A Bold Prediction for 2034

Solving the Market 07/26/2024

A Bold Prediction for 2034

According to Marc Andreessen, a visionary billionaire investor who foresaw the rise of the internet, the 9-to-5 job will become extinct in 10 years. This prediction isn't just idle speculation. Andreessen's track record includes anticipating the dominance of the internet, the sharing economy, and social media long before they became mainstream.

As we approach the mid-21st century, the landscape of investing is undergoing a seismic shift.

In 10 years, traditional 9-to-5 jobs are predicted to be relics of the past, reshaping the way we think about wealth generation and investment strategies.

This transformation is driven by advancements in artificial intelligence (AI) and its profound impact on various industries. Here’s what you need to know about these changes and how you can position yourself to thrive in this new era of investing.

The Role of AI in Transforming Work and Investment

AI is set to revolutionize the workforce by making many services incredibly affordable. Imagine legal briefs, medical diagnoses, and management consulting costing just pennies instead of thousands of dollars. This drastic reduction in costs will have far-reaching implications for our daily lives and the broader economy, and consequently, on investment opportunities.

AI-Driven Cost Efficiency

Marc Andreessen predicts that AI will make a wide range of services 1000 times cheaper than they are today. This transformative shift isn't just about lowering prices; it fundamentally democratizes access to essential services. Legal advice, healthcare, and business consulting, which are often prohibitively expensive, will become accessible to everyone. This change will have profound implications for the investment world.

Drastic cost reduction;

In a cheaper world, more capital will be available for investing.

Dirty Secrets of Mutual Funds Costs

The costs are higher to the less-knowledgeable investor.

The investment industry has long grappled with high costs, particularly in mutual fund management. Research has shown that mutual fund investors are often aware of up-front charges like sales loads but are less mindful of annual operating expenses, even though both types of fees lower overall performance.

The mutual fund industry has become adept at segmenting customers by their level of investment sophistication. Load mutual fund companies tend to charge higher expenses to their target customer: the less-knowledgeable investor. In contrast, no-load fund companies, which typically attract more sophisticated investors, offer lower expenses .

For example, from 2000 to 2004, the average annual expense ratio of load equity funds was 50 basis points higher than no-load equity funds. This widening cost disparity is evident among new and existing equity, bond, and index funds. This trend indicates that less knowledgeable investors consistently pay higher asset management fees than their more informed counterparts.

How an AI-Driven Investment Strategy Solves This

Andreessen's prediction about AI making services 1000 times cheaper can be particularly impactful in the context of investment management. By leveraging AI, the costs associated with management, advisory services, and transaction fees can be drastically reduced. This will not only increase the accessibility of professional investment management services but also enhance overall investment performance by reducing the drag on returns caused by high fees.

Next Steps for Us

In the investment world, cheap services may sound like bad services, but not anymore.

The transformative power of AI to drastically reduce service costs and democratize access to essential resources is reshaping wealth generation and investment strategies.

At Zurique Capital, we are committed to leading this revolution.

Our purpose is to exponentially expand human wealth by leveraging AI to navigate market complexities. By guiding global investors across 55 countries, we aim to build legacy wealth and redefine the future of investing. Embracing AI, we are poised to create a more accessible, efficient, and prosperous investment environment for all through:

[FREE] Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

[FREE] Actionable Monthly Analysis: Detailed update of the market cycles.

[LOW FLAT FEE] 10-Year Subscription to the Alpha Hedge Portfolio: Monthly updates via email provide you with the latest portfolio rebalance information, tailored to your risk tolerance. (1 payment of U$600 per 10-year subscription of the Wall Street Insider Report).

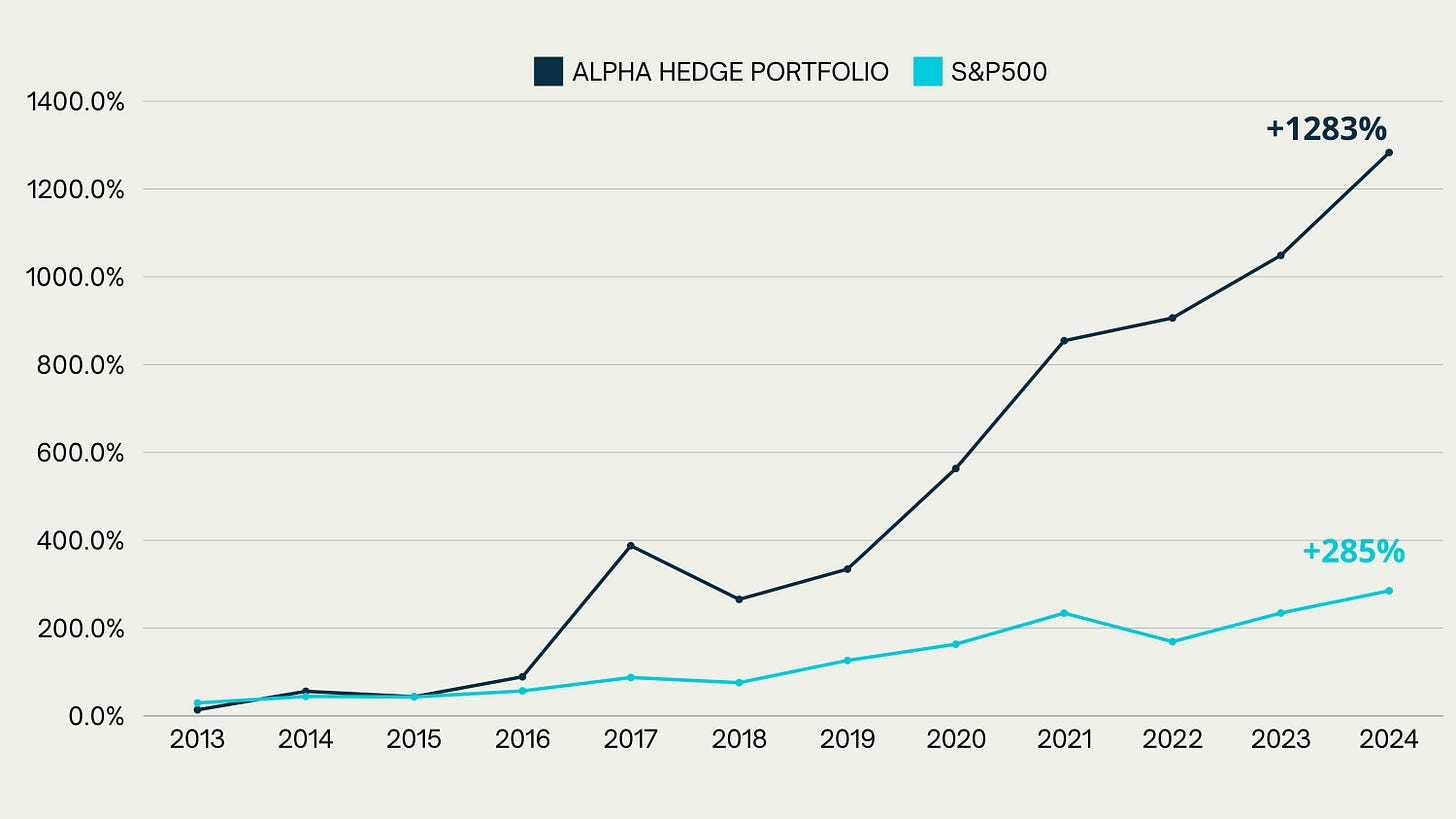

It’s a mutual commitment: we pledge to continuously enhance our exponential historical performance, while investors commit to a 10-year journey to build legacy wealth.

Subscribe today and transform your investment strategy with AI. Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

Embrace the new era of investing and secure your financial future with the unparalleled advantages of the Alpha Hedge Algorithm.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

Solving the Market 07/26/2024

Our Algorithm decode the Top 30 most significant market movements of the day.

ABR 0.00%↑ AMD 0.00%↑ ASTS 0.00%↑ BABA 0.00%↑ BAH 0.00%↑ BEN 0.00%↑ BFI 0.00%↑ BIIB 0.00%↑ BMY 0.00%↑ BROS 0.00%↑ CGTX 0.00%↑ CHTR 0.00%↑ CL 0.00%↑ COIN 0.00%↑ COUR 0.00%↑ CREV 0.00%↑ CVM 0.00%↑ CVNA 0.00%↑ CVS 0.00%↑ DDC 0.00%↑ DECK 0.00%↑ DNUT 0.00%↑ DXCM 0.00%↑ EVRI 0.00%↑ HIMS 0.00%↑ IGT 0.00%↑ MSTR 0.00%↑ NVAX 0.00%↑ TECK 0.00%↑ TNA 0.00%↑

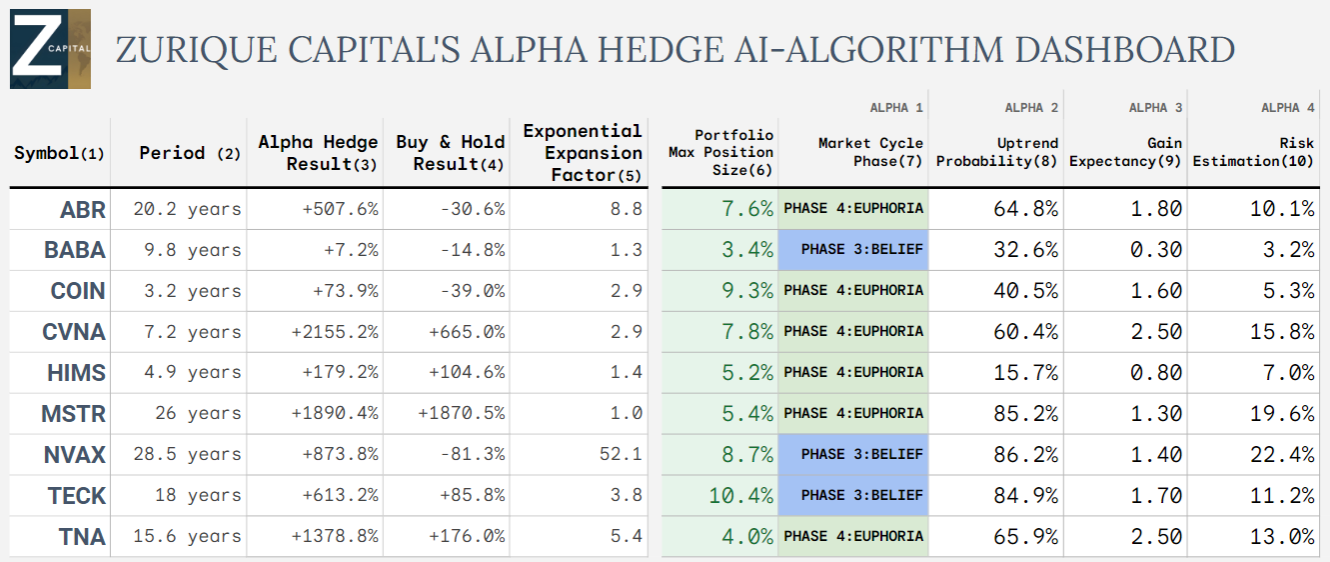

By applying the Alpha Hedge Algorithm to these assets, we decode the data for this assets, and this are our top findings:

The spreadsheet columns are defined as follows:

1: Symbol: Asset Symbol;

2: Period: Analysis period;

3: Alpha Hedge Result: Performance of the Alpha Hedge AI Algorithm Applied to the Asset. Without any new contributions or withdrawals, with profits reinvested and dividends excluded.

4: Buy & Hold Result: Performance of Buying and Holding the Asset During the Same Period.

5: Exponential Expansion Factor: Alpha Hedge Result over Buy & Hold Result;

6: Portfolio Max Position Size: Maximum Position Size calculated by the Alpha Hedge AI-Algorithm. Calculated to maximize returns and protect capital in downturns. The higher, the better;

7: Market Cycle Phase: Phase of the Market Cycle based of the Alpha Hedge AI-Algorithm. It determines the optimal entries and exits for positions.

8: Uptrend Probability: Probability of Uptrend calculated by the Alpha Hedge AI-Algorithm. Calculated based on historical data of long-term trends. The higher, the better.

9: Gain Expectancy: Probability of Uptrend calculated by the Alpha Hedge AI-Algorithm. Calculated based on historical data of long-term trends. The higher, the better.

10: Risk Estimation: Gain Expectancy calculated by the Alpha Hedge AI-Algorithm. Calculated based on the downturns Standard-Deviations. The lower, the better.

Investing in this stocks brought multiples times more return using the Alpha Hedge Algorithm, but there's an even more efficient way to exponentially expand your wealth by leveraging AI:

▪️ Harness Market Volatility: Turn fluctuations into growth opportunities.

▪️ Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

▪️ Simplified Choices: Evidence-based, AI-driven concentrated investment portfolio.

▪️ Trust and Transparency: Independent, transparent portfolio construction.

▪️ Life Balance: Hands-off solutions for professional and personal peace of mind with a long-term, low-maintenance portfolio.

__