August/24: Monthly Alpha Hedge Portfolio Allocation Update

August/24 Portfolio Alpha Hedge Rebalancing

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

August/24: Monthly Alpha Hedge Portfolio Allocation Update

Understanding and Mitigating Behavioral Biases in Investing

Behavioral biases are like hidden traps in the world of investing, often amplifying investor anxiety.

When steady gains are followed by declines, it can be particularly unnerving. This reaction is rooted in behavioral economic principles such as loss aversion and recency bias. Investors tend to fear losses more than they value gains, and recent market performance disproportionately impacts their decisions.

At Zurique Capital, we’re acutely aware of these biases and strive to mitigate them through our systematic investment process, the Alpha Hedge AI-Algorithm. Our approach ensures we stay disciplined during varied market environments, helping investors remain steadfast even during minor market corrections.

The Secret to Consistent Investment Success: AI-Systematic Portfolios

Our Alpha Hedge AI-Algorithm is designed to help investors maintain discipline through different market conditions.

Declines are a natural part of market behavior, where prices adjust after a significant run-up. Despite the discomfort these declines may cause, they generally shouldn’t prompt immediate concern or reactive decision-making.

With our disciplined systematic algorithm, we ensure that we stay invested, avoiding the pitfalls of emotional responses or prematurely being "bounced out" of a trend.

This approach helps us manage the Market Cycles effectively.

Why a Consistent Plan is Key to Investment Success

At Zurique Capital, our approach focuses on maintaining a consistent and dynamic plan. By adhering to a systematic process, we aim to navigate Market Cycles and maintain long-term compounding, even in the face of short-term volatility. This month, we’re exploring the impact of behavioral biases on investment decisions and how our AI-Algorithm can help mitigate these effects.

We’ll also discuss recent market events, how they fit into the context of a bear market’s anatomy, and our continued focus on preserving compounding through disciplined investing.

July Market Overview: Key Trends and Insights

Let's dive into what transpired in the markets in July.

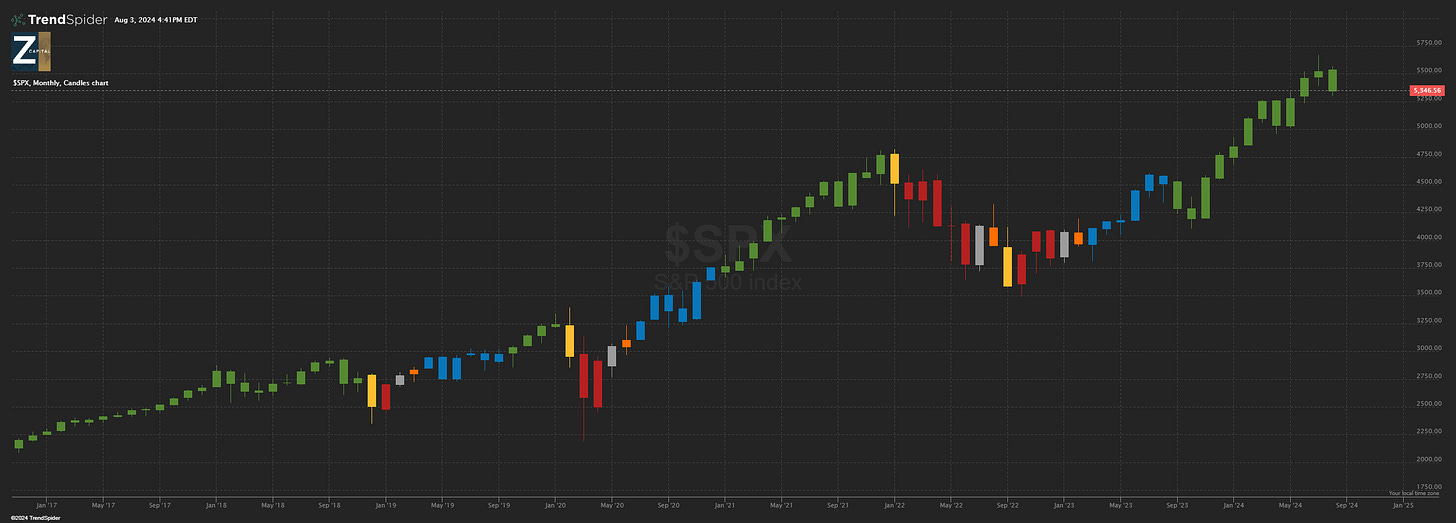

S&P 500 Index: SPY 0.00%↑ Faced a mid-month pullback, potentially leading to its second negative month in 2024.

Market Segments: Laggards like value IVE 0.00%↑ , high dividend VYM 0.00%↑, and small caps IJR 0.00%↑ became leaders, while tech QQQ 0.00%↑ and growth VUG 0.00%↑ dropped to the back of the pack. Despite this role reversal, all segments remain in uptrends.

Foreign Markets: Emerging markets IEMG 0.00%↑ are slightly ahead of their developed counterparts VEA 0.00%↑ but are weaker compared to U.S. equities.

Real Estate: Real estate securities VNQ 0.00%↑ are on pace to be the best-performing asset class in July, pushing into positive territory for the year and creating uptrends across all timeframes.

Bonds: TLT 0.00%↑ Performance has varied among different segments of the yield curve. Shorter-duration bonds have been the best performers, while longer-duration bonds have mixed trends.

3 Market Catalysts to Watch Right Now

Three potential catalysts could influence market trends:

Labor Market Cooling:

Unemployment rate increased to 4.1%, the first rise above 4% since 2021.

The hiring rate has fallen back to pre-COVID levels, with job openings per unemployed person returning to pre-pandemic levels.

Economic Balancing Act:

With inflation still above target and the labor market cooling, the Federal Reserve faces a dilemma on which issue to address.

The Fed does not expect demand or hiring to weaken soon, but if wrong, it may not cut rates quickly enough to forestall a recession.

Rising Home Prices:

For the second month, home prices hit a new high due to low inventory.

The national median existing home price rose to $426,900, a 4.1% increase from the previous year.

Why Context Matters in Understanding Market Cycles

Context is key in understanding market declines. At Zurique Capital, we’ve built a mental model to understand the different stages of market cycles. This model helps us manage emotions and make informed decisions.

Not all market cycles are equal. Context determines how one should respond. Our AI-Algorithm provides the necessary context to navigate these declines effectively.

While some cycles may turn into more severe declines, trying to time the market during a decline often backfires. Our research shows it’s far better to ignore these declines or even buy during them, depending on the signals from our disciplined systematic process.

This approach isn’t perfect, but it consistently outperforms reactive decision-making. At Zurique Capital, we take comfort in our rules-based, data-centric strategy. We might not know what will happen, but we know exactly what we’ll do depending on what does happen.

In August, the S&P 500 is in Phase 4 of the Market Cycle.

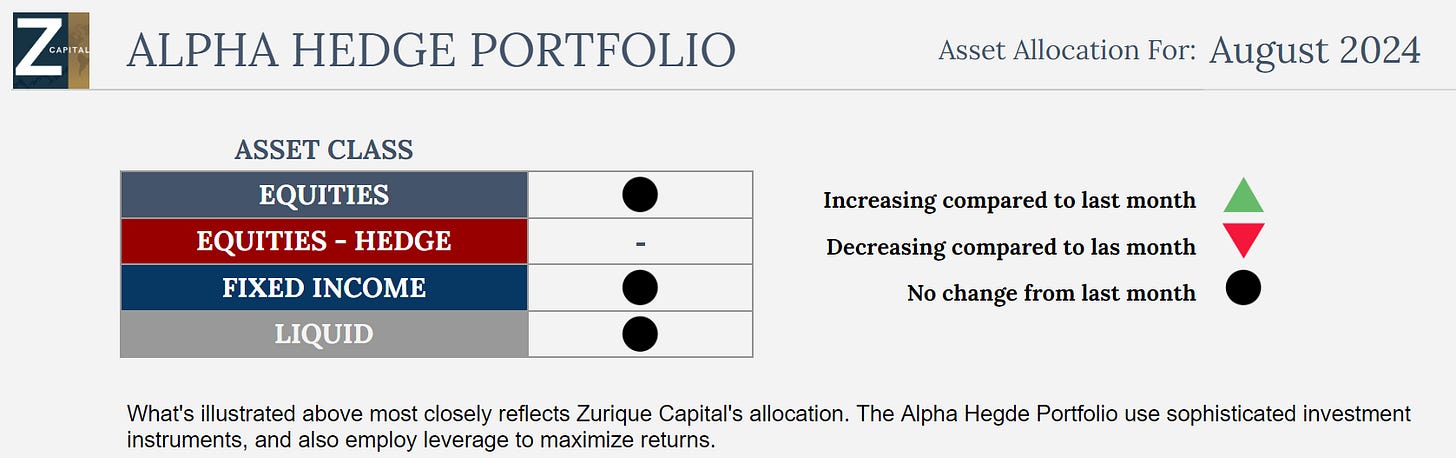

The positions in the Alpha Hedge Portfolio for the equities market will be maintained in August, marking 7 months without any position adjustments.

The Alpha Hedge Portfolio will remain overweight in RISK-ON MODE.

Alpha Hedge Portfolio Result July/2024

09/17/2021 to 08/02/2024

Alpha Hedge Portfolio Result July/2024: -0.8%

Alpha Hedge Portfolio Result 2024: +13%

Since we publicly shared the evolution of our portfolio, the Alpha Hedge Portfolio has grown significantly, with its value reaching $67,864 from the original investment of $50,000, a 35.9% gain in 34 months.

The S&P 500 had a gain of 20 19.62% in the same period.

After analyzing the performance of the Alpha Hedge Portfolio, here are the key takeaways:

Annual Return (Compounded): The Alpha Hedge Portfolio has achieved a remarkable 11.2% compounded annual return since its inception on September 17, 2021.

Win Trades and Win Months: The portfolio has a win rate of 53.6% in trades and 55.6% in profitable months.

Profit Factor: The portfolio boasts a profit factor of 3.7:1, which means the gains are 3.7 times the losses.

Correlation with S&P 500: With a correlation of 0.120 to the S&P 500, the portfolio exhibits low correlation, indicating its potential as a diversification tool within a broader investment strategy.

Sharpe and Sortino Ratios: The Sharpe Ratio of 0.61 and Sortino Ratio of 0.87 reflect the portfolio's risk-adjusted returns.

Beta and Alpha: The portfolio's beta of 0.09 suggests low market sensitivity, while an alpha of 0.02 indicates its ability to generate excess returns above the market benchmark.

Max Drawdown: The portfolio experienced a maximum drawdown of 21.7%.

Understanding the Collective2 Portfolio

The Collective2 Portfolio was established on September 17, 2021, with an initial investment of $50,000 to ensure confidence in the presented results. This Platform allows our Premium Subscribers to access the Alpha Hedge Portfolio in real-time and join us on our journey to increase our portfolio tenfold within a decade.

⚠️*We execute the Alpha Hedge Strategy in a Real-Life Brokerage Account with Interactive Brokers integrated with the Platform Collective2, a U.S. regulated company based in New York.

This way, to ensure confidence in the presented results, we enable Premium Subscribers access to our positions in real time.

Alpha Hedge Portfolio Historical Data

2013 to 09/17/2021

In 2021, the Alpha Hedge Portfolio increased 10x, yielding a 967% return on the initial investment. This was achieved without any new contributions or withdrawals, with profits reinvested and dividends excluded throughout the period.

Unlock the Alpha Hedge Portfolio ↓