AI-Driven Investing is a Detail Game

📊Algorithmic Trading in Financial and Sports + Closing Bell Overview

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

AI-Driven Investing is a Detail Game

AI is transforming the investment landscape, offering tools that analyze vast data sets, identify patterns, and make decisions at unprecedented speeds.

Unlike traditional methods, AI-driven platforms utilize advanced algorithms to swiftly process information, make data-driven choices, and automatically optimize portfolios.

The Importance of Details in AI-Driven Investing

While AI offers numerous advantages, successful AI-driven investing demands meticulous attention to detail:

Data Quality: Reliable predictions hinge on the accuracy and completeness of input data.

Model Selection: Selecting the right AI algorithms and fine-tuning them is crucial for achieving optimal results.

Ongoing Monitoring: AI models require continuous monitoring and updates to maintain performance as market conditions change.

Transparency: AI decision-making processes should be interpretable to foster trust and enable oversight.

Risk Management: Effective risk controls are essential to mitigate potential AI model errors or unexpected events.

The sophistication of AI in investing lies in its ability to enhance risk management, improve diversification, and minimize emotional bias.

By uncovering hidden, non-linear relationships among variables, AI provides a deeper understanding of market dynamics, empowering asset managers to craft strategies that navigate complex market environments more effectively.

QUANT TIME

Algorithmic Trading in Financial and Sports (Exchanges)

Click here to read the full article: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4910378

The paper compares algorithmic trading in financial markets and sports exchanges, emphasizing their similarities and differences.

Financial markets have evolved from traditional trading to ultra-high-frequency computerized trading, while sports markets are transitioning from traditional bookmakers to algorithmic exchanges like Betfair.

Sports markets, though smaller and less liquid, have potential as uncorrelated asset classes that are recession-proof.

Here a the 6 Key Themes and Insights Discussed in the Article

1. Market Structure and Evolution

Financial markets are highly liquid, with deep order books and numerous participants, while sports markets have lower liquidity and smaller scale.

Financial markets trade intrinsic assets like equities and bonds, whereas sports markets deal in implied probabilities of event outcomes.

2. Participants and Liquidity

Financial markets include a diverse range of participants, including institutional investors and speculators, while sports markets are primarily driven by retail traders, bots, and professionals.

Liquidity is a major challenge for sports markets, with growth potential dependent on market acceptance and legal frameworks.

3. Trading Mechanisms

Both markets use algorithmic trading, but the mechanisms differ. Sports exchanges focus on back and lay bets, which are similar to buying and selling in financial markets.

Sports exchanges have wider spreads, higher commissions, and different execution policies compared to financial markets.

4. Data Utilization and Machine Learning

Financial markets utilize diverse data sources, including social media and alternative data, while sports markets rely on pre-game, in-play, and exchange data.

Advanced machine learning models, such as Hidden Markov Models (HMMs) and Long Short-Term Memory (LSTM) networks, are increasingly applied in both markets to predict outcomes and optimize trading strategies.

5. Regulation and Market Integrity

Financial markets are regulated by multiple agencies with a focus on investor protection and market efficiency, while sports markets are primarily regulated for consumer protection and fair play.

Ethical concerns like spoofing and market manipulation exist in both markets, but legal consequences are more severe in financial markets.

6. Challenges and Future Directions

The potential for sports markets to evolve into major asset classes depends on increased liquidity, market acceptance, and enhanced regulatory frameworks.

The paper suggests further research into the efficiency of sports markets and the development of sophisticated pricing models tailored to sports trading.

CLOSING BELL OVERVIEW: 08/16/2024

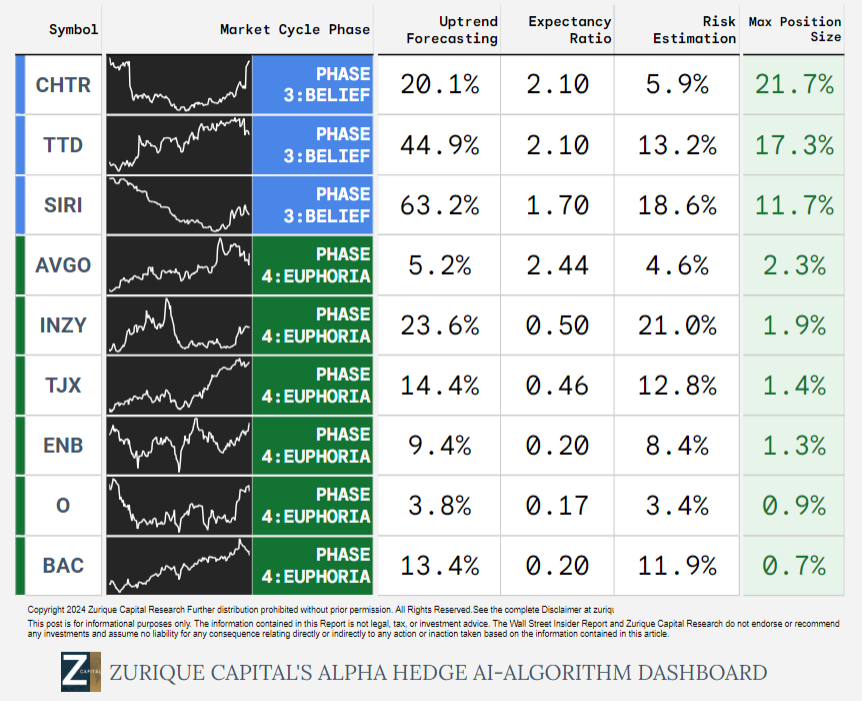

Decoding market trends, our AI algorithm has identified the top-performing assets from this list.

KHC 0.00%↑ ULTA 0.00%↑ INZY 0.00%↑ RDFN 0.00%↑ BROS 0.00%↑ VRSN 0.00%↑ AVGO 0.00%↑ CHTR 0.00%↑ SIRI 0.00%↑ TEM 0.00%↑ BIDU 0.00%↑ AI 0.00%↑ AMAT 0.00%↑ ROKU 0.00%↑ SBUX 0.00%↑ TJX 0.00%↑ ENB 0.00%↑ BB 0.00%↑ TTD 0.00%↑ QCOM 0.00%↑ BAC 0.00%↑ VALE 0.00%↑ O 0.00%↑ BMY 0.00%↑ AFRM 0.00%↑

This is our top findings:

Follow Zurique Capital on X for exclusive access to in-depth analysis of all assets:

Zurique Capital on X: https://x.com/zuriquecapital

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

ALPHA HEDGE PORTFOLIO REVIEW:08/16/2024

The Alpha Hedge Portfolio has registered a performance of -5.4% so far this month, bringing the year-to-date gain to 13.4%. Over the past 188 months, the portfolio has achieved a cumulative return of 44,007.1%, with a compound annual growth rate (CAGR) of 47.7%. In comparison, the S&P 500 has delivered a cumulative return of 664.4% over the same period, with a CAGR of 13.9%.