3 New AI Features for the Financial Sector

📶Decoding the S&P500: $AMD $AMZN $GLW $META $NVDA

Wall Street Insider Report

Decoding the S&P 500 Market Cycle and sharing the blueprint here in the Wall Street Insider Report.

Join +1.8k Wall Street Insiders across 55 countries.

WALL STREET MORNING KICKOF

3 New AI Features for the Financial Sector

The financial sector stands out as a prime example of how AI can deliver real, tangible results. Here are 3 new AI Features for Financial Sector.

1. Enhanced Efficiency

Intelligent Document Processing (IDP)

Automation: AI automates data collation, invoice classification, and processing, replacing manual and error-prone tasks.

Benefits: This frees up finance teams for more strategic work, reduces errors, and unlocks efficiency advantages like early payment discounts.

Large Language Models (LLMs)

Advanced Processing: LLMs handle complex transactional documents more effectively than traditional OCR solutions.

Integration: Combining LLMs with robotic process automation (RPA) enhances productivity and security.

Value Addition: McKinsey reports that generative AI could add $200 billion to $340 billion in value globally to the banking sector.

2. Streamlined Governance and Compliance

Workflow Optimization

Multi-Goal Achievement: AI not only speeds up document processing but also extracts valuable insights for better business forecasting.

Validation: AI ensures documents comply with industry regulations automatically, reducing manual effort.

Anti-Money Laundering (AML)

Enhanced Risk Scoring: AI analyzes transaction, account, and customer data to highlight suspicious activities.

Effectiveness: Google's AML AI has increased positive alerts by up to four times in HSBC trials.

Automated Document Reconfiguration

Global Compliance: AI adjusts documents to meet global standards, simplifying compliance and streamlining operations.

3. Proactive Cyber Fraud Detection

AI-Driven Detection

Proactive Approach: AI shifts fraud detection from reactive to proactive by analyzing vast amounts of data to identify potential threats.

Example: Mastercard’s Decision Intelligence (DI) technology uses generative AI to improve fraud detection rates by up to 300%.

Situational AI Evaluation

Flexibility: AI evaluates each transaction with nuance, reducing false positives and increasing accuracy.

Efficiency: This approach can decrease false positives in threat detection by 30%.

S&P 500 TRACKER

For 11 years, I have spoken to investors struggling to consistently surpass market performance, even amidst economic turbulence.

A Brazilian client sent me a copy of an email he sent to his advisors (translated from Portuguese to English):

"I received the June 2024 profitability report yesterday.

Another month with very, very poor results.

Let's look at the data:

Returns for the Month / Year / 3 / 6 / 12 / 24 / 36 Months and Cumulative: ALL below the CDI*!

For a total asset value of over R$ X,XXX,XXX, this is unfeasible."*CDI is equivalent to the Brazilian Risk-Free Rate.

Envision a portfolio that not only endures market downturns but also prospers in any economic climate. This vision can become your reality through Systematic Portfolio Optimization.

This doesn’t mean that every month will be a winner, but investors can be confident that their portfolio will outperform the market in the long term.

Let’s dive into the three crucial steps to portfolio optimization we apply to help our clients exponentially expand their wealth using algorithms based on machine learning, quantitative analysis, and artificial intelligence

Step 1: Initial Portfolio Analysis

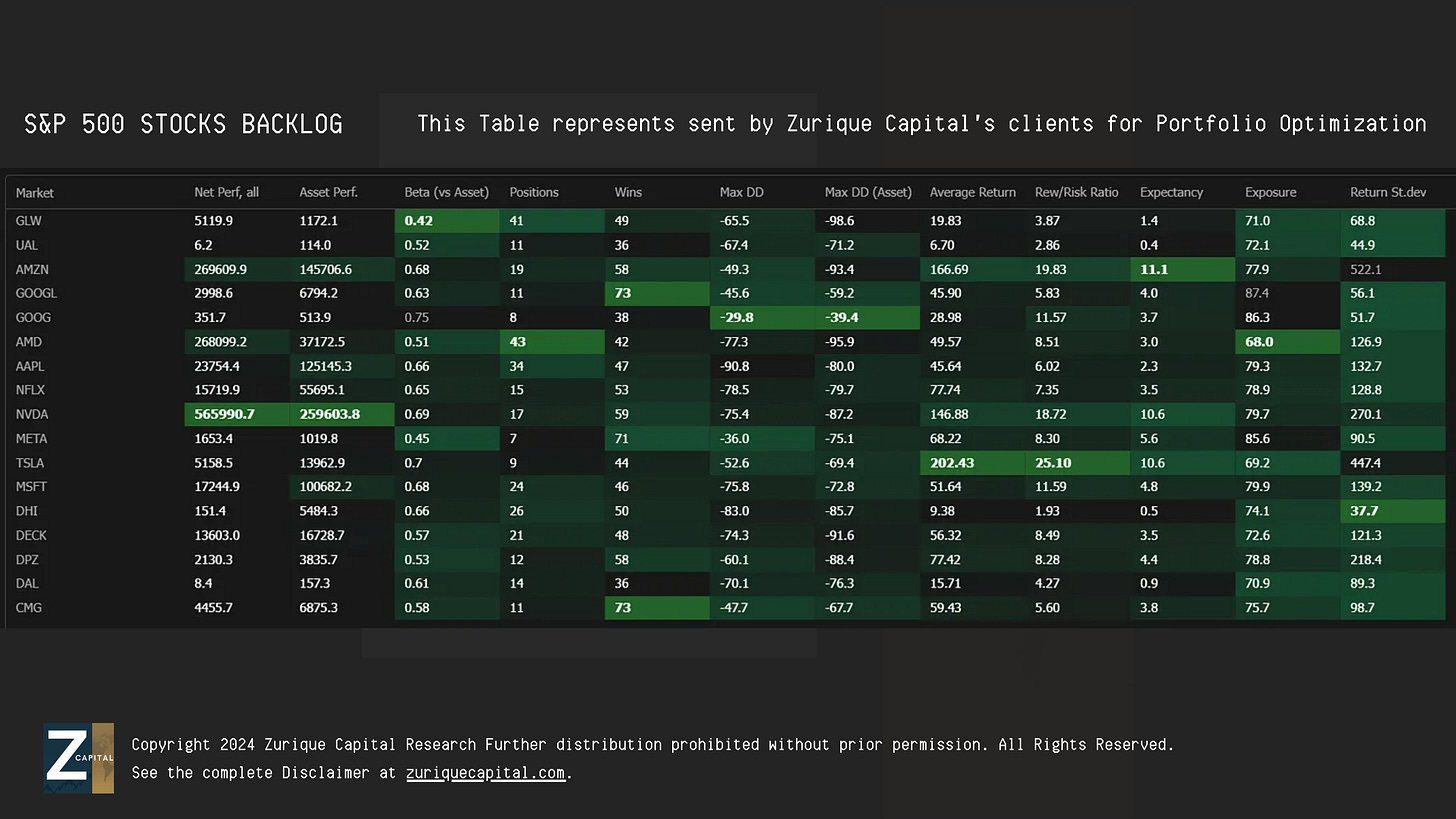

Investors send the stocks of their portfolio. This weekend I worked on these assets.

GLW 0.00%↑ UAL 0.00%↑ AMZN 0.00%↑ GOOGL 0.00%↑ GOOG 0.00%↑ AMD 0.00%↑ AAPL 0.00%↑ NFLX 0.00%↑ NVDA 0.00%↑ META 0.00%↑ TSLA 0.00%↑ MSFT 0.00%↑ DHI 0.00%↑ DECK 0.00%↑ DPZ 0.00%↑ DAL 0.00%↑ CMG 0.00%↑

Step 2: Quantitative Treatment

This step employs an advanced algorithm that considers three primary factors:

Alpha 1 - Market Cycle Phase: We begin by analyzing the current market cycle phase of each asset. It is essential to identify the position of each asset within its performance cycle. Assets in a negative cycle are excluded, ensuring that only those with a positive trajectory remain.

Alpha 2 - Probability of Long-Term Uptrend: Next, we examine the historical performance of these assets. The focus here is on identifying those with a strong probability of long-term uptrends. This step ensures that the selected assets have demonstrated consistent positive performance, qualifying them for further analysis.

Alpha 3 - Gain Expectancy: Finally, we project future performance using rigorous quantified analysis to determine each asset's gain expectancy. This approach is grounded in empirical data rather than speculation.

Here are the S&P 500 stocks with the best data:

AMD 0.00%↑ AMZN 0.00%↑ GLW 0.00%↑ META 0.00%↑ NVDA 0.00%↑

Step 3: Wealth Exponential Expansion

Optimization extends beyond selection to include protection and enhancement. We incorporate the Alpha Hedge Portfolio, constructed based on machine learning, quantitative analysis, and artificial intelligence, designed to amplify returns during bull markets and safeguard investors' capital during bear markets.

This last step of the optimization involves applying the Kelly Criterion calculation to identify the maximum position size of each asset in the portfolio. This provides an additional boost when market conditions are favorable, ensuring your portfolio capitalizes on every opportunity while remaining secure even in adverse market conditions.

ALPHA HEDGE PORTFOLIO REVIEW

The Alpha Hedge Portfolio reported a monthly performance of +4.5% and a year-to-date performance of +25.7%. Over the past 34 months, the portfolio achieved a cumulative performance of +48.1%, compared to the S&P 500's +26.6% increase during the same period. This data reflects the portfolio's ability to generate returns and manage risk effectively relative to broader market benchmarks.