📊Are Diversified Portfolios Really Effective?

Decode the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the blueprint here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

Are Diversified Portfolios Really Effective?

Despite the long-standing belief in the benefits of diversification, recent trends have highlighted its underperformance relative to the S&P 500, necessitating a reevaluation of investment strategies and a balanced approach to managing portfolios.

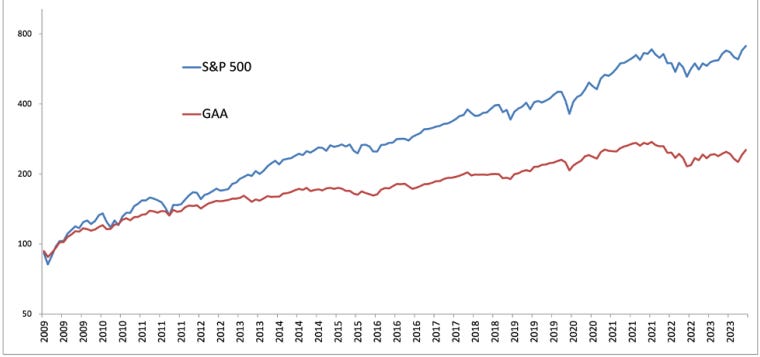

Globally Diversified Portfolios Aren't Worth Your Time

The historical performance of diversified portfolios shows a significant shift in their effectiveness post-2009. From 2009 to 2023, the S&P 500 delivered annual returns of approximately 13.9%, significantly outpacing the 6-7% returns of various globally diversified portfolios. This divergence marks a stark contrast to the pre-2009 era, where diversification provided comparable returns with lower volatility.

Why The Perfect Asset for Maximum Returns is the S&P 500 SPY 0.00%↑

Several factors contribute to the underperformance of diversified portfolios.

Key among them is the robust performance of US equities, driven by technological advancements and economic resilience. Additionally, low yields on bonds and underperformance in international markets have further exacerbated the disparity.

This period of "we’re getting rich” volatility in the US market also played a role.

Do You Know What Is the Global Asset Allocation Stress Disorder?

The psychological and behavioral impacts on investors during this period have been profound.

Watching diversified portfolios lag behind the S&P 500 year after year has led to frustration and doubt.

Many investors have questioned the rationale behind holding underperforming assets like foreign stocks and gold, leading to a phenomenon humorously dubbed "Global Asset Allocation Stress Disorder" (GAASD).

Stop Diversifying Too Much: Concentrate Your Investments for Maximum Gains

Over the past 16 years, the S&P 500 SPY 0.00%↑ has outperformed global stocks ACWX 0.00%↑ by 3.3 times.

ACWX 0.00%↑: The ETF seeks to track the investment results of the MSCI ACWI ex USA Index composed of large- and mid-capitalization non-U.S. equities.

A $50k investment in SPY 0.00%↑ from May/2008* has grown to 273.3k, compared to only $81.5k if invested in ACWX 0.00%↑ .

This stark performance difference highlights the importance of understanding where to concentrate your investments.

Investors often diversify their portfolios across different asset classes and regions to manage risk. However, spreading investments too thin can dilute potential gains.

A dynamic, concentrated portfolio that decodes the S&P 500 SPY 0.00%↑ market cycle solves this.

*Creation of the ACWX 0.00%↑ ETF.

Conclusion

The underperformance of diversified portfolios relative to the S&P 500 over the past decade challenges traditional investment paradigms.

While diversification remains a traditional risk management tool, investors must adapt to evolving market conditions by employing a more dynamic and flexible approach.

References

Cambria Investment Management. (2024). The Bear Market in Diversification. Retrieved from [link to PDF]

Faber, M. (2015). Global Asset Allocation: A Survey of the World’s Top Asset Allocation Strategies. Global Financial Data.

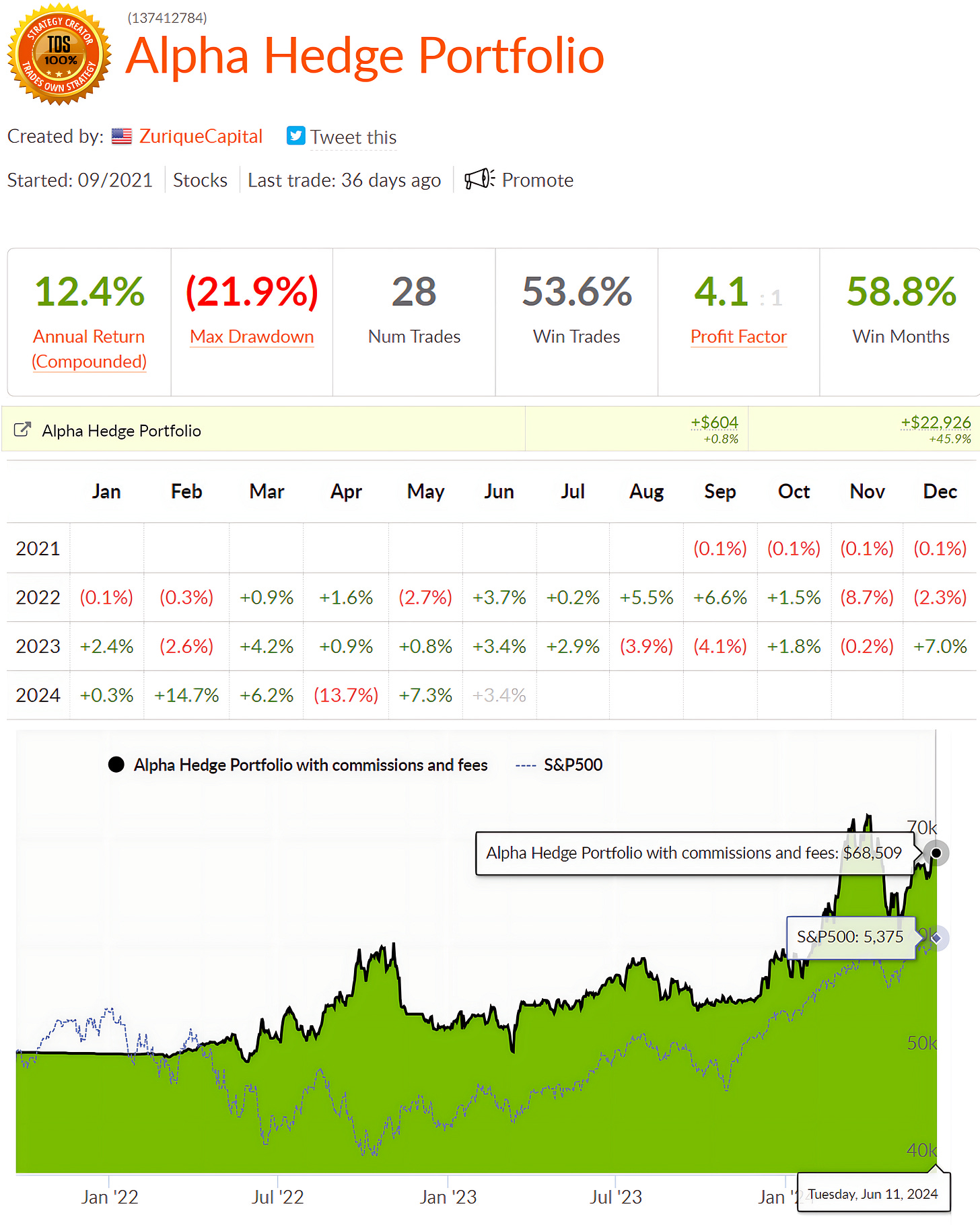

Portfolio Daily Review

The Alpha Hedge Portfolio achieved a daily gain of +0.8%.

The S&P 500 increased by +0.3%, driven by Apple's AAPL 0.00%↑ impressive climb to an all-time high.

Over the month, the Alpha Hedge Portfolio has maintained a strong upward trajectory, recording a cumulative gain of 3.4%.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓