📊5 Takeaways from the latest Howard Marks Memo (commented)

And 5 Case Studies comparing our Market Cycle System and Howard Marks Calls

#keypoints

Daily Educational Content [Free]:

5 Takeaways from the latest Howard Marks Memo

Key Themes and Insights

Case Study [Free]:

5 Market Calls Analysis

January 2000

Late 2004 to Mid-2007

Late 2008

March 2012

March 2020

Bottom Line

5 Takeaways from the latest Howard Marks Memo

Last Monday Howard Marks posted a Memo explaining the reasons he believes matters when making market calls. Marks discusses five key market calls he made during this period, explaining the reasoning behind each call and how they turned out to be correct.

Here are the Top 5 Takeaways from this Memo and our comments applied to our approach of the Market Cycle investing strategy.

Key Themes and Insights

The author emphasizes the importance of understanding market cycles and the role of causality in these cycles.

Our Comment: Everyday we emphasize this concept in our Market analysis.

He highlights the dangers of irrational investor behavior and the tendency to ignore the lessons of past cycles.

Our comment: Most authors treat the market as if It is efficient and investors rational, that’s why most predictions fail.

The author also underscores the value of contrarian thinking and "second-level thinking" in making successful market calls.

Our comment: Many investor insist on go against the Cycle (or the trend), thinking It will put them on advantage, when the reality is the opposite. Contrarian thinking makes you sound smart, but don’t make money.

The article suggests that excessively negative sentiment often precedes major market gains.

Our comment: I agreed, most of the my best positions came when the logic was telling that would happen of what the Market was delivering.

Observe that It differs from the contrarian thinking of the topic above, because we were not betting against the market, but following exact what the market was doing.

Contrarian thinking in this case would be goes against what the Market was doing.

The author stresses that while his market calls turned out to be correct, they were made with great trepidation, indicating the inherent uncertainty and risk in predicting market trends.

Our comment: A bit difference from our approach from this point is that we don’t try to predict the trend, we enter when It is already confirmed. This way we get a better Risk/Return Ratio.

This doesn’t mean that we are correct all the time (actually we are correct 60% of the time), but we opt to trade a little of the initial trend (and It’s consequent return) to increase our chances of success.

📈Case Study: 5 Market Calls Analysis

January 2000: The author predicted the bursting of the tech, media, and telecom (TMT) bubble. He based this on historical patterns of financial bubbles and the irrational behavior of investors during the TMT boom. The subsequent market crash validated his prediction.

Our system is designed not in base of patterns for predictions, but to react to the market. This way we wait for confirmation of the beginning and ending of a trend.

Our algorithm trigged the exit on June/00, with a In this comparison the exit of our algorithm was on () a little after Marks call (on January/00) a difference of -6%.

Late 2004 to Mid-2007: The author warned of an impending financial crisis due to the Federal Reserve's accommodative monetary policy and investors' increasing risk tolerance. His prediction was confirmed by the Global Financial Crisis of 2008.

Late 2008: During the Global Financial Crisis, the author decided to invest aggressively, assuming that the financial world would continue to exist. This decision paid off as the market eventually recovered.

As seen above, our algorithm trigged the exit, saving the profits from the 2008 financial crisis on January/08, with a +11.74% of result in this Cycle.

In Jun/09, our system trigged an entry when was identified a new Positive Cycle. This Cycle lasted until Jun/10.

March 2012: The author drew parallels between the pessimistic investor sentiment of the time and the market conditions of 1979, predicting a major gain in the S&P 500. This prediction was also validated as the S&P 500 returned 16.5% a year from 2012 through 2021.

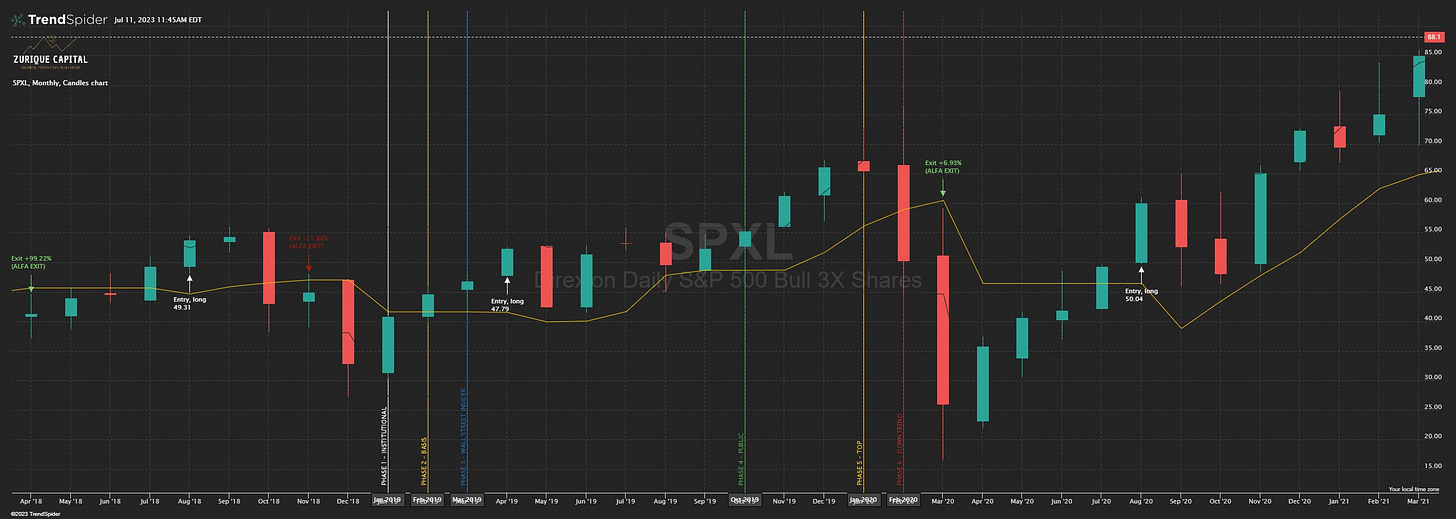

By this time we where already assembling our positions in Leveraged ETFs, amplifying our results and managing risk from position sizing and trailing Stops. This Cycle was from February/12 to September/15.

Our Alfa Hedge Portfolio I achieved 21%, 37% and -7.9% in 2013, 2014 and 2015, going from U$50.000 in the beginning of 2013 to U$76.337 by the end of 2015 (an increase of ~53%).

March 2020: The last of the five calls – recent enough for readers to recall the context – came in the early days of the Covid-19 pandemic. The disease began to enter most people’s consciousness in February 2020, and from mid-February to mid-March, the S&P 500 fell by approximately one-third.

This cycle started in April/2019 and was drastically interrupted on March/20. With a small profit of +6.93%. During this time, some hedge assets gave good opportunities that we could take because we closed the S&P 500 position on March. We closed 2020 with a +52.7% as the Market recovered by August/20.

Bottom Line

Reading the Market Cycle put the investor in advantage because most take decisions based on the assumption that the market is efficient and investors rational, which is not true.

Market Cycle investing use data-driven decisions and seen the market as It really is.

Here is the complete memo from Howard Marks: https://www.oaktreecapital.com/insights/memo/taking-the-temperature

If you liked this content, you will love the others contents of our Report.👇

Wall Street Insider Report

Demystify the MARKET CYCLES investing SMARTER in Wall Street

Theory + Action: Learn & Replicate a High Performance + Low Maintenance + Long-Term Portfolio

Join +13k Global Investors and Really Master the Market Cycle Investing