AI Data-Driven Insights Uncover Key Market Trends

📊Solving the Market + Alpha Hedge Portfolio Review: 08/08/2024 Updates

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

AI Data-Driven Insights Uncover Key Market Trends

The Alpha Hedge Strategy leverages AI data-driven insights to uncover key market trends, enabling a dynamic and forward-looking approach to investment. By analyzing vast datasets with proprietary algorithms, this strategy identifies pivotal market shifts, empowering investors to stay ahead of trends and make informed decisions.

SOLVING THE MARKET: 08/08/2024

MORNING KICKOFF

This are the assets identified this morning:

LLY 0.00%↑ NVAX 0.00%↑ HOOD 0.00%↑ WBD 0.00%↑ OXY 0.00%↑ DDOG 0.00%↑ PLUG 0.00%↑ BMBL 0.00%↑ BROS 0.00%↑ CDT 0.00%↑

After our AI-driven analysis, these were the key morning market trends.

The Dashboard columns are defined as follows:

1: Symbol: Asset Symbol;

2: Portfolio Max Position Size: Maximum Position Size calculated by the Alpha Hedge AI-Algorithm. Calculated to maximize returns and protect capital in downturns. The higher, the better;

3: Market Cycle Phase: Visualization of the Market Phase, It determines the optimal entries and exits for positions;

4: Uptrend Forecast: Uptrend forecast calculated by the Alpha Hedge AI-Algorithm. Calculated based on historical data of long-term trends. The higher, the better;

5: Expectancy Ratio: Gain Expectancy calculated by the Alpha Hedge AI-Algorithm. The higher, the better;

6: Risk Estimation: Gain Expectancy calculated by the Alpha Hedge AI-Algorithm. Calculated based on the downturns Standard-Deviations. The lower, the better.

CLOSING BELL

This are the assets identified after the bell:

SOUN 0.00%↑ BROS 0.00%↑ MSTR 0.00%↑ LLY 0.00%↑ WBD 0.00%↑ BMBL 0.00%↑ FROG 0.00%↑ VSAT 0.00%↑ MGOL 0.00%↑ MCK 0.00%↑

After our AI-driven analysis, these were the key closing market trends.

KNOWLEDGE HUB

Every day, we analyze hundreds of assets to uncover opportunities.

We use our Alpha Hedge Algorithm to decode significant market movements to identify assets with the highest potential for long-term exponential growth.

Our analysis follows this step by step:

Step 1: Optimize Your Buy, Hold and Sell Decisions

Optimize Your Buy, Hold and Sell Decisions identifying the perfect moments to act.

In this step, Our algorithm determines the current phase of each asset within the market cycle, helping you to understand if it's time to buy hold or sell the asset depending on Its phase.

Step 2: Discover high-potential assets.

In this step, We identify assets with the highest probability of exponentially expanding wealth while minimizing risk, using advanced quantitative methods, machine learning, neural networks, and AI to forecast performance.

Step 3: Maximize Wealth with Minimal Risk

Maximize Wealth with Minimal Risk achieving the best balance in your portfolio. We mathematically define the optimal position size for each asset, ensuring maximum returns and minimized risks.

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

ALPHA HEDGE PORTFOLIO REVIEW: 08/08/2024 UPDATE

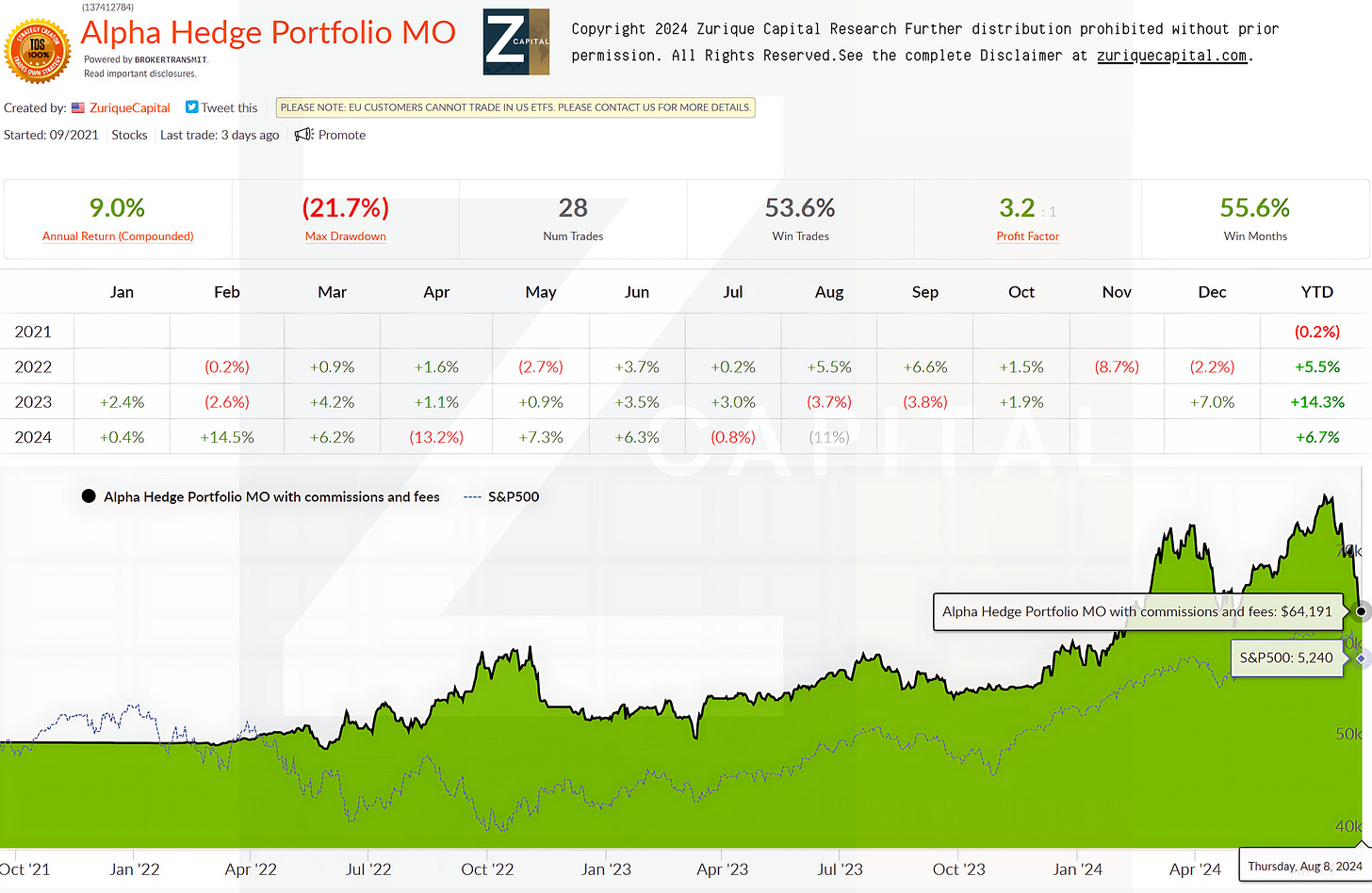

The Alpha Hedge Portfolio recorded a monthly performance of -11%, reflecting recent market volatility, while its year-to-date performance stands at +6.7%. Over a 35-month period, the portfolio has achieved a cumulative return of +35.7%, outperforming the S&P 500, which posted a +19.4% gain during the same period.