AI for Investment: The Power of AI in Wealth Management

📊The Top 7 Assets AI Picked for Today & Alpha Hedge AI Algo Portfolio Review

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

Breaking Down AI for Investment: The Power of AI in Wealth Management

Are Your Investments Truly Prepared for the Future?

Imagine this: You’ve been working hard, saving diligently, and investing what you can. But deep down, you wonder—are you really doing enough to secure your financial future?

Traditional wealth management strategies—those given to us by the “experts”—are based on outdated models that can leave your portfolio exposed to market volatility and emotional decision-making. And that’s the problem: Emotional investing and old-school strategies can hurt your long-term wealth.

The world is changing fast. AI is now a major player in finance, but are you harnessing it?

The truth is, if you’re not using the right tools to manage your investments, you’re falling behind. Every day you’re missing out on opportunities—market trends, growth potential, and automated strategies that AI can bring to the table.

What if there was a better way?

I’ll share how you can take control of your investments using the same tools that hedge funds and big players use—without any guesswork.

The Secret to Smarter Investing? AI Knows the Way

There is a high risk on relying on outdated investment strategies that are vulnerable to emotion and unpredictable markets. But it doesn’t have to be this way.

Imagine if you could turn every data point, market trend, and price movement into a precise, data-driven decision that works FOR you—not against you.

That’s where AI comes in.

By using AI-driven wealth management, you can:

Analyze market cycles like a pro in a blink of an eye

Process real-time data faster than any human could

Make informed, emotion-free decisions that optimize returns

No more guessing. No more sleepless nights wondering if you’re making the right move. Just clear, data-backed insights that lead you toward your financial goals.

How to Use AI to Build Legacy Wealth – A Step-by-Step Guide

Here’s the process to build legacy wealth with AI:

1. Analyze Market Cycles with AI

AI processes market data at lightning speed and identifies trends long before human investors catch on. This allows you to position yourself ahead of market changes.

2. Process Real-Time Data

AI uses real-time information to make split-second decisions, optimizing your portfolio for maximum gains while managing risk.

3. Manage Risk Efficiently

AI removes emotional biases from investing, helping you make data-driven decisions that reduce the risk of making costly errors.

4. Portfolio Optimization

With AI, your portfolio is continuously rebalanced to meet optimal conditions, helping you grow wealth while minimizing losses.

This approach takes the guesswork out of investing and ensures that every decision is backed by data and precision.

If you want to explore this topic further, check out this post:

Want to see it in action? ↓

The Top 7 Assets AI Picked for Today—Here’s the Proof

I’ve been telling you how AI can transform your investments, but now it’s time to see it in action.

Here are the Top 7 Assets identified by our Alpha Hedge AI Algorithm today. These are assets that have the potential to capitalize on market trends while managing risk—thanks to AI’s powerful data analysis.

STEP 1: OPPORTUNITY MARKET SCANNER

The Alpha Hedge AI Algorithm decodes market movements to identify assets with high long-term growth potential.

STEP 2: USE MATHEMATICS TO MAXIMIZE WEALTH

Optimize buy and sell decisions by analyzing market cycles to pinpoint the perfect moment to act. Discover high-potential assets, use math to maximize wealth with minimal risk, achieving the ideal portfolio balance.

STEP 3: TOP MUST-WATCH ASSETS

Assets in Phases 3 or 4 with strong quantitative data are given higher weight; all the others are excluded.

Each of these assets was selected based on real-time data, AI analysis, and market trends, ensuring a calculated decision-making process. This isn’t guesswork—it’s a proven strategy that helps investors outperform the market.

Have access to more insights like this every day—ensuring you’re always in a position to make informed investment decisions, even during turbulent market conditions.

Follow our notes and access all the assets analyzed in the day:

But what if I told you there’s a way to make this process even easier?

With my Alpha Hedge AI-Algo Portfolio, you don’t need to do any of the heavy lifting. The AI does it all for you, optimizing your wealth-building strategy every step of the way.

Want to Build Legacy Wealth? My AI-Powered Portfolio Can Help

In this article, we’ve discussed the power of AI in wealth management, and I’ve shown you how it can identify opportunities, manage risks, and optimize your portfolio.

Now, let me introduce you to the ultimate solution for building legacy wealth:

The Alpha Hedge AI-Algo Portfolio.

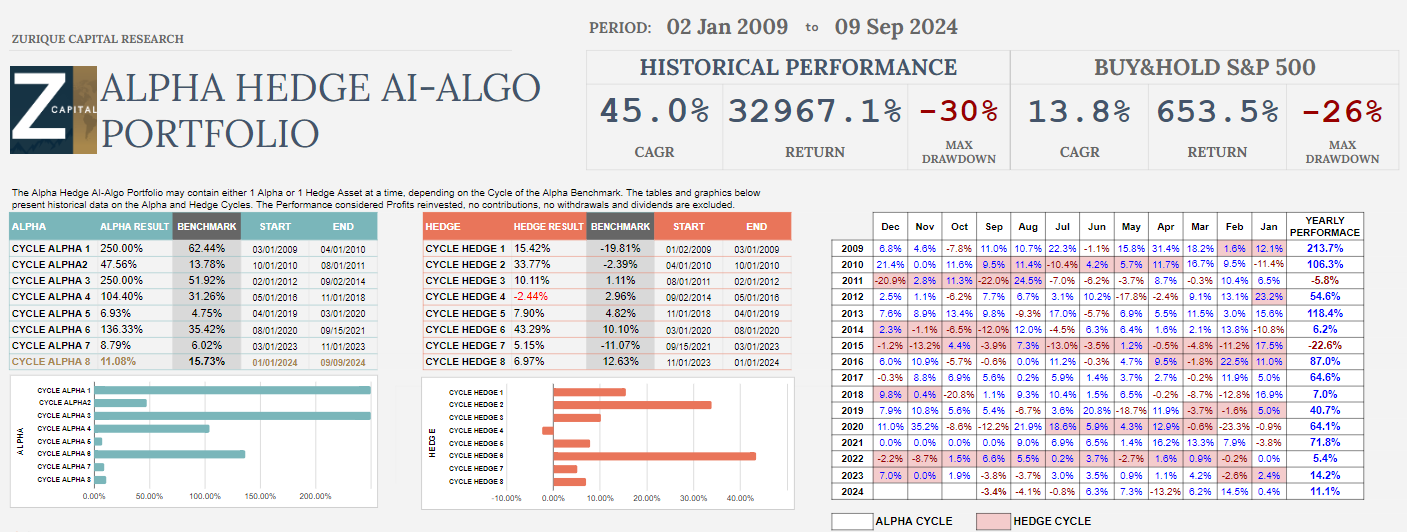

The Alpha Hedge AI-Algo Portfolio may contain either 1 Alpha or 1 Hedge Asset at a time, depending on the Cycle of the S&P500.

The tables and graphics below present historical data on the Alpha and Hedge Cycles. The Performance considered Profits reinvested, no contributions, no withdrawals and dividends are excluded.

Alpha Hedge AI-Algo Portfolio Review: 09/09/24

Over the past decade, we developed the Alpha Hedge Algorithm using advanced quantitative methods, machine learning, neural networks, and, more recently, AI to build a portfolio designed to exponentially grow wealth while minimizing risk.

To ensure confidence in our results and uphold our commitment to full transparency, since September 2021, we have shared our performance in real time from a live brokerage account, allowing our clients to track the portfolio’s progress.

Over the past 36 months, the Alpha Hedge Portfolio has delivered a total return of 33.7% (CAGR 10.2%), compared to the S&P 500's total return of 18.8% (CAGR 5.9%).

The portfolio is down 3.4% this month but has gained 11.1% year-to-date.

At a CAGR of 10.2%, the portfolio doubles capital in 7.1 years, whereas the S&P 500, with a 5.9% CAGR, takes 12.1 years to do the same.

This AI-driven portfolio leverages the same technology used by major institutions to:

Capitalize on market opportunities

Navigate volatility with precision

Minimize losses and maximize growth

Optimize tax efficiency and wealth preservation

This is the hands-off, long-term solution you’ve been looking for. The best part? You can access it in real-time, through my Wall Street Insider Report Premium, giving you direct insights from AI that’s continuously analyzing and optimizing.

Ready to take the leap?

Subscribe to the Wall Street Insider Report Premium today and gain access to my AI-powered Alpha Hedge Portfolio, daily market insights, and exclusive monthly updates.

▶️Read what the Wall Street Insiders wrote about us↓

![Rethinking Wealth Management with AI [Lesson 2/7]](https://substackcdn.com/image/fetch/$s_!ZopN!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff06ef0f0-c008-45b0-916c-9a465047aa55_1920x1080.png)