AI's Impact: US Bank Stocks React Negatively to ChatGPT

📊 Wrapping Up the Day: Top 7 Assets

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

AI's Impact: US Bank Stocks React Negatively to ChatGPT

Artificial intelligence (AI) has been making waves across various industries, and banking is no exception. A recent study titled "ChatGPT and the Banking Business: Insights from the US Stock Market on Potential Implications for Banks" delves into the potential impacts of ChatGPT, a revolutionary AI technology, on the banking sector. By examining the US stock market’s response to ChatGPT's launch, the study offers valuable insights into the potential future of banking in an AI-driven world, highlighting both opportunities and challenges that lie ahead.

Market Reactions to ChatGPT's Launch

The study uses an event study methodology to assess the cumulative abnormal returns (CARs) of US bank stocks following the launch of ChatGPT on November 30, 2022.

A significant negative reaction was observed in the stock prices of US banks, indicating market concerns about the potential impact of AI on the banking sector.

Differential Impact on Bank Types

The negative market reaction was more pronounced for deposit-dependent and larger banks.

Commercial banks showed significant negative CARs, while savings institutions were less affected.

Potential Advantages and Disadvantages

Advantages: ChatGPT could enhance efficiency in customer service, risk management, and investment recommendations, potentially leading to cost savings and improved service delivery.

Disadvantages: Concerns include data security, regulatory compliance, and the potential erosion of customer trust. The introduction of AI could also lead to increased competition in the banking sector.

Delayed Market Reaction:

The market reaction was not immediate; investors took time to process the information and understand the implications of ChatGPT for banks.

The delayed reaction suggests that the market was initially uncertain about the technology's impact.

Heterogeneous Effects Based on Bank Characteristics

Banks with higher deposit ratios and larger sizes experienced more significant negative reactions, indicating that these banks might be perceived as more vulnerable to AI disruption.

Insights and Practical Implications

For Bank Executives: The findings suggest a need for careful consideration of AI integration, particularly in balancing technological advancements with traditional banking practices.

For Investors: The study provides insights into how AI technologies like ChatGPT may affect bank valuations, especially for larger, deposit-dependent banks.

For Policymakers: Regulatory frameworks need to evolve to address the challenges posed by AI in banking, ensuring data security and maintaining customer trust.

Bottom Line

ChatGPT’s launch has clearly made waves in the banking sector, sparking a notable, if delayed, negative reaction in the stock market. However, the long-term impact of this AI technology remains to be seen. While it presents clear opportunities for efficiency and innovation, it also brings challenges that could reshape the landscape of banking as we know it.

In the end, how banks adapt to this new technology will determine their future success—or failure. As the industry continues to evolve, ongoing research and discussion will be essential to fully understand and harness the potential of AI in banking.

WRAPPING UP THE DAY

: TOP 7 ASSETS - 08/28/2024

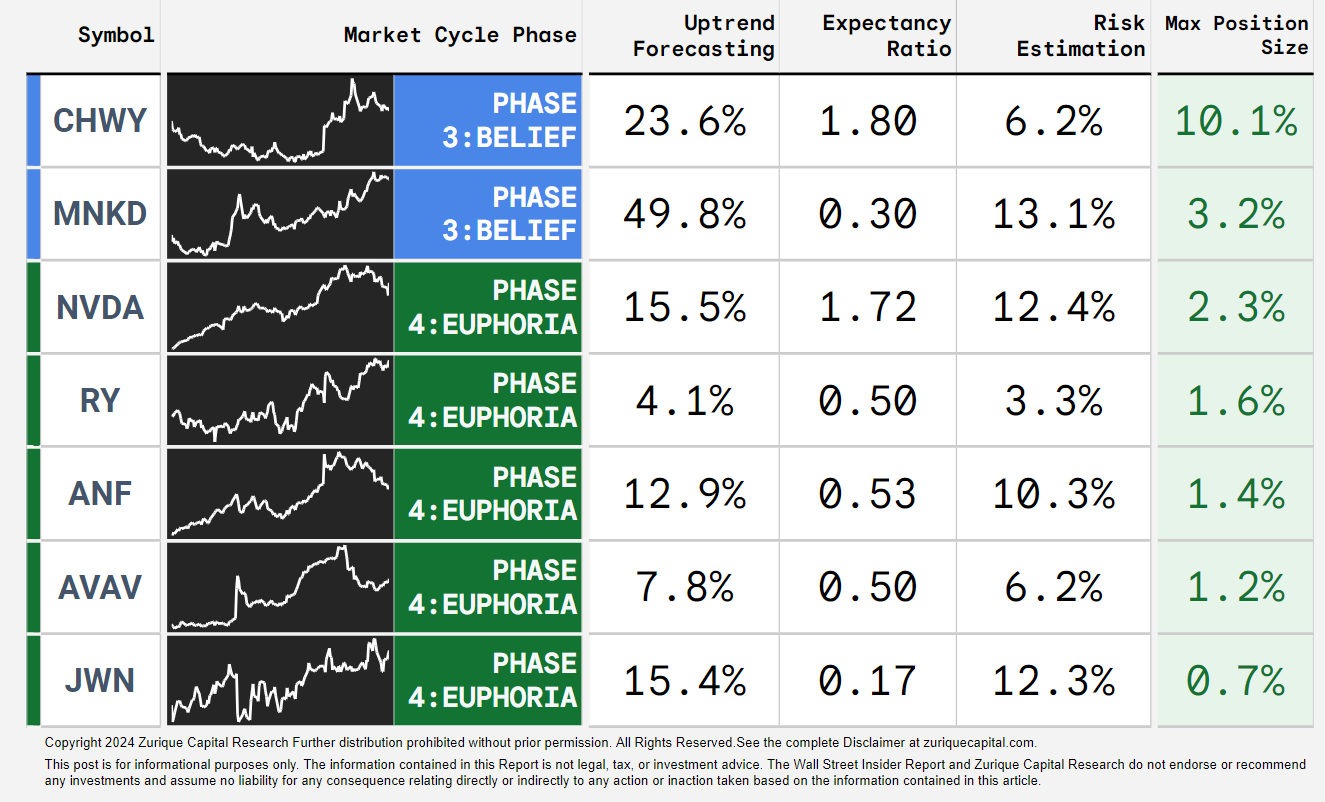

The Alpha Hedge Algorithm decodes market movements to identify assets with high long-term growth potential. Today, it identified 76 assets; here are the Top 7:

Follow Zurique Capital on X for exclusive access all the findings of the day:

Zurique Capital on X: https://x.com/zuriquecapital

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

ALPHA HEDGE PORTFOLIO REVIEW:08/28/2024

The Alpha Hedge Portfolio is down 5% this month, with a year-to-date gain of 13.9%. Over 35 months, it has returned 37.6% (CAGR 11.2%), compared to the S&P 500's 21.4% (CAGR 6.9%).

The Alpha Hedge AI Algo Portfolio's CAGR indicates it doubles capital in 6.3 years, compared to 10.4 years for the S&P 500.