📊5 S&P500's Data Points to Watch This Week (+4 to Ignore)

Decode the S&P 500 Market Cycle

Wall Street Insider Report

Decoding the S&P500 Market Cycle and sharing the blueprint here in the Wall Street Insider Report.

Join +1.5k Wall Street Insiders across 30 US states and 51 countries.

5 S&P500's Data Points to Watch This Week (+4 to Ignore)

Every week we analyze over 100 of data points about the S&P 500 index SPY 0.00%↑, this are the top 5 S&P500's data points to watch this week and 4 to ignore. (Sources in the images and graphs).

5 S&P500's Data Points to Watch This Week

1. Revenue Alone Isn't Enough

10 years ago, Apple's AAPL 0.00%↑ market cap was 53 times higher than Nvidia's. NVDA 0.00%↑ , now Nvidia has reached a market cap of $3 trillion, surpassing Apple to become the second-largest company in the world.

Apple Inc. (AAPL 0.00%↑)

Annual Revenue: $380 billion

Annual EBITDA: $125 billion

Market Cap: $3 trillion

Nvidia Corporation (NVDA 0.00%↑)

Annual Revenue: $80 billion

Annual EBITDA: $50 billion

Market Cap: $3 trillion

Comparative Analysis

Revenue Comparison: Apple generates 5 times more revenue than Nvidia.

EBITDA Comparison: Apple has roughly 2.5 times the EBITDA of Nvidia.

This shift exemplifies that revenue is nothing without market demand.

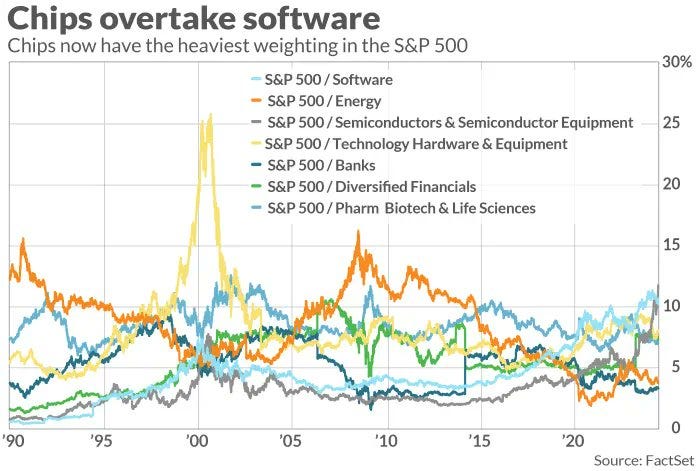

2. S&P 500 Sector Showdown

Semiconductors have significantly driven the S&P 500's SPY 0.00%↑ performance, accounting for approximately 40% of the index's 11.3% return so far in 2024.

For the first time ever, semiconductors represent the heaviest weighting within the S&P 500.

3. Check Out These New Market Sentiment Indicators

The S&P 500 SPY 0.00%↑ recently recorded its lowest trading volume in 18 years, excluding holiday-shortened trading days and lower levels of volatility.

This reflects an extended phase of market tranquility and investor hesitation.

4. This Are the Stocks Really Working in 2024

The performance of big tech companies has become synonymous with the overall health of the stock market.

This year alone, Amazon AMZN 0.00%↑, Apple AAPL 0.00%↑, Microsoft MSFT 0.00%↑, Google GOOG 0.00%↑, and Nvidia NVDA 0.00%↑ have surged by an astounding 27%, driving the S&P 500's SPY 0.00%↑ impressive 11% year-to-date gain.

In stark contrast, the remaining 495 companies within the index have collectively experienced a modest 6% increase. Additionally, the equal-weighted S&P 500 index has seen a mere 5% rise in 2024, underscoring the outsized influence of the largest tech firms.

5. Bigger than China

Currently, the six largest components of the S&P 500 represent a record-breaking 30% of the index.

To put in perspective, the combined market value of Microsoft MSFT 0.00%↑, Nvidia NVDA 0.00%↑, Apple AAPL 0.00%↑ exceeds the total value of all China-listed stocks.

These are the data points that matter to investors, but many fall into prediction pitfalls. Here are three data points that investors must ignore to avoid being misled by the randomness of the Market. (sources in the images).

Top 4 S&P500's Data Points Investors Must Ignore

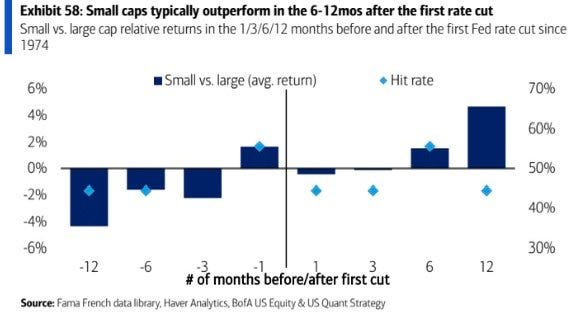

Small Caps Outperformance Post-Rate Cut: Historically, small-cap stocks tend to outperform in the 6-12 months following the first rate cut, which has an 83% probability of occurring in September.

S&P 500 Market Momentum and Upside Potential: The S&P 500 is currently in a bullish overbought condition with potential upside to the 5600 and 6150 levels, as indicated by the Williams %R momentum indicator.

Low Breadth in S&P 500 Rally: This year's S&P 500 rally has been driven by a small number of stocks, with historically low breadth, a trend similar to those seen near the end of asset bubbles in 2007 and 1998.

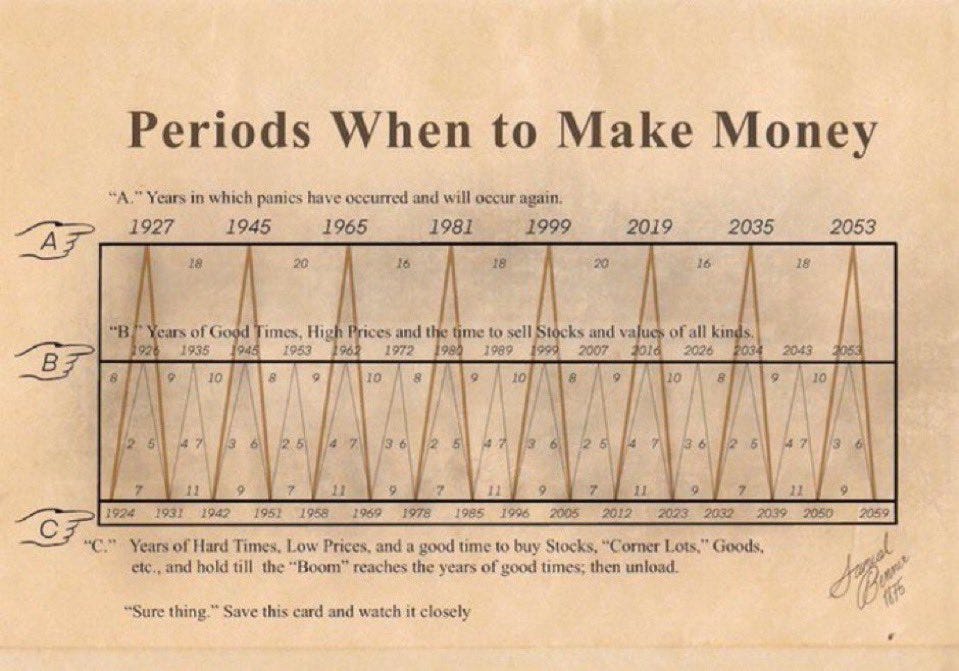

Samuel Benner's Accurate Market Analysis: Samuel Benner, a farmer from the 1800s, published a book on market cycles, which has proven remarkably accurate over 150 years, often more so than many contemporary Wall Street strategists.

Over the past decade, our subscribers have outperformed the American Market Decoding the S&P 500 Market Cycle.

You too can make investment decisions based on objective data.

That's where the Wall Street Insider Report comes in. We've developed a unique approach to investment management that puts you back in the driver's seat.

Know more about our 5-Year Plan and join +1.5K Pro Investors and Finance Professionals across 51 countries who are exponentially growing their - and their clients - wealth for over a decade.↓