3 Cost Savings for Investors from Adopting AI-Driven Investing

📊Unlocking Market Trends with AI to Boost Wealth

Wall Street Insider Report

AI-Powered Insider-Level Insights to Exponentially Expand Wealth by Decoding Wall Street.

Join our global community of investors who are leveraging cutting-edge technology to build and preserve wealth for future generations.

If the link doesn’t work, copy this link in your browser: https://wallstreetinsiderglobal.com/build-legacy-wealth

3 Cost Savings for Investors from Adopting AI-Driven Investing

Unlocking Market Trends with AI to Boost Wealth

The adoption of AI technology is proving to be a game-changer, offering significant cost-saving opportunities.

With AI's ability to process vast amounts of data and execute trades with precision, investors are discovering new ways to enhance their returns while cutting down on unnecessary expenses. Let's explore the top 3 ways AI is transforming the investment landscape, saving both time and money.

1. Enhanced Analytical Capabilities

AI can process vast amounts of data more efficiently than traditional methods, leading to better investment decisions.

By utilizing AI algorithms for data analysis, investors can identify undervalued stocks and market trends faster, potentially increasing returns while minimizing research costs.

This efficiency can lead to significant savings in both time and resources spent on market analysis.

2. Lower Transaction Costs

AI-driven trading platforms can optimize trading strategies, allowing for more precise timing of trades and reduced transaction costs. For instance, investors can subscribe to our AI-Driven Long-Term Alpha Hedge Portfolio for just $600, covering a full 10-year subscription.

Automated trading systems can execute trades at optimal prices without the emotional biases that often lead to poor decision-making.

This can result in lower fees and better price execution, contributing to overall cost savings for investors.

3. Risk Management and Mitigation

AI can enhance risk assessment and management processes by analyzing patterns and predicting market movements.

By using AI to identify potential risks and adjust portfolios accordingly, investors can avoid costly losses.

This proactive approach to risk management can lead to substantial savings, particularly in volatile markets where traditional methods may fall short.

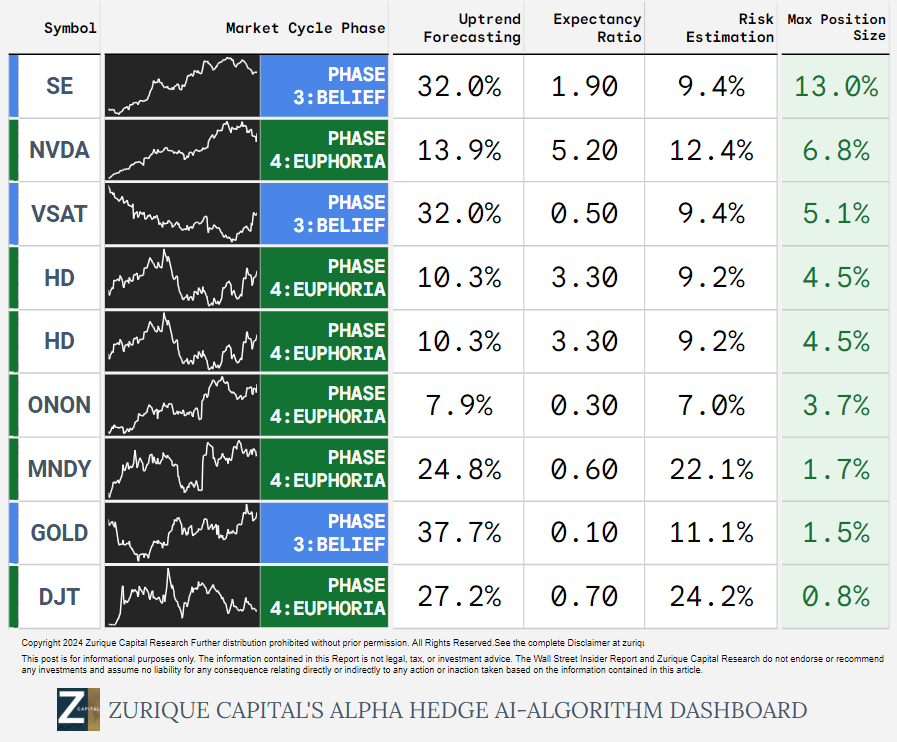

Let’s unlock the top market trends our AI-Algo system highlighted:

CLOSING BELL OVERVIEW: 08/13/2024

We use our Alpha Hedge AI-Algorithm to decode significant market movements to identify assets with the highest potential for long-term exponential growth:

SBUX 0.00%↑ CMG 0.00%↑ NKE 0.00%↑ CXAI 0.00%↑ HD 0.00%↑ ONON 0.00%↑ NET 0.00%↑ ELWS 0.00%↑ SE 0.00%↑ VSAT 0.00%↑ DJT 0.00%↑ GNLN 0.00%↑ JBLU 0.00%↑ NVDA 0.00%↑ SMCI 0.00%↑ GCTS 0.00%↑ GOLD 0.00%↑ KEY 0.00%↑ PSIG 0.00%↑ MARA 0.00%↑ MNDY 0.00%↑

This are our top findings today:

Follow Zurique Capital on X for exclusive access to in-depth analysis of all assets:

Zurique Capital on X: https://x.com/zuriquecapital

Before investing in these assets, let me tell you that there is an even more efficient way to exponentially grow your wealth by leveraging AI.

If you are looking for:

Harness Market Volatility: Turn fluctuations into growth opportunities.

Wealth Preservation: Minimize losses, reduce costs, and optimize tax efficiency.

Simplified Choices: Evidence-based, AI-driven investment portfolio.

Trust and Transparency: Independent, transparent portfolio construction.

Life Balance: Hands-off solutions provide professional and personal peace of mind with a long-term, low-maintenance portfolio.

Subscribe today to the Wall Street Insider Report Premium and join 1.8K+ Global Investors across 55 countries who are building legacy wealth. Gain access now to:

10-Year Access to the Alpha Hedge Portfolio: Witness and follow the AI-driven investment portfolio in real-time.

Daily Insider-Level AI Analysis: Uncover the layers of US Stocks and ETFs cycles.

Actionable Monthly Analysis: Detailed update of the market cycles.

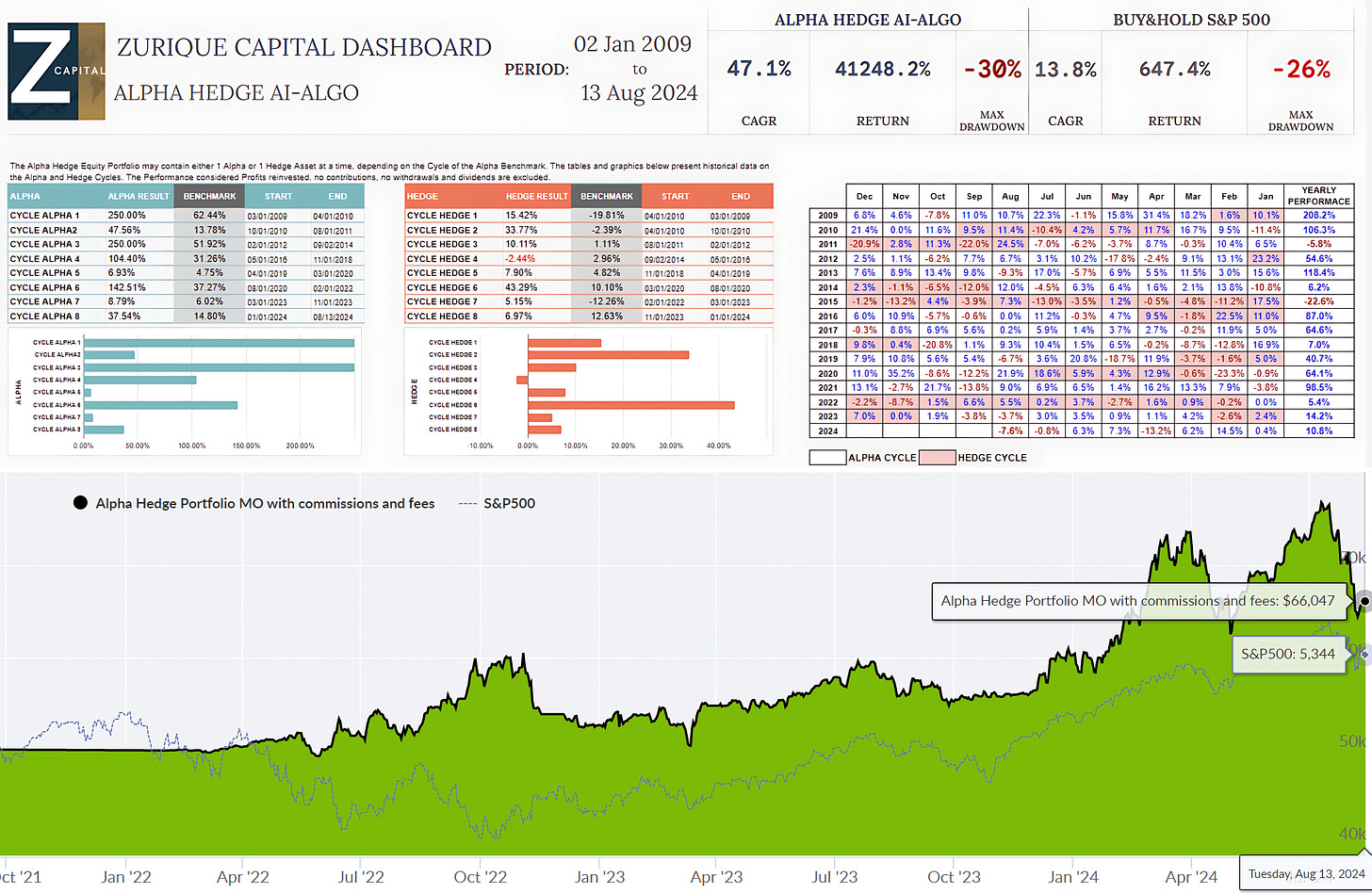

ALPHA HEDGE PORTFOLIO REVIEW:08/13/2024

The Alpha Hedge Portfolio experienced a monthly decline of 7.6%, reducing its year-to-date performance to +10.8%. Over the 188-month period, the portfolio has achieved a cumulative return of 41,248.2%, with a compound annual growth rate (CAGR) of 47.1%. In comparison, the S&P 500 has gained 647.4% during the same period, with a CAGR of 13.8%.