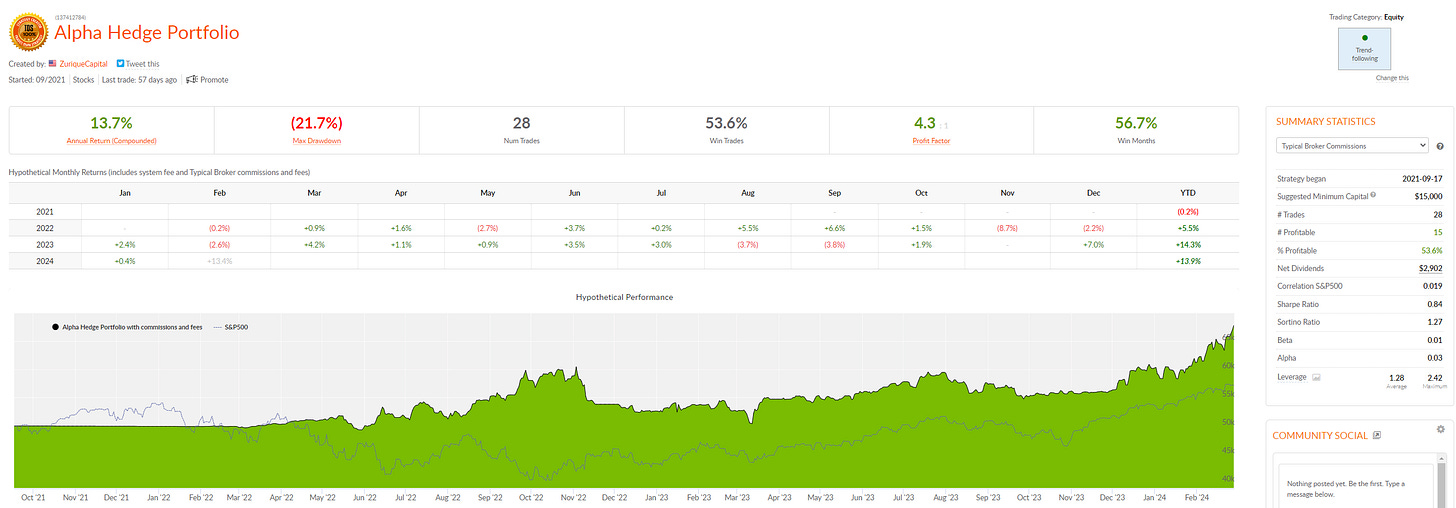

In 2022, the Alpha Hedge Portfolio increased 10x, yielding a 900% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits and dividends excluded throughout the period.

In 2021, we restarted the 10x journey.↓

Alpha Hedge Collective2 Portfolio

Bond Market Spotlight

*To ensure confidence in the presented results, our Subscribers can follow the Alpha Hedge Portfolio in Real Time, from a Real-Life Brokerage Account.

** The Alpha Hedge and Benchmark performances presented in Market Spotlight were achieved without any new contributions or withdrawals, and with profits and dividends excluded throughout the period.

Bond Market Anticipates Interest Rate Impact

The anticipation surrounding the PCE inflation data reflects on the Bond Market as it directly influences interest rate expectations.

Higher inflation readings may discourage the Federal Reserve from cutting rates, affecting bond yields. The adjustment in the GDP growth rate to 3.2% from an initial estimate of 3.3% also plays a role in setting expectations for economic health and monetary policy, which are crucial for bond investors.

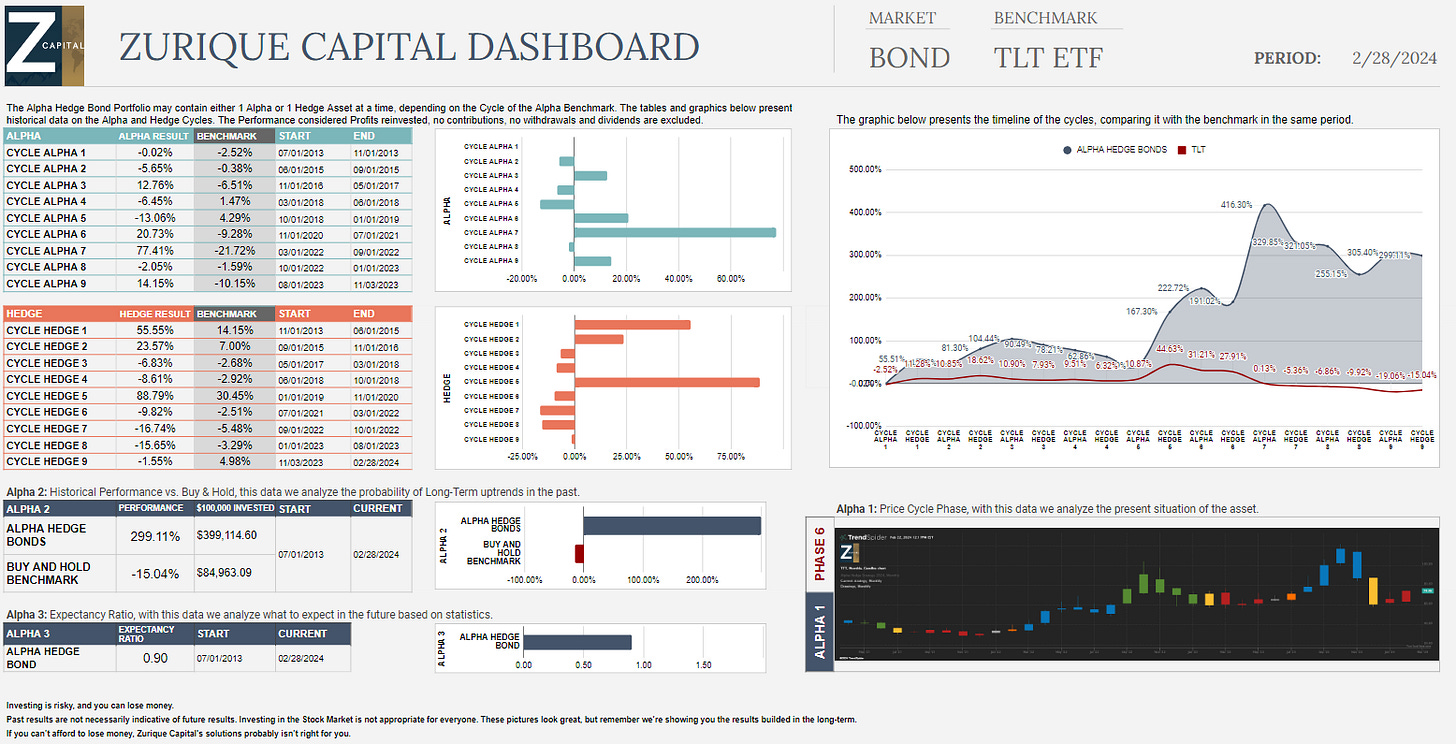

Alpha Hedge Bond Portfolio

The Bond Market's driving force is the 20-Year Rate, currently in Phase 6 (Denial Phase). A Hedge Position was established in November 2023. As of February 23, 2024, this Hedge Cycle experienced a negative return of -1.55%, yet it has yielded 299.11% since July 2013*.

The benchmark for this portfolio is the TLT 0.00%↑ ETF, which recorded a -15.04% performance since July 2013**.

Understanding the Alpha Hedge Bond Portfolio

This portfolio combines 1 Alpha Asset during increasing 20-Year Rate or 1 Hedge Asset during 20-Year Rate downtrend.

The Alpha Hedge Bond Portfolio currently represents 15% of the Alpha Hedge Portfolio.

Q&A

In what ways can philanthropy and impact investing serve as effective tools for wealth preservation and growth during periods of market uncertainty?

Market Cycle Mastery

If you want to know more details about the Alpha Hedge Strategy and Portfolio, learn about the importance of recognizing trends, understanding how timing is crucial in investments, and how the right strategy can make all the difference in your financial growth, join the Market Cycle Mastery Summit:

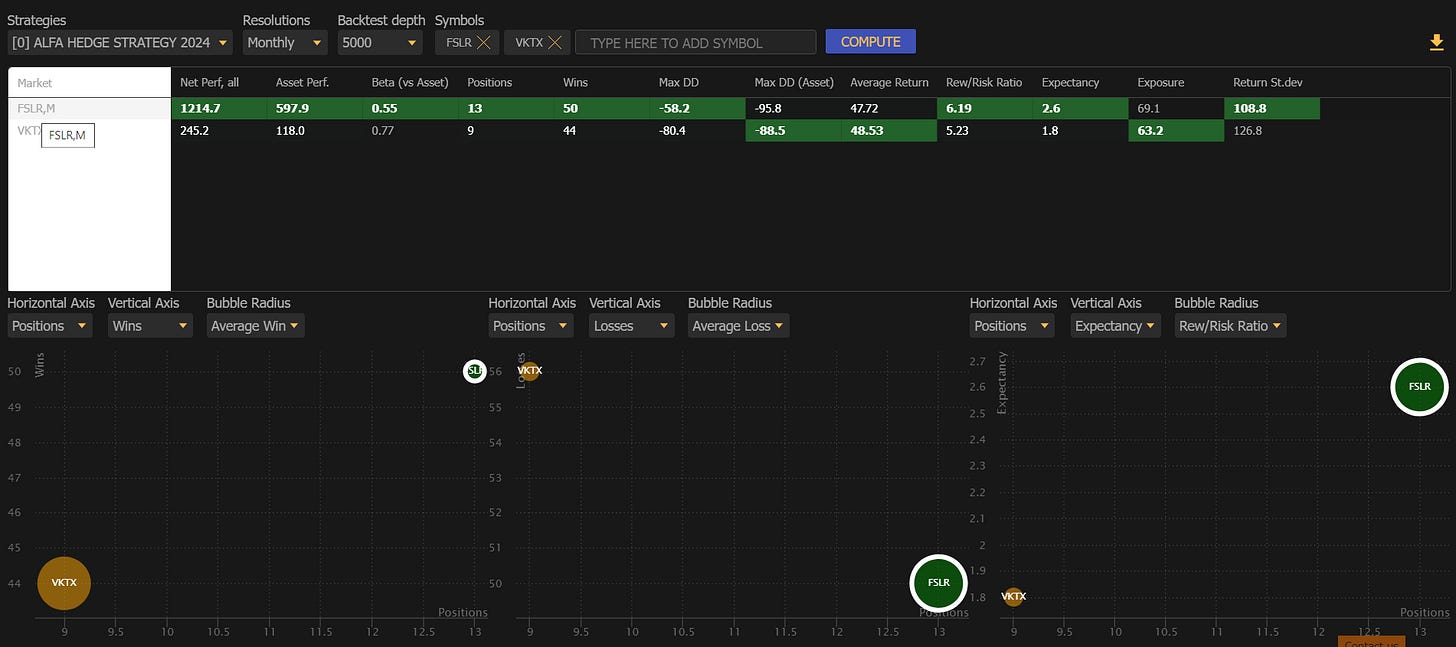

Zurique Capital Institutional Spotlight

These are some assets we are working on for our Institutional clients:

VKTX 0.00%↑ FSLR 0.00%↑ BYND 0.00%↑ EBAY 0.00%↑ AAPL 0.00%↑ JANX 0.00%↑ NFLX 0.00%↑ AMC 0.00%↑ CPNG 0.00%↑ UNH 0.00%↑ LMND 0.00%↑ DVN 0.00%↑ LAZR 0.00%↑ NCLH 0.00%↑ AXON 0.00%↑ PLUG 0.00%↑ RKLB 0.00%↑ A 0.00%↑ SPLK 0.00%↑ SPCE 0.00%↑ CXAI 0.00%↑ RXRX 0.00%↑ BMBL 0.00%↑ URBN 0.00%↑ RDFN 0.00%↑ SOFI 0.00%↑ CAVA 0.00%↑ ARRY 0.00%↑ AMBA 0.00%↑

Top Findings

FSLR 0.00%↑ presented the best combination of Statistical Data.

Zurique Capital Research

Zurique Capital Research aims to assist Hedge Funds, Family Offices, Advisors and Financial Educators to help their clients, Global Investors, in protecting and expanding their wealth, balancing financial, professional, and personal life through Zurique Capital’s investment proprietary strategy.

Book a Consultancy Call: zuriquecapital.com